Argentina - the crisis in six charts

AFP

AFPArgentina is once again looking into the barrel of an economic crisis.

The currency is sliding, inflation rising and there could well be a recession in the making.

The International Monetary Fund (IMF) is providing an emergency loan.

It's all happening under a government that was seen by the international financial markets as offering Argentina new hope, one which, under the leadership of President Mauricio Macri, held out the prospect of stability and sustainable market-oriented economic policy that could begin to reverse a century of poor performance.

We look at six factors which have helped drive the crisis.

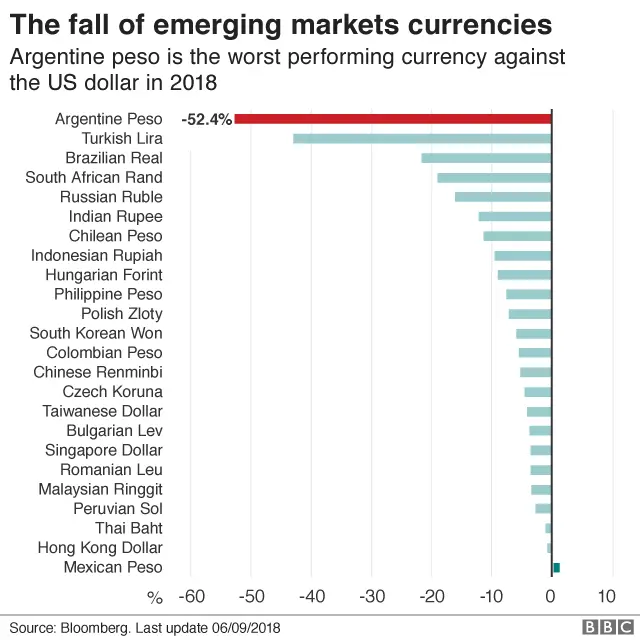

Peso plummets

It has been a grim year for the Argentine economy and the national currency, the Peso. Almost all emerging market currencies are down, due to rising interest rates in the United States encouraging investors to move money there.

But the Peso has declined further than any other.

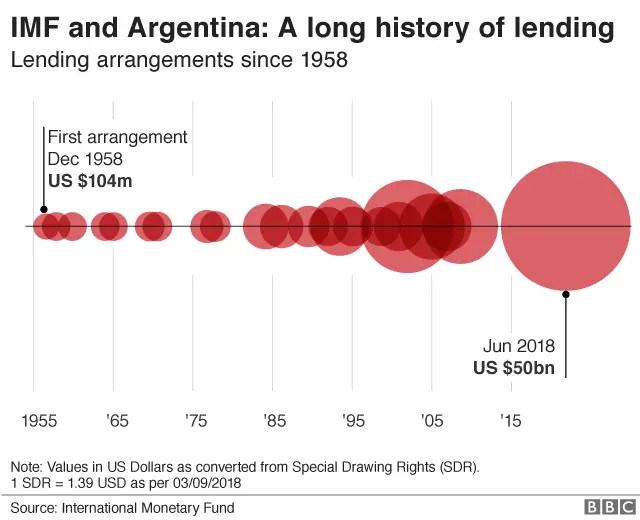

Argentina has IMF history

Once again, Argentina has turned to the IMF for financial help in a crisis.

It has agreed to lend Argentina a total of $50bn. Going to the IMF is a controversial move, especially so in Argentina.

IMF support generally comes with conditions that include unpopular austerity. Many Argentines blamed the IMF for the previous crisis in 2001. And there's a history. Argentina had its first IMF programme sixty years ago.

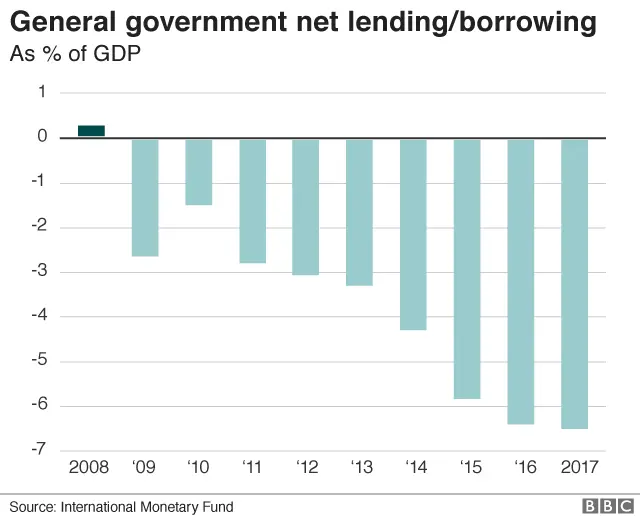

Messy finances

The loss of confidence among international investors reflects concerns about whether the government can meet all its debt repayments and borrow the new money it needs to finance its spending.

