Factory blaze adds to computer chip supply crisis

Renesas

RenesasOne of the car industry's biggest computer chip suppliers has warned that a major fire at one of its factories in Japan could have a "massive impact" on its ability to fulfil orders.

The incident comes at a time when supplies of chips to the auto industry were already running short.

Shares in the semiconductors firm Renesas fell, along with its clients including Toyota, Nissan and Honda.

Elsewhere, Volkswagen has said chip scarcity might last until the autumn.

"I think things will get stable by the fall but certainly its going to be complicated, and its going to be challenging but I think we'll navigate it," Scott Keogh, VW's North America chief executive told the BBC.

He added that some of the company's plants were likely to run fewer shifts a day, but added that he hoped factory shutdowns could be averted.

Allow X content?

Clean rooms

Renesas has said the blaze occurred last Friday, and was caused by a plating tank catching fire as a result of an electrical "overcurrent", whose cause is still being investigated. It took fire fighters more than five hours to put out.

Renesas

Renesas Renesas

RenesasThe fabrication plant involved is based in the city of Naka, in the eastern province of Ibaraki. It specialises in 300mm wafers, making it one of the company's most advanced facilities.

The firm has said there were no human casualties, but 11 of its manufacturing equipment units were damaged.

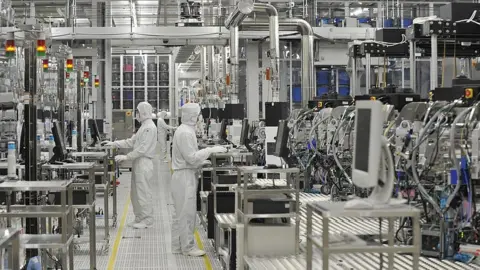

And because this occurred in one of its environmentally-controlled "clean rooms" - which are designed to avoid any dust or other particles from ruining the tiny transistors and circuits involved in a chip - efforts to restart production will involve more than just swapping out the ruined kit.

While Renesas said the majority of the products manufactured using the affected machines could in theory be manufactured elsewhere, the wider supply shortfall will make that difficult to achieve in practice.

The company has said it hopes to restart production in a month, but the Nikkei Asia news site said it could take three months before output is back to normal.

Getty Images

Getty ImagesIce and drought

Renesas has said that it has about a one-month stockpile of chips to continue fulfilling automakers' orders - so the impact to car production will not be immediate.

But it comes at a time of crisis.

New cars often include dozens of microprocessors.

At the start of the coronavirus pandemic, car-makers cut orders for the components because of a slump in sales of their vehicles.

When the market rebounded towards the end of 2020, they found it hard to find supplies because other consumer electronics makers had stepped in with orders of their own to meet higher than normal demand for their gadgets because of lockdowns.

In addition, February's freezing weather in Texas closed chip-making plants there.

US trade restrictions placed on the telecoms firm Huawei and chip-maker SMIC, among others, have caused other Chinese companies to stockpile supplies of their own.

And a drought in Taiwan is threatening production there. Wafer manufacturing requires a lot of water.

Stocks drop

Many car-makers have slowed or temporarily halted production at some of their plants. It had earlier been estimated that they faced losing more than $60bn (£43.3bn) of sales as a result.

Getty Images

Getty Images"Given that automotive semiconductor capacity is very stretched right now, this fire is effectively a blow upon a bruise, so to speak," commented Richard Windsor, owner of research firm Radio Free Mobile.

"But because following 2011's Fukushima nuclear disaster, Toyota ordered all its suppliers to keep more inventory than it had done in the past, it's quite possible it won't be as badly impacted as Honda and Nissan."

Renesas' stock fell 4.9% in Tokyo trade on Monday.

Toyota's fell by 2.6%. Honda's by 3.6%. And Nissan's by 3.7%.

Memory chips

Elsewhere, there has been further evidence of constrained chip production having wider knock-on effects.

The Nikkei Asia reported on Sunday that the price of memory chips had risen 60% since the start of 2021. It noted that supplies of older chips were particularly constrained, which would impact printer-makers among other gadgets that rely on them.

And last week, Samsung's co-chief executive Koh Dong-jin warned of a "serious imbalance in supply and demand of chips in the IT sector globally".

Although the South Korean company is unusual in that it both designs and manufactures state-of-the-art chips for use in its own products and others, it still relies on third-party supplies. And it has faced a shortage of application processors from the US firm Qualcomm.

Qualcomm's chief executive commented indirectly on the issue at the China Development Forum in Beijing on Saturday.

Steve Mollenkopf predicted that supplies of some older-technology chips would recover before their newer counterparts, adding: "So, depending on the product, you may be in a position to get some improvement."