SNP government vows to scrap two-child benefit cap

The Scottish government will scrap the "pernicious" two-child cap on benefits north of the border, Finance Secretary Shona Robison has vowed.

The UK-wide policy was originally introduced in 2017 by the Conservative government and has been kept in place by Labour.

It prevents parents from claiming universal credit or child tax credit for a third child, with a few exemptions.

Setting out her draft Budget at Holyrood, Robison said she would aim to provide funding to the families of the 15,000 affected children in Scotland by April 2026 - a month ahead of the next Scottish election.

Opposition MSPs have accused the Scottish government of financial mismanagement.

It is not yet clear what the mechanism will be to scrap the cap, how it will work, or how much it will cost.

Robison said she would need the UK government to provide data on the cap to fully mitigate it north of the border.

The move will be seen as a big challenge to Labour, which has said it is willing to listen to ideas - but points out that there is not a penny in the coming year’s budget to support it.

Robison told MSPs: "My challenge to Labour is to work with us - join us in ending the cap in Scotland, give us the information that we need.

"But, either way, let me be crystal clear, this government is to end the two-child cap and in doing so will lift over 15,000 Scottish children out of poverty."

She added: "Be in no doubt that the cap will be scrapped".

A Scottish government source said they believed the measure would cost between £110m and £150m.

The Scottish Fiscal Commission has said the policy is uncosted because they were only told about it last week, describing it as a “fiscal risk”.

Getty Images

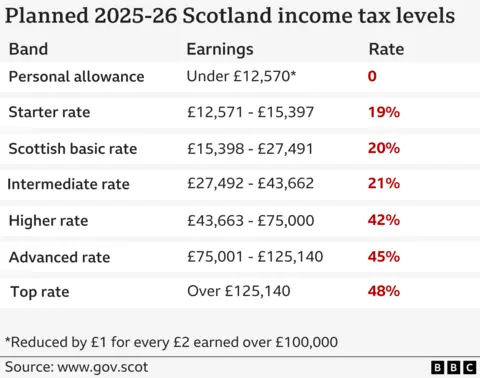

Getty ImagesRobison also announced changes to Scotland's income tax bands to mean more of people's earnings will be taxed at lower rates.

She said this would mean that the majority of people in Scotland would pay less income tax than they would if they lived elsewhere in the UK - although only by very small amount.

Scotland has six income tax bands, in contrast to England, Wales and Northern Ireland where there are just three.

Robison told Holyrood that the threshold of the basic band – a tax of 20% on earnings between £14,876 and £26,561 – and the intermediate band – a tax of 21% on earnings between £26,562 and £43,662 – would increase by 3.5%.

Despite most of the bands remaining static, more people would pay a higher rate of tax through a process known as fiscal drag.

This happens when bands are not raised with inflation, and do not keep pace with increases in pay, meaning some people are "dragged" into higher tax brackets.

Yvonne Evans, a tax expert and Senior Lecturer at Dundee University, told BBC Radio Scotland's Drivetime that lower and middle earners would only benefit slightly from the increased tax thresholds.

"At best that helps people by about £20, so it's not worth getting over-excited about really,” she said.

Currently, people in Scotland earning more than about £28,850 - about half of the country's taxpayers - pay more income tax than they would elsewhere in the UK.

The Scottish government said the proposed income tax change would increase that figure to £30,300.

Those with earnings below this amount would save up to £28.27 per year compared to if they lived elsewhere in the UK, according to the Chartered Institute of Taxation.

It said Scots earning £40,000 would pay £97 more in income tax than they would elsewhere in the UK, while those on £50,000 would pay £1,528 more. Scots on £100,000 would pay £3,331 more.

The draft Budget, setting out £63bn in spending plans, also included:

- An extra £2bn for the NHS, bringing total funding to £21bn

- Funding for a new winter fuel payment for Scottish pensioners

- A total of £15bn for councils – with no freeze or cap on council tax rises

- £4.9bn to tackle the climate and nature crises

- A 3% increase in education spending

- £768m for affordable homes

- Almost £800m more for social security benefits

- And a £34m increase in culture funding

Announcing the health funding, Robison said: "That is money that will make it easier for people to access GP appointments, that will improve A&E and ensure more Scots get the care they need in good time."

She told MSPs it would mean by March 2026 no-one will wait longer than 12 months for a new outpatient appointment, inpatient treatment or day case treatment.

The finance secretary said the funding for councils would be a record amount and would fund pay increases for teachers, social care workers and refuse collectors, among others.

There is currently a freeze on council tax, but the finance secretary said she did not intend to repeat this measure in 2025-26.

However, she suggested local authorities should not see that as an opportunity to hike rates.

Robison added: "While it will be for councils to make their own decisions with record funding, there is no reason for big increases in council tax next year.”

'Drop in the ocean'

Scottish Conservative social security spokesperson Liz Smith said her party continued to support the two-child cap.

“Social security payments must be fair to people who are struggling and to taxpayers who pick up the bill," she said.

"The rapidly rising benefits bill is currently unsustainable as a direct consequence of the SNP’s high tax rates and mismanagement of our economy and public finances.”

However, Robison's announcement was welcomed by the Child Poverty Action Group in Scotland and Save the Children Scotland.

They called for further action to help families more quickly, such as an increase in the Scottish Child Payment.

The government cut affordable housing funding by £196m in last year’s budget. Although this was reduced to £163m following in-year adjustments, the funding was still down by more than 22% in real terms from 2023-24.

Aditi Jehangir, chairwoman of Living Rent, said the £768m of funding announced by Robison was “only a reverse of previous cuts made to the budget” and a “drop in the ocean compared to what is needed”.

Council body Cosla, which warned ahead of the Budget that cash-strapped local authorities were at a financial “tipping point”, said it would take time to consider the finance secretary’s proposals.

What comes next?

MSPs will initially debate the proposals and are able to table amendments. They will not vote on the bill until February, when ministers will hope to pass it into law.

The government has a minority of the seats in parliament, and will need help from non-SNP MSPs to push through its plans.

If the budget cannot be agreed, there could be a snap election – though the government is hopeful of being able to agree a deal that will see opposition MSPs either back the budget or abstain.

The Scottish Greens, who were kicked out of a power-sharing agreement with the SNP earlier this year, have said they will not support the Budget without substantial changes.

Green MSP Ross Greer said: “This budget fails to deliver on Green proposals like expanding free school meals for P6 and P7 or a price cap on bus fares.

“It slashes funding for core local services like schools and for key climate projects like the Nature Restoration Fund.”

Scottish Labour finance spokesperson Michael Marra said the Budget was an opportunity for the SNP to take Scotland in a new direction after the UK government provided £3.4bn of additional funding.

"If only they had the imagination to take that new direction,” he told MSPs.

"Scotland is going in the wrong direction under the SNP."