The economy: Three better things, one worry

Getty Images

Getty ImagesThey won't exactly be clinking the champagne glasses at the Treasury.

But on Wednesday, the Office for National Statistics (ONS) did provide some relatively positive signals on the economy.

I say relative, given that since the financial crisis the economy has been struggling to match the type of earnings growth and productivity growth that was common before 2008.

The ONS data provides the latest health assessment of the economy.

In simple terms, there are three pieces of better news - and one concerning rattle from the engine.

Productivity rates saw the second quarter of growth well above recent trends.

At 0.8%, it is the second highest figure since 2011.

And, over a six month period, productivity growth measured by output per hour worked is now at levels not seen since the credit crunch.

Second, wage growth, excluding bonuses, is up, from 2.3% to 2.5%.

Getty Images

Getty ImagesThat is still below inflation at 3%, so the squeeze on real incomes (wages rising less quickly than prices) continues - even if it is easing gradually.

The public finances are also in better shape.

Or, more accurately, are in a less worse state than forecast last year.

As accountancy firm PwC reports, the budget deficit for the financial year to January is now £7bn lower than in the same period a year earlier.

When the final figure for 2017/18 is calculated - probably somewhere below £45bn - that will be a significantly smaller figure than the £49.9bn forecast by the official economic watchdog, the Office for Budget Responsibility, in its November forecast.

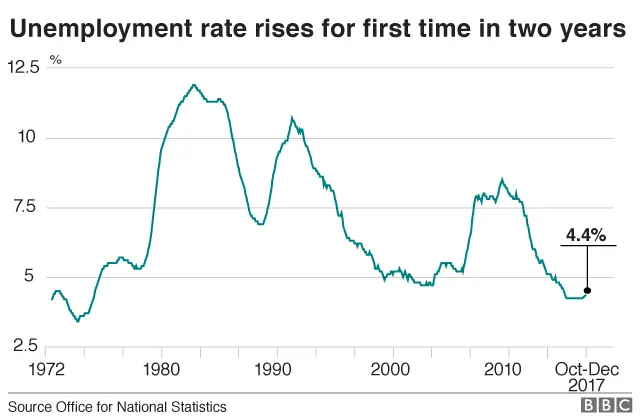

Rising unemployment

The one rattle in the engine is unemployment. That figure rose for the first time in two years.

Now, the increase is still small, and unemployment remains at a very low rate, 4.4% - 0.4% lower than in the three months to December 2016.

But, as the ONS says, the slight rise does spark a question.

Has unemployment reached its minimum? And could it now rise for the rest of the year?

Many believe that is unlikely.

The labour market remains "tight" - that is there is a high demand for jobs as growth strengthens and weak supply because of that very low unemployment.

There has also been a slowdown in the growth of the number of European Union workers in the UK.

Both those factors suggest unemployment may fall further.

Not by much, probably, as the economy is just about at the point of technical "full employment" - that is the equilibrium jobless rate for a developed economy where supply and demand are approximately matched.

After the Bank of England's upgrade to economic growth forecasts earlier this month, this is another set of more positive figures on the economy.

Good, not great

Few are suggesting that it is unalloyed good news. Government debts are still substantial and rising.

Wage increases are still weak.

Productivity would need years of positive figures to unwind the damage of the financial crisis.

And growth, the figures suggest, is not as strong as it would have been without the uncertainty around the Brexit process.

For the Treasury no champagne. But officials might allow themselves a half of lager on the way home tonight.