What to expect from Rishi Sunak's Spring Statement

BBC

BBCThere is a very big question hanging over tomorrow's Spring Statement: just how much do the public expect the government to give a helping hand at a time of international emergency?

The instinct of the chancellor, is that he can only do so much.

In my travels from Ayrshire to Derbyshire over the past week, trying to take the temperature of the economy at the time of a seismic price shock, it's clear that the public expects more than it used to.

Whether it was Milligan's coach company, unable to work out if it can price its trips at a profit because of rising diesel costs; or the farm owner in Ashover, unprotected by energy caps, facing "open-ended" price increases from heating oil.

Over the period of the pandemic, the chancellor repeatedly rolled out ever expanding multi-billion pound economic rescues, with mainly borrowed money.

But Rishi Sunak does not want expanded government spending to define his tenure at Number 11.

The statement that is coming on Wednesday was originally intended to be no more than an economic update, alongside the new forecast from the Office for Budget Responsibility.

Plans have changed since then to reflect the acute challenges for household budgets, but it would be wrong to see this as a mini-Budget. Perhaps not even a micro-Budget. There is still not enough for the traditional "red book" of measures.

The big takeaway from the chancellor's words over the weekend was not about a significant rescue package, but that he can not protect the country from all the pressures arising out of the global wave of surging prices.

The most important text ahead of the chancellor's statement, is his Mais lecture from last month. He used it to push back against the idea that the size of the British state would be left bigger forever.

Political judgement

This is an area of political judgement as well as economic strategy.

The main area of household economic stress - domestic gas and electricity bills - will be dealt with at a later date. The official cost of the government package designed to lessen the burden of next month's record rise, will be revealed.

But whether the further rise will be another few hundred pounds a year or over a thousands pounds a year for an average household can not yet be known with certainty.

The original £9bn package helped mitigate less than half of the £21bn rise in energy prices until January, and that was mostly through loans. But the total value of price rises is on course to more than double to over £43bn.

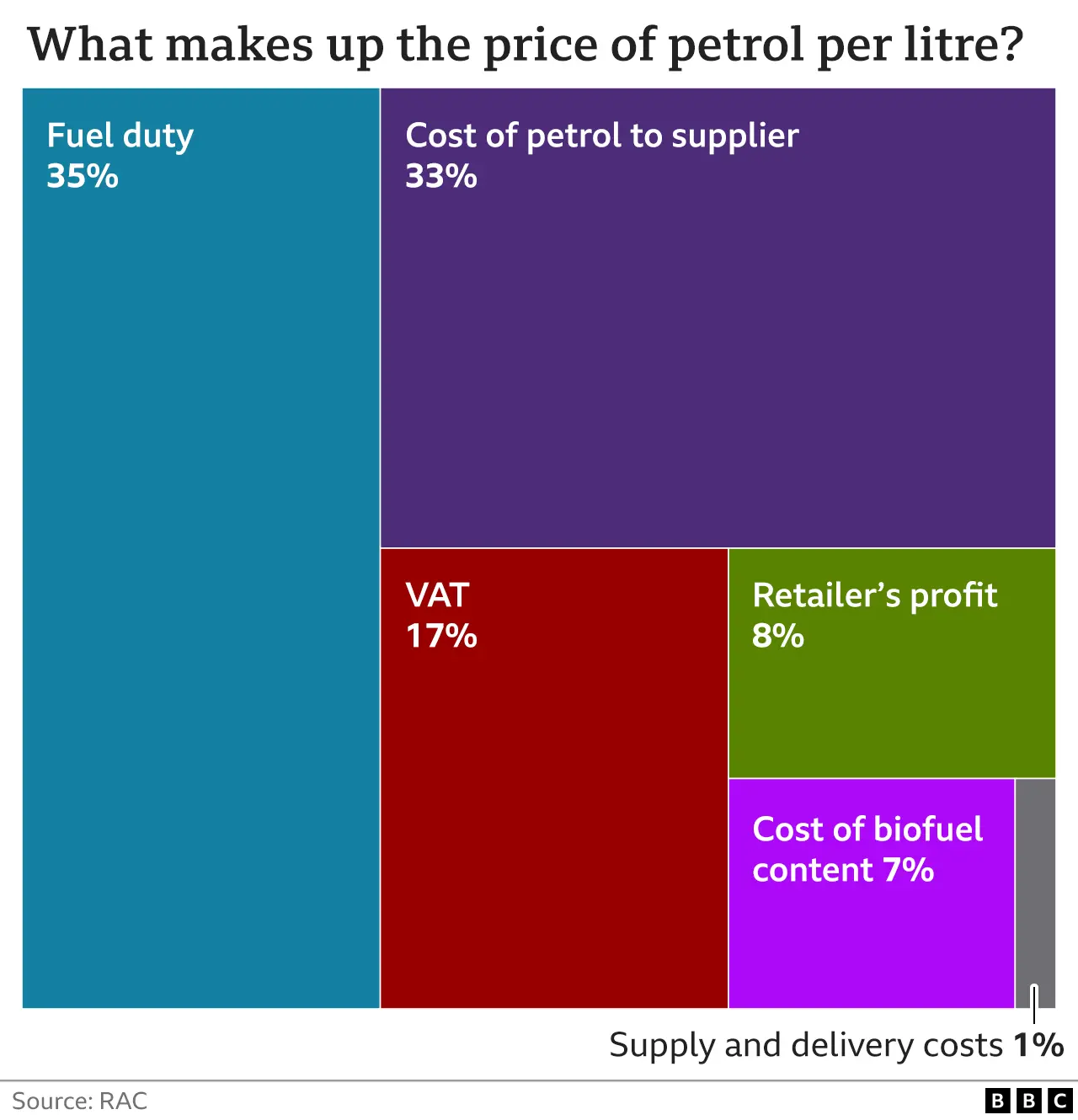

There is scope to cut back fuel duty on petrol and diesel by a few pence - however, pump prices will still feel like they are at a record, with an average diesel tank costing close to £100.

The really stark fact in here is that amid these global pressures arising from the pandemic bounce-back and the invasion, the government is further squeezing households with significant new tax rises.

It is remarkable this is all hitting at the same time. It is difficult to think that the government would have devised policy in this way, had the price surge occurred earlier.

The effect of some of the national insurance rise on low and middle earners could be unpicked by a rise in the threshold over which it is paid. But, to be clear, these are slightly smaller rises in taxes, not tax cuts.

Inflation nation

The problem for the exchequer is that acknowledging the reality of 8% inflation rates for national insurance thresholds, points to doing the same for universal credit and for public sector pay.

Indeed the Bank of England are now projecting that inflation could be at double digit levels at the end of the year.

While some increase in the generosity of universal credit could come, public sector pay is being left to the pay review bodies. In April at least there will be immediate real terms pay cuts, as wages fail to match inflation.

Some of this might be undone by the summer, but the government's position so far is that public sector should pay more attention to the 2% inflation target for setting interest rates, than actual rates of inflation.

And all the while, the Treasury would rather be talking about long term plans to raise investment, productivity, growth, living standards and tax revenues.

The current cost of living crisis threatens to turn into an emergency. And although this could be a new normal lasting years, don't expect a pandemic-style rescue, this time.