When President Macri took office at the end of 2015 the deficit in the government's finances - how much more it spends than it takes in taxes - was large. He wanted to bring it down but adopted a gradual approach to economic reform.

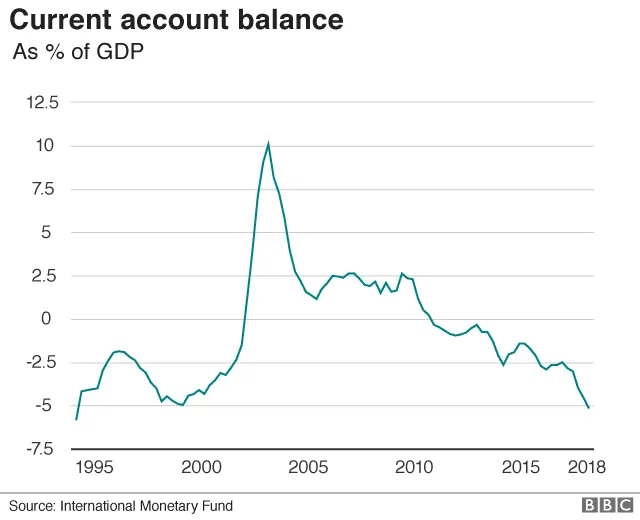

There is also a growing deficit in the country's international trade (or strictly speaking its current account). That has to be financed by foreign borrowing or investment, which is increasingly challenging at a time when US interest rates are rising.

In fact the deficit got slightly larger leaving Argentina at risk from anything that might make investors more inclined to pull their money out.

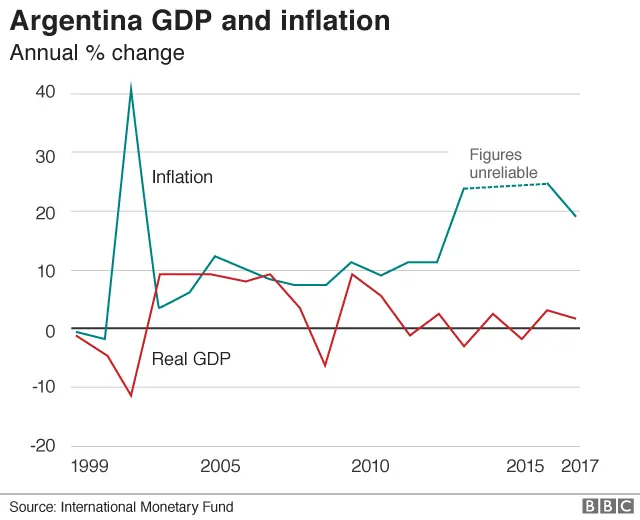

Rocketing inflation

Argentina's long standing inflation problem is another element in the crisis. The most recent figure is around 30%. That is one of the highest in the world, although not exceptional in Argentina's history.

There was a period of relatively moderate inflation in the 2000s, but it didn't last. (There is a gap in the graph, where the IMF thought the official inflation figures unreliable).

The economy (GDP in the graph) grew strongly in the years after the previous crisis in 2001-2. But its recent performance has been more uneven. Over the long term, Argentina's performance has been dismal.

A hundred years ago, it was richer than many countries in Western Europe, in terms of economic activity (GDP) per person. Now it's less than half the levels of France Germany and the UK. The intervening century has been described as "one of the most puzzling stories in the annals of modern economic history."

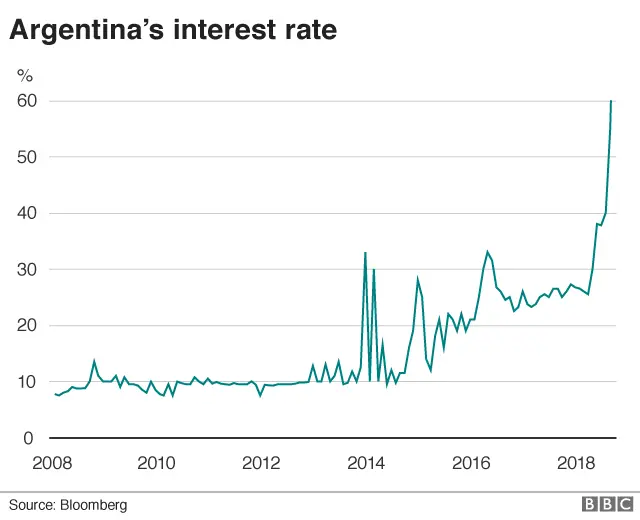

Interest rates soar

Interest rates have been increased sharply by the central bank in an effort to stabilise the Peso and bring inflation under control.

That is painfully high for consumers and businesses that want or need to borrow.

Even if the IMF bailout and the government's reforms do work, it looks like Argentina is, again, in for a torrid time as it seeks to chart its way through yet another economic crisis.