EU seeks to supercharge computer chip production

Getty Images

Getty ImagesThe European Commission has set an ambitious target to boost production of cutting-edge computer chips by the end of the decade.

It wants 20% of such chips, in terms of value, to be manufactured within the EU by 2030. It was 10% in 2020.

The pledge comes at a time when supply has failed to meet demand, causing problems for car-makers and others.

Part of the challenge will be that the US and mainland China are also seeking to increase their own output.

At present, Taiwan's TSMC and South Korea's Samsung dominate, with the two companies being the only ones capable of physically producing the very latest in chip tech.

"We are in a sort of paradoxical situation where Europe is using a lot of these different types of technology, but we're producing little," said European Commission executive vice-president Margrethe Vestager.

"Yet [chip] production is reliant on machinery produced in Europe. So... there is an interdependency here."

Getty Images

Getty ImagesOne observer suggested growing US-China tensions had prompted the commission into action.

"Semiconductor chips are one of those overlooked but incredibly important strategic components on which masses of technology are built," said Emily Taylor from the Chatham House think tank.

"So this is a very interesting development, and it's welcome to see any initiative that stimulates innovation."

Hard to master

Europe used to have a thriving chip-making industry.

But while the Netherlands is still home to NXP Semiconductors, and Germany is the base of Infineon Technologies, they and others have outsourced much of their production.

Setting up cutting-edge fabrication plants is a hugely expensive business.

A large plant can cost up to $20bn (£14.3bn) to build and kit out, according to a report by the US's Semiconductor Industry Association (SIA) last year. And it can take many years before the factories make a profit.

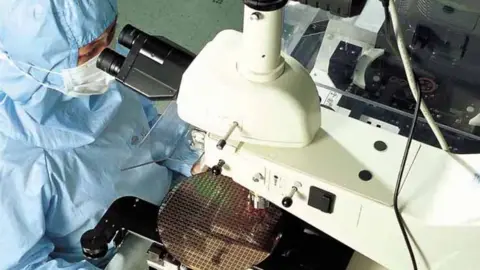

Taiwan Semiconductor Manufacturing Co Ltd

Taiwan Semiconductor Manufacturing Co LtdMoreover, costs have been going up over recent chip generations. And as the US firm Intel has found to its cost, it is hugely challenging to master the latest state-of-the-art processes required to manufacture the smallest transistors possible.

EU Internal Market Commissioner Thierry Breton has previously made the case for a major new fabrication plant to be built locally.

But he acknowledged at the report's launch that it was still unclear whether this would involve offering tax cuts to woo TSMC, Samsung or another major player to establish a new site within Europe.

He said a fabrication plant would be a very important investment.

"We have had some voluntary discussions with companies that have this know-how.

"So we have opportunities to do this with a partner - it may be a good idea - but nothing has been decided yet," he said.

Five-year plan

Being able to make the most advanced chips is taking on greater geo-political importance.

The US has already taken steps to restrict China's access to chips and other technologies involving American intellectual property on the grounds they could be used by the Chinese military and/or to carry out surveillance of its minority Uighur population.

And a recent report prepared for US President Biden advised him to take steps to ensure China continues to remain at least two chip generations behind.

"If a potential adversary bests the United States in semiconductors over the long term or suddenly cuts off US access to cutting-edge chips entirely, it could gain the upper hand in every domain of warfare," the National Security Commission on AI warned.

Last week, Beijing announced fresh steps to help its domestic semiconductor industry make advances of its own that could reduce the country's reliance on imports.

The country's latest five-year plan lists "integrated circuits" as one of seven frontier technologies that will benefit from a planned 7% annual boost in overall R&D investment between now and 2025.

'Future shockwaves'

Part of the EU's concern is how it might get caught up in the crossfire of a tech trade war between the two superpowers.

The Trump administration prevented ASML - a Dutch firm whose products use special light to carve transistors in silicon wafers - from exporting its most advanced machines to China's biggest chip-maker SMIC.

ASML

ASMLAnd it also imposed sanctions on Huawei, which prevented it from getting its own chip designs manufactured. This led the UK government to bar the Chinese telecoms equipment maker from future involvement in its 5G networks.

"Europe has woken up to the reality of the US-China technology 'war' [and] should play on its strengths to reduce its vulnerabilities to future shockwaves, and organise its long-term resilience as a key player of the global supply chain," advised a recent report from the French think tank Institut Montaigne.

Yearly review

The EU's new target was outlined within a wider plan called Digital Compass 2030.

Other goals included:

- developing the bloc's first quantum-accelerated computer by 2025

- ensuring all households have access to gigabit internet speeds

- employing ten million information and communications tech specialists, up from 7.8 million in 2019, with a focus on bringing more women into the industry

The European Commission intends to nudge individual governments into action by publishing an annual review of progress, but will have to leave it up to others to take the steps required for a rise in chip production output.