Argentina seeks IMF financial aid 'to avoid crisis'

AFP

AFPArgentina is to start talks about a financing deal with the International Monetary Fund (IMF) on Wednesday amid reports it is seeking $30bn (£22bn).

Finance minister Nicolas Dujovne is due to fly to the IMF's Washington offices.

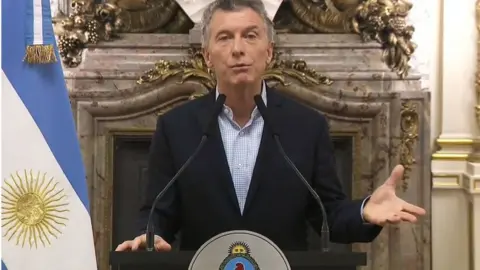

After recent turmoil that saw interest rates hit 40%, President Mauricio Macri said IMF aid would "strengthen growth" and help avoid crises of the past.

The talks come 17 years after Argentina defaulted on its debts and 12 years since it severed ties with IMF.

Mr Macri said in an address to the nation on Tuesday: "Just a few minutes ago I spoke with (IMF) director Christine Lagarde, and she confirmed we would start working on an agreement."

"This will allow us to strengthen our program of growth and development, giving us greater support to face this new global scenario and avoid crises like the ones we have had in our history," he said.

Local media and Bloomberg reported that Argentina was seeking $30bn, although the government declined to comment.

The peso has lost a quarter of its value in the past year amid President Macri's pro-market reforms.

Last week the central bank raised interest rates from 33.25% to 40%.

Many people still blame IMF austerity requirements for policies that led to a financial and economic meltdown in 2001 to 2002 that left millions of middle class Argentines in poverty.

Argentina eventually defaulted on its debts. And although its last IMF loan was paid down in 2006, the country severed ties with the Washington-based body.

Reforms

Mr Macri said Argentina was suffering as a result of high oil prices and the expectation that US interest rates would rise in the coming months.

Describing Argentina as a "valued member" of the IMF, Ms Lagarde said: "Discussions have been initiated on how we can work together to strengthen the Argentine economy and these will be pursued in short order."

Argentina is in the middle of a pro-market economic reform programme as Mr Macri seeks to reverse years of protectionism and high government spending under his predecessor, Cristina Fernandez de Kirchner.

Inflation, a perennial problem in Argentina, was at 25% in 2017, behind Venezuela as the highest in Latin America.

This year, the central bank has set an inflation target of 15% and has said it will continue to act to enforce it.

Last week's rate rise to 40% was the third increase in eight days in an attempt to boost the peso.

'Avoid crises'

News of the new talks may be controversial in some quarters. Many people in Argentina still blame the IMF for the policies that led to the 2001 financial and economic crisis. The country defaulted on $80bn (£59bn) of sovereign debt - the biggest in history.

Millions of middle class Argentines were plunged into poverty as a result.

However, Mr Macri said the new negotiations with the IMF would give the country "greater support to face this new global scenario and avoid crises like the ones we have had in our history".

Markets reacted positively to the news, with both local shares and the peso recovering some ground.

Miguel Kiguel, a former Argentine finance official who runs local consultancy Econviews, tweeted: "An IMF line of credit is the least expensive option for growth in Argentina."

By Andrew Walker, BBC economics correspondent

Argentina has had a turbulent relationship with the IMF.

In 2013 the country was censured by the Fund over the inflation and economic growth data published by the administration of President Cristina Fernandez de Kirchner. It was a step in a process that could ultimately have led to Argentina's expulsion from the IMF.

Earlier, many had blamed the IMF for contributing to a financial and economic crisis that came to a head around the end of 2001, which set back living standards severely.

Relations have improved under the current president, Mauricio Macri, whose approach to economic policy was much more consistent with that favoured at the IMF.

The prospect of a new IMF loan will test that improvement. It will come with economic policy conditions, including almost certainly spending cuts and tax rises, which are likely to aggravate political strains in Argentina.