Cost of living: Port Talbot mum's debt drove her to the brink

BBC

BBCWhen her 16-year-old daughter called "petrified" that bailiffs in full body armour were banging on the door, Julie Andrews realised she needed help.

The carer was £28,000 in debt for not paying gas, electric and council tax bills and had payday loans so she could buy her three children school uniform.

"There were times I thought I wasn't going to manage and there were times I tried to take my life," said Julie, 57.

Julie wants to warn of high interest loans amid the cost of living crisis.

Experts estimate that one in seven people in the UK - more than seven million people - are financially excluded.

This is is where people's credit profiles are so poor that things like loans or mobile phone contracts, for example, have higher interest rates and are more expensive.

Wales has highest proportion of financial exclusion in Great Britain, including Julie, who was so "ashamed" she was one of those in financial difficulty she didn't tell anyone - even her family or closest friends.

"I had to wait for the kids to leave the house before I broke down," said the residential care home worker from south Wales.

'Ashamed'

"It was tough. It's something people don't want to talk about because you're ashamed.

"It was the fear, I brought my children up that you don't answer the door until I'm there - and every time I went out, I was looking over my shoulder to see if anybody was coming up the street, like debt collectors or bailiffs."

Her money troubles began when Julie, who lives in a two-bedroom home in Port Talbot, got divorced and her father, who used to help her, died.

"It's so easy as I carried on being a single mum and started ignoring all of the bills - and before you know it, I was £28,000 in debt," she said.

"The kids went without but had what they had to and I went to foodbanks."

'You've got to get for your children at Christmas'

But Julie said her children "had to have something to open on Christmas Day or their birthdays" and added there was "no other way" than to get a high interest loan.

"I don't care if I borrowed £500 and have to pay £1,500 back," she said.

"They may have gone without holidays or luxury food but Christmas... no. I couldn't see my babies go without. You've got to get for your children at Christmas."

Getty Images

Getty ImagesJulie said she found it difficult to seek help or talk to someone about her problems, almost until it was too late when she considered taking her own life. But she said she could not go through with it.

"I realised this was the lowest point you can go," she recalled.

"Having lost my mother when I was young, I was now [considering] taking my children's mother from them - and more to the point, they will find me - I can't have that."

Julie remembers the day when she finally sought financial help to stop the suffering of not just her, but her family.

'Petrified'

"I was at work and my daughter, who was 16 at the time, she rang and said there were bailiffs at the house threatening her," Julie recalled.

"So I told her not to answer the door and put the phone through the letterbox and I told them politely I'm at work and stop threatening my daughter. I told them the debt is mine, not her debt.

"I was petrified, she was petrified and I thought this is not fair on the children. My family was gobsmacked when I told them I was in so much debt."

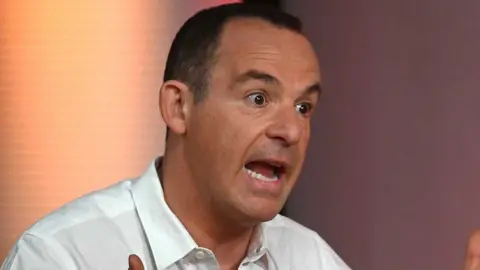

Although not a religious person, Julie got free help from Christians Against Poverty after seeing the not-for-profit organisation recommended on TV by money saving expert Martin Lewis.

They called Julie's creditors, froze her debts and helped her declare herself bankrupt. Christians Against Poverty estimate that 13% of the UK adults have fallen behind on their bills.

Now most loans have become more expensive since the Bank of England put up interest rates to 2.25% last month - the highest level for 14 years - and rates are forecast to rise to about 6% by the spring.

'Worrying rise'

About 370,000 people in Wales - that's one in six, the highest rate in Scotland, England or Wales - are classed as financially excluded, according to financial analysts.

This means they do not have access to high street financial services and pay more for bills like utilities.

Analysts also say data shows county court judgements (CCJs) have doubled in Wales in the past two years, with what they say is a "worrying" rise in CCJs for "small debts" under £500.

"More people are applying for short-term loans at a higher price," said Steve Elliot of Cardiff-based Lexis Nexis Risk Solutions.

LexisNexis

LexisNexisHe added: "Life at the moment is difficult for an increasingly number of people and having clear financial records that are able to give people access to financial and utility services in a more affordable way is a significant step to help them reduce cost."

Christians Against Poverty (CAP) have said calls to their helpline are rising every month and in the past two months, they have tripled the amount of emergency fuel top-ups than they did last year.

Now the organisation is calling on the UK government to raise benefits in line with inflation and "review their plans" to cut the Energy Price Guarantee from a minimum of two years to six months.

"We are increasingly seeing people coming to us that are struggling with fuel bills," said Karen Homans of CAP.

"This is particularly bad for those that are reliant on using expensive oil to heat their often poorly insulated and drafty homes.

"While we work with each person to look at their debts and help them maximise their income, more and more people are finding that they simply don't have enough income to match the skyrocketing energy and cost of living increases."

Christians Against Poverty

Christians Against Poverty'Debt can ruin your life'

The stories of financial struggles resonates with Julie and all she hopes is people in difficulty call for help before they get as deep into debt as she did.

"There are millions like me," she said. "Debt can ruin your life - calling for help was the best call I made.

"I'm petrified of slipping back into my old habits but I will never be there again. I don't know how I will stay out of debt but I'm hoping to.

"I'm still struggling. I work 30 hours a week, I'm only just keeping my head above the surface. I had 23p Universal Credit last month, I can't afford to shop every week and use the food bank occasionally. I can't do everything I want but have money to live on."

Julie is now enjoying life as a grandmother to seven children, all under the age of six, which she could not have envisaged before she sought help with her debt.

If you have been affected by any of the issues in this story, the BBC Action Line has links to organisations which can offer support and advice