Covid: Cash and card use dived in lockdown, says report

Getty Images

Getty ImagesConsumers kept their cash and cards in their pockets last year, as lockdowns cut the number of payments made for the first time in six years, banks say.

More than eight out of 10 payments by consumers are spontaneous but options were limited by the Covid crisis.

The total number of payments was down on the previous year, but when people did spend money they were increasingly likely to use contactless technology.

Covid concerns meant shoppers were encouraged to use it instead of cash.

Contactless technology allows consumers to place their debit or credit card, or smartphone, near a trader's terminal to pay for things, without needing to enter a four-digit pin.

Of the payments that were made last year, an increasing proportion were via contactless cards, banking trade body UK Finance said.

The contactless limit was hurriedly raised at the start of the pandemic to £45 per use, from £30.

Ministers are planning to allow that limit to be increased to £100 later this year.

The total number of payments made by consumers last year fell by 13% compared to the previous year, to 31 billion, according to the UK Finance report.

Contactless payments accounted for 27% of these transactions. They were most commonly made in supermarkets, although these were among the relatively small list of outlets which were able to remain open throughout the pandemic.

Nine out of 10 people shopped online and they were increasingly likely to spend via this method during lockdowns.

Payments made via smartphones and other digital devices also increased, primarily among the younger generations.

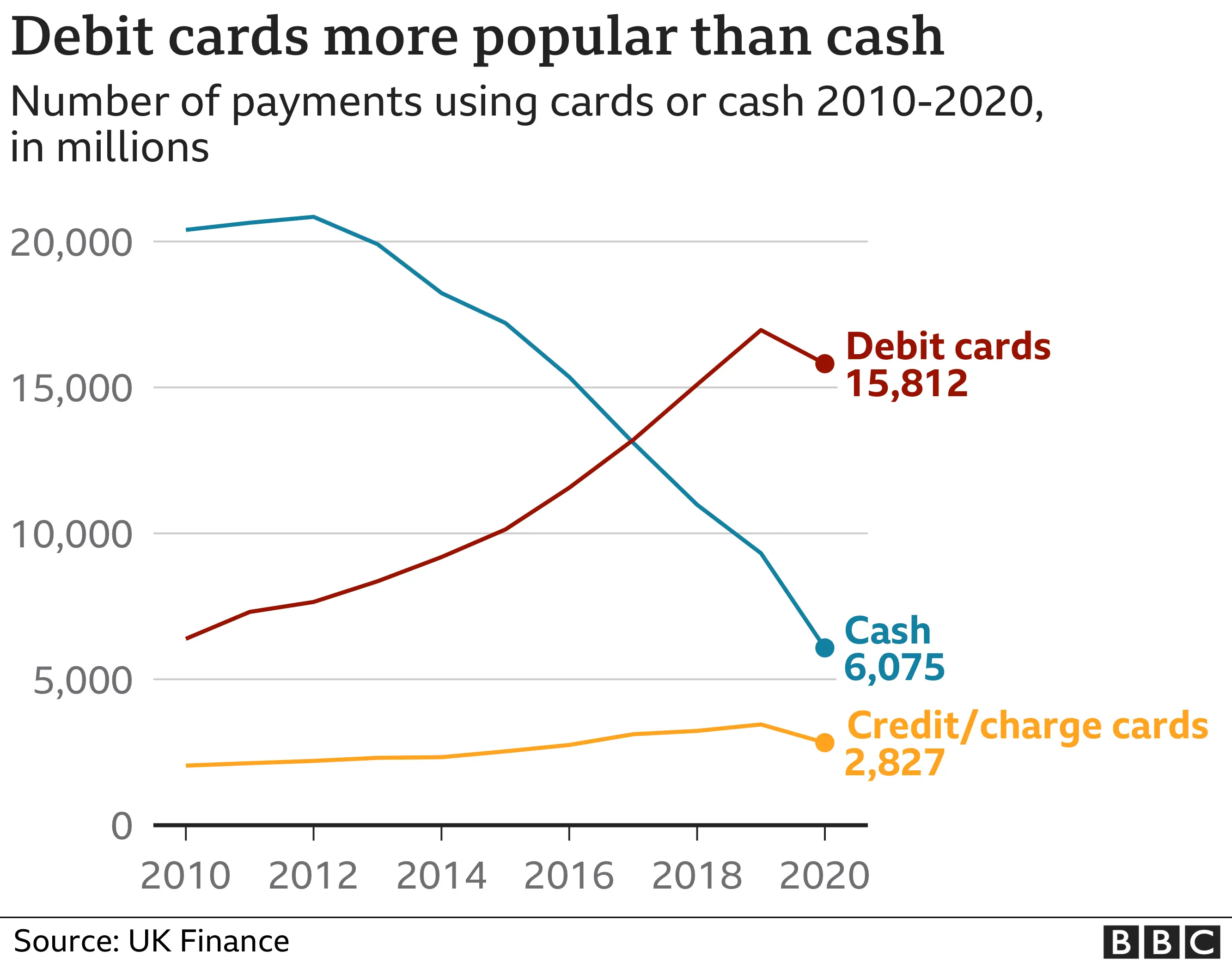

In contrast, cash use fell. The number of payments made with notes and coins dropped by 35%. This continued a trend of recent years, but also reflected the reduced opportunities to pay for things during lockdowns.

It still accounted for 17% of all payments, making it the second most-popular way to pay behind debit cards.

"While it is still too early to say if this is a permanent change to people's behaviour as, in many other parts of people's lives, the pandemic has also affected UK payment markets," the report said.