Spring Statement: Cafe owner begs chancellor to rethink NI hike

BBC

BBCThe owner of a 100-year-old family cafe has pleaded with the chancellor not to increase National Insurance payments.

Louise Luporini, who runs Kardomah Cafe in Swansea with her husband Marcus, said the cost of ingredients was rocketing.

In his Spring Statement, Chancellor Rishi Sunak is expected to continue with big tax increases for businesses.

It comes as the cost of living increased by 6.2% in the last year, the fastest rise for 30 years.

As well as the tax increase for businesses, Mr Sunak is expected to tell employees to use National Insurance to pay for health and social care.

The cost of living crisis and the battle to make ends meet is not expected to ease.

Whether it is to heat your home or drive your car, energy prices have risen in a way never seen before and that in turn is pushing up the prices of many goods.

The UK government planned increases in National Insurance were announced last autumn when energy prices had begun to rise, but increases in the cost of living were not forecast at the extent that they are now.

It was also before the conflict between Russia and Ukraine escalated.

"Please, please don't increase National Insurance, not right now, there is too much instability in the country and the world," said Ms Luporini.

Her cafe has been running for more than 100 years and for 50 of those it has been run by the Luporini family.

The Kardomah employs 18 staff, but Ms Luporini said "it's not fun being a business owner right now".

Customers have started to return to the cafe as Covid restrictions have eased, but she said people had not fully returned to the city centre and business meetings that used to be common in the city centre were not happening as many people work from home.

'Everything has gone up'

The Kardomah's turnover is still down 50%, there are fewer officer workers wanting takeaways and the "suited and booted" are just not around.

At the same time "everything has gone up" said Louise.

The food is cooked on gas and the cafe is powered by electricity, both have rise steeply as they have for all households and businesses.

Ingredients have risen steeply too.

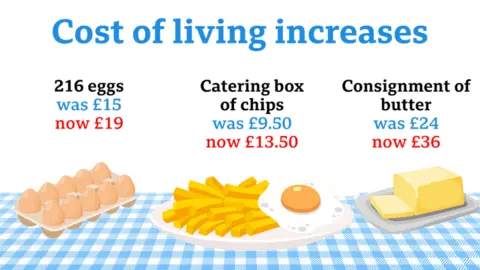

The cafe buys in bulk to reduce prices, but it cannot completely protect itself - 18 dozen eggs used to cost £15, it is now £19.

A catering box of chips was £9.50, it is now £13.50 and a consignment of butter used to cost £24, but now it is £36.

"We love our jobs, we love our staff and we would love to continue, it's just hard to make a profit," Louise said.

The cafe is making a profit, but the costs of running the business are expected to continue to rise into the autumn at least.

So what would help?

Louise and Marcus long to see office workers return to the city centre, they would like the increase in National Insurance delayed and funding towards their energy bills.

"We've got loads of fridges and freezers, lighting and heating.

"We keep looking at our numbers and crunching them, the minimum wage is going up as well as then in turn pensions, it's difficult," said Louise.

During the pandemic, VAT was reduced for the hospitality industry, Louise would like that to continue to reduce the prices that they have to charge customers.

Mother and daughter Doreen Davies and Tracey Williams see lunch in the cafe as their treat.

Tracey works in a care home and is on minimum wage, while her husband is a painter and decorator.

"There's an increase in everything, it's definitely very hard. My husband has to work more and myself too," she said.

The increase in National Minimum Wage from April will boost her wage packet "slightly", but "taxes are going up as well," she added.

She wants the chancellor to delay the increase in National Insurance payments and said people were "paying out enough now."

Her mother, Doreen Davies, relies on a state pension.

"The bills are frightening coming in," she said, adding that she does not put the heating on until the evening and "it's warmer to go out, walk to town, because if you stay in you automatically feel colder and put the heating on, so I won't put it on now until teatime when I go home".

This comes at a time when millions of households are already facing rises in energy bills not seen before, as well as increases in the price of essentials like food and clothes.

The steep rise in energy costs in expected to continue into the autumn, in fact the increase in the past few weeks means that the support given by the chancellor earlier this year now only covers a fifth of the increase in bills many households face.

The rise in energy prices will affect everyone, but those who were struggling anyway, or who were just making ends meet, will be hit hardest in terms of the proportion of their overall spending going on energy.

On top of that, those who are working face rises in National Insurance - for an employee on £30,000 a year, their National Insurance payment would rise by £255 - in Wales, we have a high proportion of people working on low pay.

For businesses, the increase in National Insurance will make it more expensive to employ someone and could result in them deciding to continue with fewer workers.

The National Minimum Wage and benefit payments are rising, but not as much as the increase in the cost of energy and goods in shops, so in effect people are getting poorer.

We knew big increases in taxes were on the way from April, but what was unexpected when the chancellor announced them in the autumn was such steep rises in the cost of living and a war between Russia and Ukraine that will have a huge impact well beyond the borders of those two countries.

The National Insurance increase will also affect employees - 33-year-old Clare Tucker works in the cafe, as does her husband, Paul Richards, 45, who is a chef.

They have three children and no car, and are still being hit by price rises.

They were both furloughed during lockdown and she believes that money needs to be paid back, but she does not agree with National Insurance payments rising now.

She added that she would like "everything frozen until we get the economy back", but cannot see that happening.

- LESSONS FROM LOCKDOWN: How has the experience of lockdown changed us?

- WILD MOUNTAINS OF SNOWDONIA: Five farming families open their gates and share their lives