NatWest fixes app outage which left customers fuming

Getty Images

Getty ImagesNatWest says it has now fixed an issue which left customers unable to use the bank's mobile app, leaving some unable to access their accounts.

Customers reported problems including being unable to make purchases or pay staff.

NatWest apologised to customers "for any inconvenience caused", having previously said its web-based online banking service was still working normally - however some customers disputed this.

"We have resolved the issues causing this and customers are now able to log in and make payments as normal," a spokesperson said.

Problems began to be reported on outage-checking site Downdetector at 0910 GMT.

BBC/NatWest

BBC/NatWestCustomers then took to social media to complain about the impact the IT failure was having on them.

One person said they had to "put back my shopping because of it", while another said they were "waiting to go shopping" but couldn't transfer money to do so.

Customers were advised to access their accounts in other ways if they can - such as through online banking.

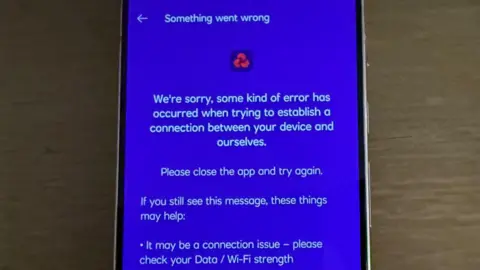

However, some people reported problems with NatWest's online service too, with one sharing an error message which they said was displayed when they tried to make a payment.

Others have expressed frustration with the bank's response, with one saying it was "disgraceful" there was no timeframe given for resolving the problem, while another called it "very poor service".

"What I don't get is the bank closes loads of branches 'to save money' and forcing people to rely on the app and online banking... but clearly hasn't invested in a system that works properly," one angry customer said.

A recurring problem

This is the latest in a long line of banking outages.

In May, a number of major banks disclosed that 1.2m people were affected by them in the UK in 2024.

According to a report in March, nine major banks and building societies have had around 803 hours - the equivalent of 33 days - of tech outages since 2023.

Inconvenient for customers, outages come at a cost to the banks, too.

The Commons Treasury Committee found Barclays could face compensation payments of £12.5m over outages since 2023.

Over the same period, Natwest has paid £348,000, HSBC has paid £232,697, and Lloyds has paid £160,000.

Other banks have paid smaller sums.

Sign up for our Tech Decoded newsletter to follow the world's top tech stories and trends. Outside the UK? Sign up here.