Ulster Bank to close 10 branches in Northern Ireland

BBC

BBCUlster Bank is closing 10 branches across Northern Ireland and cutting 21 jobs, it has confirmed.

Among the sites to close is its Lisnaskea branch, leaving the County Fermanagh town with no banks - a decade ago it had three.

The branches will close between February and November 2024.

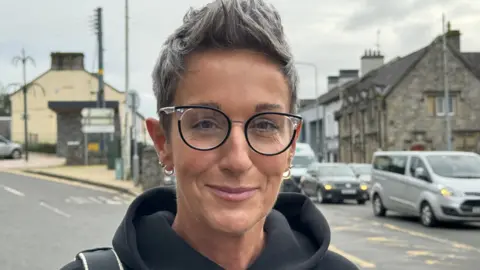

Lisnaskea business owner Alma Kinnear described the closure as "so sad and so ridiculous", saying: "I don't know how much more we can take in the town."

The other branches due to close are Ballynahinch, Crumlin, Downpatrick, Glengormley, Lurgan, Waterside in Londonderry and three branches in Belfast - Ormeau Road, University Road and Kings Road.

The decision was made in response to more customers banking online, the bank said.

Long queues and unreliable internet

Glenn Charles, from Cherry Tree Bakery in Lisnaskea, said customers are being driven online by the banks, rather than by choice.

"Every time you go to a bank they say: 'Oh, you can do this online.' So you just have no choice," he said.

Alma Kinnear, owner of the Kissing Crust Cafe, is concerned about what it means for the town.

"Is there going to be no ATM on the main street? These things are so important for a rural community," she said.

Lisnaskea resident Anne Phair says the closure will be a big blow to the community.

"At one point we had three local banks, now we're relying on online banking and, of course, not everybody's able to access that especially in Fermanagh where internet access isn't always reliable," she said.

"I feel especially sorry for the older community here in the town because we have a local post office that does do some banking services, but unfortunately there's always large queues.

"I feel really sorry for those that have to queue a long time (and) may be unable to do so."

No more changes until 2026

It is understood the bank is responding to changing consumer behaviour, after counter transactions reduced by 53% between 2019 and 2023, while the number of customers using mobile apps increased by 45%.

An Ulster Bank spokesperson said: "As with many industries, most of our customers are shifting to mobile and online banking, because it's faster and easier for people to manage their financial lives.

"We understand and recognise that digital solutions aren't right for everyone or every situation, and that when we close branches we have to make sure that no one is left behind.

"We take our responsibility seriously to support the people who face challenges in moving online, so we are investing to provide them with support and alternatives that work for them."

Getty Images

Getty Images"We will be investing over £3m across our branch network in the next two years, following £3.25m of investment in 2023. We will be making no further changes to our branch network until at least 2026."

The dates for each closure are:

- Ballynahinch - 28 February 2024

- Crumlin - 20 March 2024

- Downpatrick - 19 November 2024

- Glengormley - 13 March 2024

- Kings Road - 21 February 2024

- Lisnaskea - 6 March 2024

- Lurgan - 5 March 2024

- Ormeau Road - 20 February 2024

- University Road - 12 March 2024

- Waterside - 27 February 2024

Earlier this year, Ulster Bank shut down its entire branch network in the Republic of Ireland, with 63 branches affected.

In 2022, Ulster Bank announced it was closing nine branches in Northern Ireland in response to online and mobile banking.