Fraudsters steal £4m a day as crime surges

Getty Images

Getty ImagesMore than £4m on average was stolen by fraudsters every day in the UK during the first half of the year as losses skyrocketed during the pandemic.

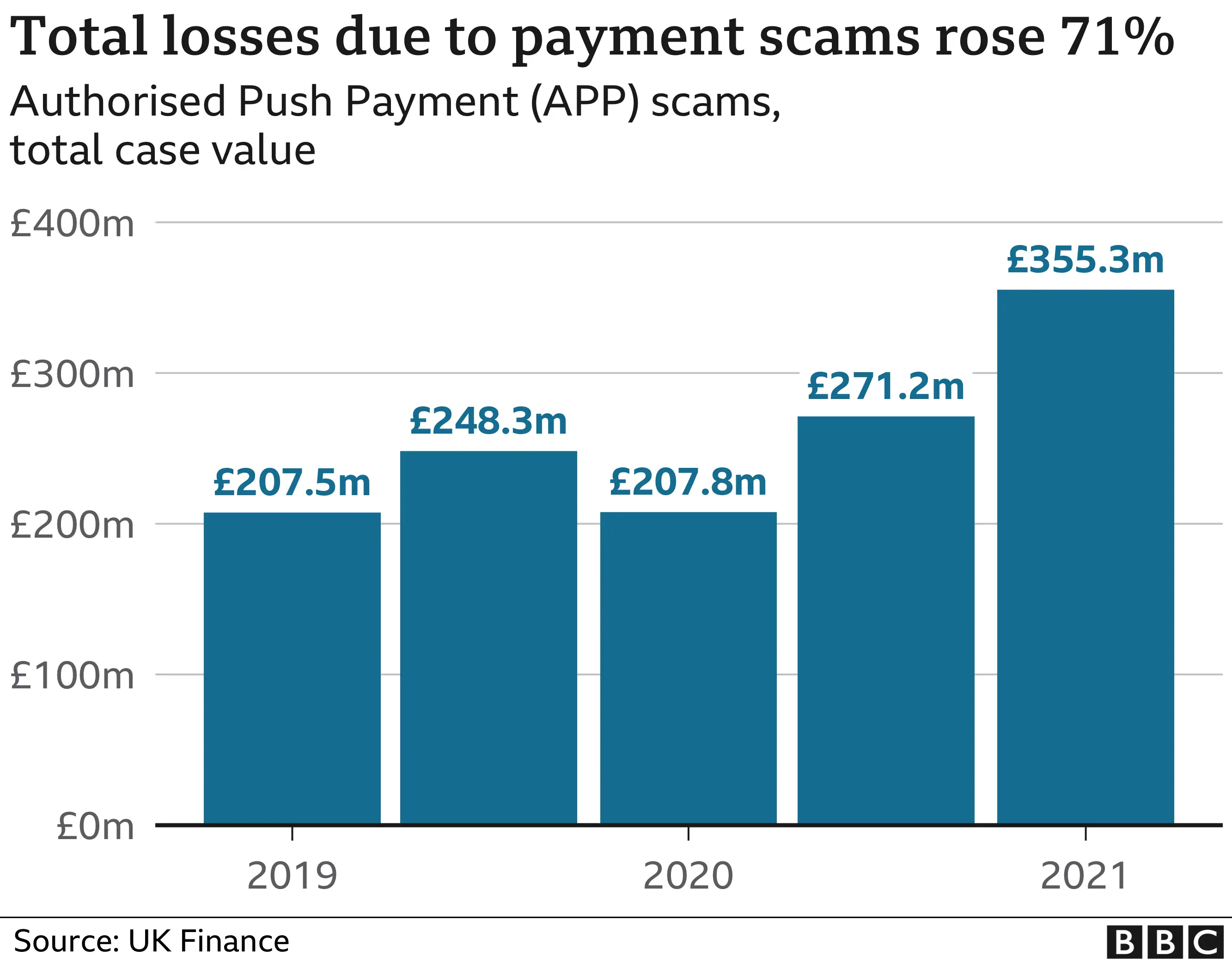

Fraud committed when individuals are tricked into handing over money and personal details surged by 71% compared with the first six months of last year.

Less than half of the money lost in these cases was refunded by banks.

Banking trade body UK Finance said teenage criminals buying fraud kits online were among the con-artists.

In total, £754m was stolen through fraud in the first half of the year, an increase of 30% compared with the same period last year.

Within this total, so-called authorised push payment (APP) fraud - when victims think they are paying a genuine organisation - rose by 71% to £355m.

Those scams can range from fake delivery texts asking for payment, which were common during the pandemic, to higher-value losses when fraudsters pretend to be solicitors during a house purchase.

Romance and impersonation scams rising

APP fraud losses have now outstripped fraud losses on bank and credit cards for the first time. Impersonation scams more than doubled (up 123%), investment scams rose by 95% and romance scams were up 62%.

Negotiations between banks to create a permanent, central pot of money to refund these scam victims collapsed earlier this year.

Katy Worobec, managing director of economic crime at UK Finance, said: "We are calling for coordinated action and increased efforts from government and other sectors to tackle what is now a national security threat."

Young victims

Rudy D'Souza

Rudy D'SouzaRudy D'Souza, aged 18, lost the £700 left over from his government-backed Child Trust Fund to fraudsters.

"This money was the most important money I could have had," he said.

"I'd just moved out and got a new job. But my pay is due after my rent, so I felt really tense and like an idiot for falling for this scam.

"I never even heard of push payment fraud until I became a victim."

Banks and police have discovered that fraudsters range from organised criminals to teenage thieves without any previous convictions operating in their bedrooms.

Children as young as 14 have been hired as money mules to launder stolen funds. Cryptocurrency wallets have also been used to shift money out of sight of the authorities, UK Finance said.

It estimated that 70% of fraud originated via online platforms, including social media, and technology bosses are being questioned by MPs on the Treasury Committee later about their efforts to prevent economic crime.

Ms Worobec said that co-ordination was needed between banks and a range of technology providers to tackle the issue, as well as raising awareness among consumers.

However, the banks' and police's own efforts in stopping the rising tide of fraud will also come under the microscope, with ministers promising an overhaul in the fight against fraud.

- To report scams, contact Action Fraud, or Police Scotland

- To report email scams, contact the National Cyber Security Centre (NCSC) by emailing [email protected]

- For consumer advice, please call the Citizens Advice Consumer Helpline on 0808 223 1133