Plan for law to protect neighbourhood cash access

Getty Images

Getty ImagesConsumers and businesses will have a legal right to withdraw and deposit cash within "a reasonable distance" of their home or premises, under government plans.

The long-awaited proposals are designed to ensure notes and coins remain available to those who need them.

Cash remained a necessity for at least eight million people, research found.

Campaigners fear some retailers could stop accepting cash if it becomes too burdensome to process.

Small businesses, particularly, have been affected by closing bank branches. Travelling further to deposit their takings costs time and money.

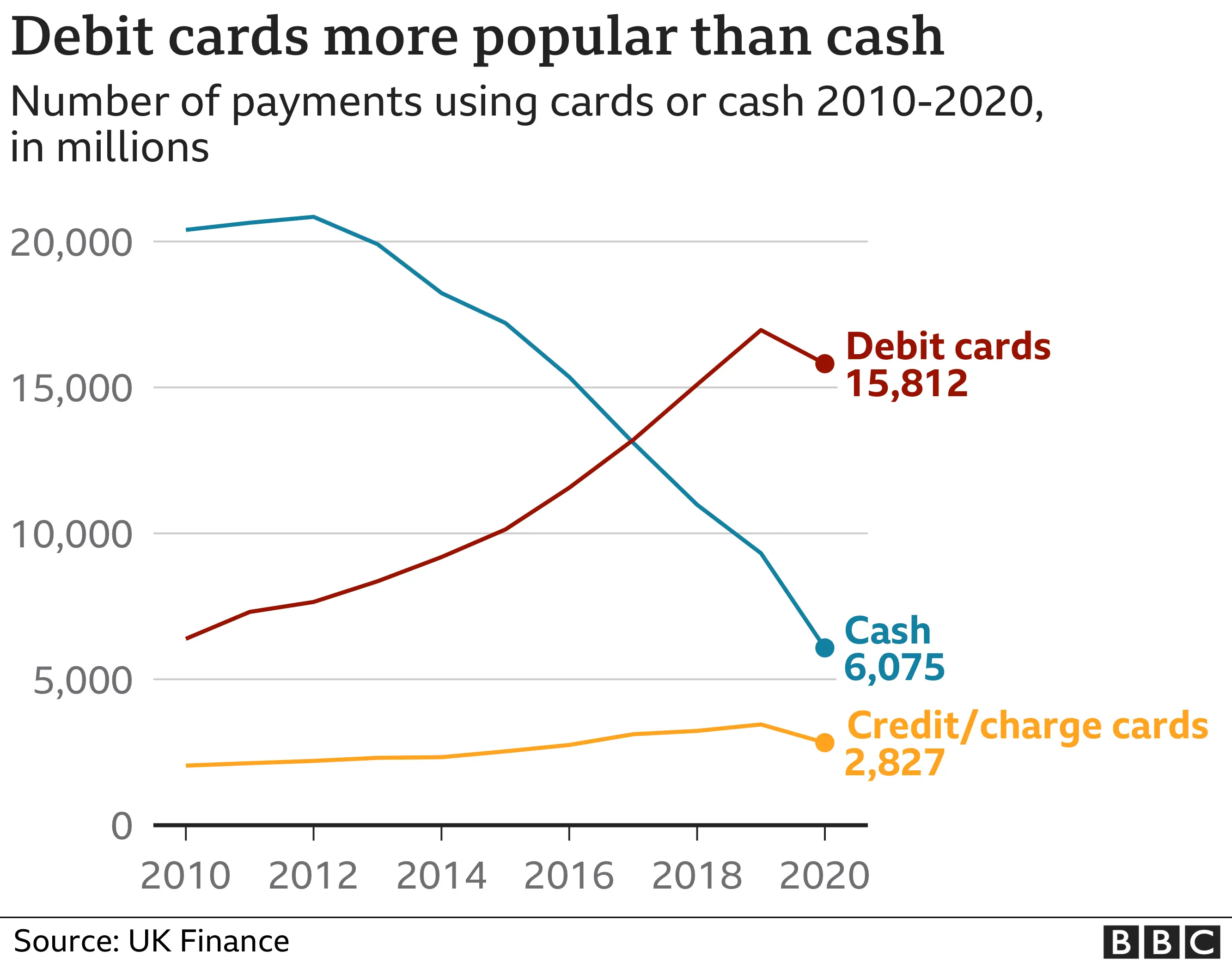

The proportion of purchases made using cash has been falling in recent years, and accelerated during the Covid crisis.

The number of payments made with notes and coins dropped by 35% last year, according to banking trade body UK Finance, reflecting the reduced opportunities to pay for things during lockdowns.

It still accounted for 17% of all payments, making it the second most-popular way to pay behind debit cards.

Consumer preferences and the closure of bank branches and ATMs have put particularly pressure on access to cash for those who need it.

Experts have suggested that there was a danger of cash infrastructure collapsing if it becomes uneconomical to process and transport.

The Treasury has already thrown its weight behind the use of local shops as an alternative to ATMs. It is keen on the idea of shops offering cashback to customers even if they have not made a purchase.

In its newly-published proposals, it said that people should not have to travel beyond a reasonable distance to withdraw or deposit money, even if they are in low population areas.

"The government proposes that these geographic requirements would be set on the basis of cash access facilities being available within maximum distances of a minimum percentage of the population," the Treasury said.

Initially, the Treasury suggests that people should not have to travel more than 1km, but that distance could be extended over time if cash becomes less popular. The distance proposal is open to views during consultation.

Other considerations include whether the facilities are appropriate for vulnerable people, are accessible for people with disabilities, have adequate opening hours, and are suitably secure for high-value cash deposits.

The City regulator, the Financial Conduct Authority (FCA), would oversee the system. The geographic requirements would be set for Britain, and then separately for Northern Ireland.

Consultation on the proposals ends on 23 September.

Last week, charity Age UK said that people required the same guarantee of access to cash as they do for running water, electricity and the post.

It said older people had been particularly exposed to operating without the cash they needed during the pandemic and faced difficulties owing to the rapid move to online banking and digital payments.

Various trials of banking hubs and community services to help people who need cash are taking place during the spring and summer.