UK borrowing at lowest level since financial crisis

Getty Images

Getty ImagesUK borrowing for the year to date is at its lowest level since the financial crisis, according to the Office for National Statistics (ONS).

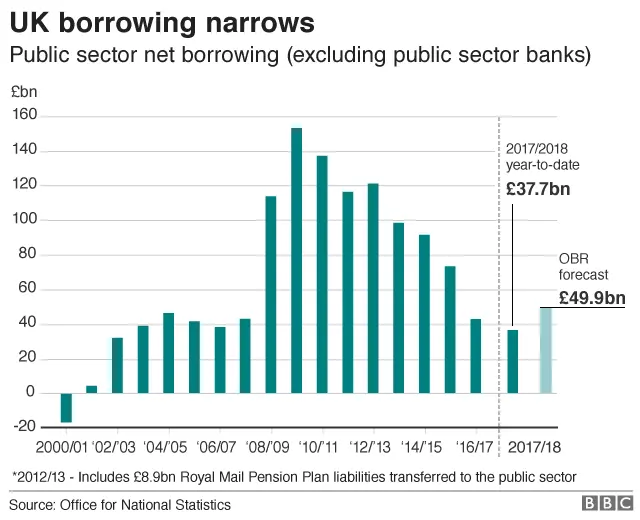

Public sector net borrowing, excluding state-owned banks, fell to £37.7bn between April and January, down £7.2bn on the comparable period.

It is the lowest figure for the period since January 2008, the ONS said.

It added that it is investigating the impact of Carillion's collapse on public sector finances.

At the Budget in November, the government's independent forecaster, the Office for Budget Responsibility (OBR), forecast that public sector net borrowing would rise by £4.1bn to £49.9bn in the financial year to March 2018.

John Hawksworth, chief economist at accountancy firm PwC, said it now "looks likely" that public borrowing will fall below last year's figure of £45.8bn and the OBR's expectations.

"This will be a welcome windfall for the chancellor," said Mr Hawksworth. "But we would expect him to bank it for now rather than spending it in his March Spring Statement, which looks set to be a low key affair.

"The chancellor will want to retain as much room for manoeuvre as possible for his next Budget in November, bearing in mind ongoing uncertainties around the Brexit negotiations."

In January, public sector net borrowing, excluding state-owned banks, showed a surplus of £10bn.

It was £1.6bn lower than the surplus in January 2017 but ahead of economists' expectations of £9.6bn.

January is typically a strong month for government finances due to a boost from self-assessment tax receipts.

Elizabeth Truss, chief secretary to the Treasury, said: "These are strong borrowing figures, which is proof that we are fixing our nation's finances and reducing the burden on future generations."

Carillion

CarillionThe ONS also said that it would be looking into the impact of Carillion's liquidation on the public sector finances "both in relation to the public-private partnership projects" and "the additional funding that government has provided in order to maintain public services".

"We will announce our findings in due course," it said.

Carillion went into liquidation last month. The construction giant ran a series of crucial services for schools, hospitals and prisons.