When is the Scottish Budget and what will be in it?

PA Media

PA MediaFinance Secretary Shona Robison will announce her plans for income tax, welfare benefits and more in the Scottish Budget.

Her proposals will be set out in a speech to the Scottish Parliament on 4 December.

Robison and First Minister John Swinney have warned for months that the government is facing the most difficult financial situation since the Scottish Parliament reconvened in 1999.

The UK government, however, says it is providing the largest funding package in the history of devolution.

What is the Budget?

The Budget is the Scottish government’s opportunity to set out its tax and spending plans for the next financial year, which runs from 1 April 2025 until 31 March 2026.

This includes raising or lowering taxes, as well as major decisions about spending on areas controlled by the Scottish Parliament such as health, schools, police and many other public services.

The government can also set out proposals for new taxes, welfare benefits, public services and infrastructure projects.

The finance secretary's speech will be accompanied by a Budget bill, which sets out the plan in a legal document.

MSPs will initially debate the proposals and are able to table amendments. They will not vote on the bill until February, when the SNP government will hope to see it passed into law.

When is the Scottish Budget?

The Scottish Budget will be on Wednesday 4 December.

The speech usually starts shortly after14:00 and lasts for about 30 minutes. It will be broadcast live on the BBC Scotland News website.

Opposition MSPs will then be given about an hour to respond in the chamber.

How much money does the Scottish government have to spend?

The Scottish Budget is largely funded through the block grant - essentially an annual lump sum transferred from the UK government - as well as taxes raised north of the border.

Changes to the block grant are calculated using the Barnett Formula, which is designed to provide Scotland, Wales and Northern Ireland with a proportionate share of UK government spending in England.

The total budget for the past two years has been about £60bn.

Holyrood ministers are legally obliged to balance their books and have only limited borrowing powers with which to raise additional funds.

In each of the past three years, they have used emergency measures part way through the financial year due to unanticipated budget shortfalls.

PA Media

PA MediaThis year, the government cut £500m from its spending plans to fund higher than expected public sector pay deals, with ministers also citing inflation.

For the coming year the UK government says it will provide a block grant of £47.7bn, an increase of £3.4bn on 2024-25.

Economists at the Fraser of Allander Institute says that is “likely to make the Scottish government’s job of balancing its budget significantly easier".

However, Swinney has said his government has “difficult” decisions to make, and that the extra Treasury funding was not “nearly as much" as had been claimed.

SNP ministers have also warned they will have to fork out an extra £500m in public sector costs as a result of Labour's plans to increase National Insurance payments for employers from April.

The UK government has vowed to compensate devolved administrations for the tax hike, but SNP ministers have warned they could be short changed due to Scotland's proportionally bigger public sector.

Swinney says his government is yet to hear how much compensation is coming its way, adding that he does not expect to have an answer by the time the Budget is announced.

What might be in the Scottish Budget?

- Income tax

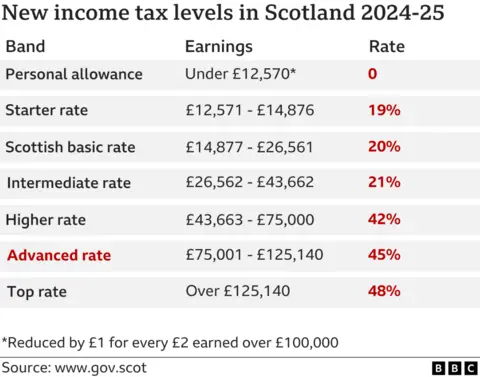

The Scottish government is able to set its own income bands and rates, so close attention will be paid to any proposed changes.

As it stands, Scotland has six tax bands, in contrast to England, Wales and Northern Ireland where there are just three.

People earning more than £28,567 in Scotland - about half of the country's taxpayers - pay more in income tax than they would elsewhere in the UK.

Those earning under that sum pay slightly less than they would if they lived in another part of the UK.

The Scottish government has defended its tax system as "progressive", with Swinney urging the UK government to copy its system.

The Conservatives have called for tax cuts, and even some within the SNP do not seem entirely convinced with the Holyrood tax regime.

SNP MSP Kenneth Gibson, who leads Holyrood's finance committee, recently suggested having rates of 19%, 20% and 21% was "daft" and "a nonsense".

Robison hinted earlier this year that income tax changes were unlikely. She told MSPs that the government could only "go so far", warning that major tax reform would be required across the UK to generate more revenue.

Yet even if bands and rates remain static, it may result in more people paying more tax through a process known as fiscal drag. This happens when bands are not raised with inflation, and do no keep pace with increases in pay, meaning some people are "dragged" into higher tax brackets.

- Council tax

In this year's budget, the government pledged more than £200m to help local authorities cover the costs of a nationwide council tax freeze.

A freeze was welcome news for homeowners, but it angered councils desperately short of cash.

It has also been criticised as an inefficient way of helping the worst off, with rates based on archaic property values from 1991.

Ministers have defended the measure - with Swinney refusing to rule out another freeze in 2025-26.

- Winter fuel payments

Another key policy to look out for is a potential move to fund universal winter fuel payments.

The benefit was cut by the UK government for millions of pensioners south of the border earlier this year.

Getty Images

Getty ImagesThe Scottish government had been due to launch a Holyrood-managed equivalent. But SNP ministers said the prime minister's decision left them £150m short and with no choice but to follow suit in imposing means testing.

The decision is expected to result in about 900,000 fewer pensioners in Scotland getting the payment.

With a bigger block grant coming its way, could the Scottish government now find the cash to fund universal coverage?

- Business rates

The Scottish government is being urged to replicate business rates relief for firms south of the border.

Holyrood sets its own business rates, called non-domestic rates. These are a form of property tax, administered by councils, which help to pay for local services.

The Fraser of Allander Institute estimates that it would cost £220m to replicate the business rates relief in Scotland - significantly more than the £147m generated via the Barnett formula by the decision in England.

Will the Scottish Budget be passed by MSPs?

The SNP group in the Scottish Parliament has been cut to 62 MSPs after John Mason was expelled from the party over his comments about the conflict in Gaza.

However, the Glasgow Shettleston MSP has indicated he would continue to support the SNP.

Assuming it has his support, the government would need a further two votes for a majority of 65.

This means ministers would need two opposition MSPs to either side with them or abstain.

PA Media

PA MediaIf the vote ends in a tie at stage one, Presiding Officer Alison Johnstone would have the casting vote. This traditionally goes "in favour of the status quo" and would let the bill proceed, to allow talks to continue.

But if there is a tie in the final vote, the "status quo" would be the existing budget arrangements - so Johnstone would vote the new budget down.

If the parliament is completely deadlocked, it is possible that an election would have to be called next year to break it.

Whether there is any appetite for a snap poll is another matter - especially considering that under Holyrood election rules, this would mean two elections in two years.