Scottish income tax 2025-26 - What might you be paying?

Getty Images

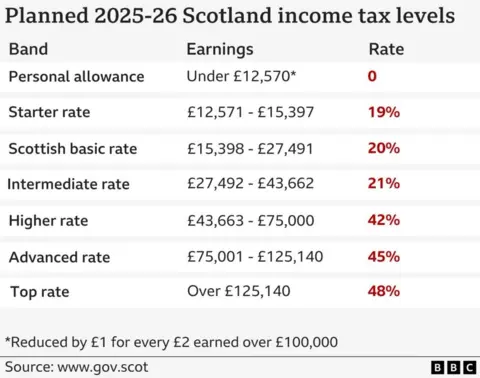

Getty ImagesThe Scottish government's Budget Statement made no changes to Scottish income tax rates and there were no new tax bands this year.

Finance Secretary Shona Robison did make some changes to tax thresholds which she said meant more of people's earnings would be levied at lower rates.

She also said this would mean that the majority of people in Scotland would pay less income tax than they would if they lived elsewhere in the UK.

Based on these changes, tax consultant Deloitte has put together examples spanning different salaries.

The lower earner - £15,000 salary

If you earn a salary of £15,000 in 2025-26 and have no other income, the personal allowance of £12,570 will be deducted and £2,430 will be taxable.

If you are resident in Scotland, your income tax calculation will be as follows:

Starter rate - £2,430 at 19% = £461.70

Total tax = £461.70

This is a reduction in income tax of £1.24 compared to 2024-25 due to the inflationary increase to the starter rate band.

If you earned the same sum of money but were not resident in Scotland the full £2,430 would be taxable at 20% (UK basic rate) producing an income tax bill of £486. Therefore, you would pay £24.30 less as a resident of Scotland.

The medium earners - £33,000 salary

If you earn a salary of £33,000 in 2025-26 and have no other income, the personal allowance of £12,570 will be deducted and £20,430 will be taxable.

If you are resident in Scotland, your income tax will be as follows:

Starter rate - £2,827 at 19% = £537.13

Scottish basic rate - £12,094 at 20% = £2,418.80

Intermediate rate - £5,509 at 21% = £1,156.89

Total tax = £4,112.82

This is a reduction in income tax of £14.51 compared to 2024-25 due to the inflationary increase to the starter rate and basic rate bands.

If you are resident elsewhere in the UK, the full £20,430 will be taxable at 20%, giving an income tax liability of £4,086.00. A Scottish resident would pay an additional £26.82 in income tax compared with living elsewhere in the UK.

£50,000 salary

If you earn a salary of £50,000 in 2025-26 and have no other income, the personal allowance of £12,570 will be deducted and £37,430 will be taxable. If you are resident in Scotland, your income tax will be as follows:

Starter rate - £2,827 at 19% = £537.13

Scottish basic rate - £12,094 at 20% = £2,418.80

Intermediate rate - £16,171 at 21% = £3,395.91

Scottish higher rate - £6,338 at 42% = £2,661.96

Total tax = £9,013.80

This is a reduction in income tax of £14.51 compared to 2024-25 due to the inflationary increase to the starter rate and basic rate band.

If you are resident elsewhere in the UK, the full £37,430 will be taxable at 20%, giving an income tax liability of £7,486.00. A Scottish resident would pay an additional £1,527.80 in income tax compared with living elsewhere in the UK. This may feel particularly acute for employees living in Scotland with earnings between £43,662 and £50,270 who have an effective marginal tax rate of 50% once national insurance is taken into account, compared to 28% in the rest of the UK.

The higher earner - £110,000 salary

If you earn a salary of £110,000 in 2025-26 and have no other income, you are entitled to a reduced personal allowance of £7,570 because your income exceeds £100,000. Your taxable income is therefore £102,430.

If you are a resident in Scotland, your income tax breaks down is as follows:

Starter rate - £2,827 at 19% = £537.13

Scottish basic rate - £12,094 at 20% = £2,418.80

Intermediate rate - £16,171 at 21% = £3,395.91

Scottish higher rate - £31,338 at 42% = £13,161.96

Scottish advanced rate - £40,000 at 45% = £18,000.00

Total tax = £37,513.80

This is a reduction in income tax of £14.51 compared to 2024-25 due to the inflationary increases to the starter rate and basic rate bands.

Although the highest headline rate at this income level is the advanced rate of 45%, the marginal rate of income tax for incomes between £100,000 and £125,140 is 67.5% (69.5% including national insurance) due to the effects of the tapering of the personal allowance.

If you are a resident elsewhere in the UK, on this salary you will pay £33,432.00 in tax - £4,081.80 less than north of the border.

£200,000 salary

If you earn a salary of £200,000 in 2025-26 and have no other income, you are not entitled to a personal allowance because your income exceeds £125,140. The taxable income is therefore £200,000.

If you are a resident in Scotland, your income tax breaks down is as follows:

Starter rate - £2,827 at 19% = £537.13

Scottish basic rate - £12,094 at 20% = £2,418.80

Intermediate rate - £16,171 at 21% = £3,395.91

Scottish higher rate - £31,338 at 42% = £13,161.96

Scottish advanced rate - £62,710 at 45% = £28,219.50

Top rate - £74,860 at 48% = £35,932.80

Total tax = £83,666.10

This is a reduction in income tax of £14.51 due to inflationary adjustments to the starter rate and basic rate bands.

If you are a resident elsewhere in the UK, on this salary you will pay £76,203.00 in tax - £7,463.10 less than north of the border.

Analysis – Small tax reductions but fiscal drag remains a problem

Garry Tetley, Tax Partner at Deloitte, said: "There were no increases in Scottish income tax rates or new tax bands this year.

"Inflationary adjustments in the lower rate bands will result in small tax savings of up to £14.51 for taxpayers at all levels, but wage inflation will push many taxpayers into higher rate bands.

"While the starter rate band will increase by 22.6% and the basic rate band will increase by 6.6%, the higher rate threshold remains at £43,662 for a fifth year running.

"This is still significantly lower than the UK higher rate threshold of £50,270 which has been frozen until 2027/28.

"Employees earning between these thresholds also pay 8% national insurance, which results in a combined marginal tax rate of 50% in this income bracket for those living in Scotland.

"The advanced rate (45%) threshold and the top rate (48%) threshold are also frozen at £75,000 and £125,140, respectively.

"Lower earners in Scotland continue to pay less tax than those in the rest of the UK (the maximum saving is £28.27); the breakeven point for 2025/26 is £30,318.

"The Scottish government's devolved powers for personal taxes are limited to setting the bands and rates of income tax for non-savings non-dividend income, such as salaries, profits and pensions.

"Income tax on savings and dividend income, capital gains tax and national insurance are all set by the Westminster government.

"Most of these rates and thresholds are the same in 2024/25 and 2025/26, with the exception of employer's national insurance and certain capital gains.

"The commitment (for the rest of the Parliament) not introduce any new bands or increase the rates of Scottish Income Tax and uprate the starter and basic rate bands by at least inflation provides stability.

"However, the continued divergence from the rest of the UK means that top talent earning higher salaries will continue to face higher tax bills in Scotland.”