Cash access as vital as running water, says Age UK

Getty Images

Getty ImagesConsumers should be given a guarantee that they will have access to cash, as they do with water, electricity and the post, a charity says.

Some 2.4 million people aged 65 and over rely on cash in their daily lives, Age UK said.

The charity warned that many would face being excluded from society if they could not get hold of notes and coins.

Various trials are taking place across the UK to help those who require cash, including testing new banking hubs.

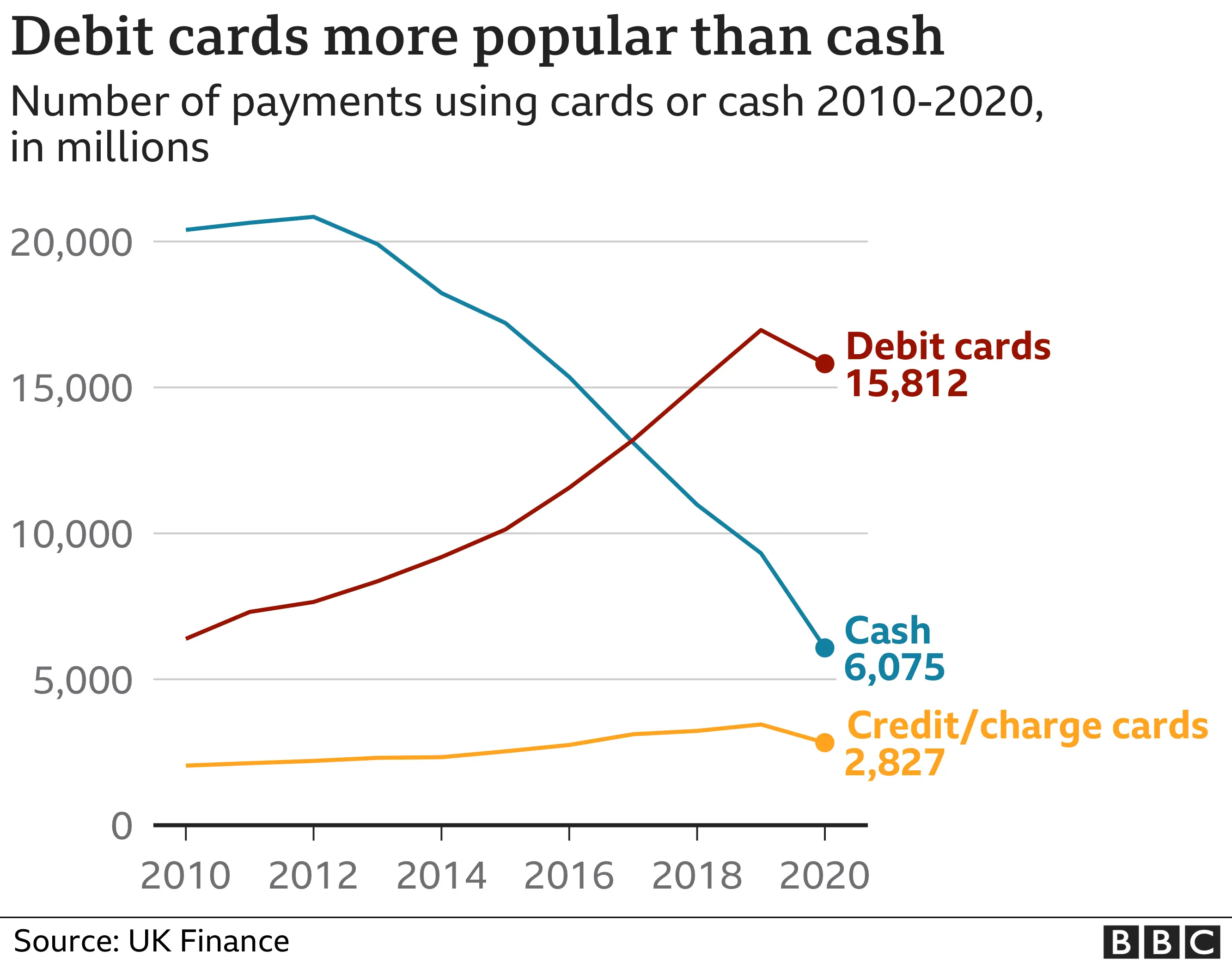

Cash use in purchases fell sharply during the pandemic, as lockdowns reduced the options for spending. This accelerated a trend of falling use of notes and coins in transactions.

Some people turned to digital channels for their banking for the first time, if they were unable to leave home.

However, Age UK said it would be a mistake to assume that everyone was willing or able to do their banking digitally. The pandemic had exposed the difficulties a lack of access to cash would create.

It points to the experience of Eileen, aged 72, who told the charity: "People were lovely and would do some shopping for us, but I didn't always have money in the house to pay them, and I couldn't access money.

"The ATM in our village is nearly always empty. All these little things that we take for granted suddenly become huge problems."

The charity said the vast majority of older people could manage their money themselves, but the rapid move to online banking and digital payments left them struggling with the technology.

In turn, this meant they were at risk if being socially excluded.

"Older people who use cash and their local bank branch are finding it increasingly impossible to manage their money because more and more barriers are being put in their way," said Caroline Abrahams, charity director at Age UK.

"It is time for the government to recognise how important banknotes and coins are to all our lives and treat the cash system as the essential piece of infrastructure it is - just like utilities, post and broadband."

The Treasury has thrown its weight behind the idea of cashback from local stores, without having to make a purchase, when ATMs are disappearing. It also wants the City regulator, the Financial Conduct Authority, to take the lead in securing the future of cash for consumers and small business owners who need it.

Natalie Ceeney, author of the Access to Cash Review and leader of a series of cash trials, said it was important that businesses still accepted cash, rather than just concentrating on making sure bank branches and ATMs were available to provide it.