UK economy growth forecasts slashed for next two years

Getty Images

Getty ImagesThe UK economy will grow much more slowly than expected in the next two years as inflation takes longer to fall, the government's forecaster says.

Living standards are also not expected to return to pre-pandemic levels until 2027-28, the Office for Budget Responsibility (OBR) said.

It comes as the chancellor announced tax cuts and a rise in benefits in his Autumn Statement.

Labour said people were still paying for "Tory economic recklessness".

The OBR, which is independent from government, publishes two sets of economic forecasts a year, which are used to predict what will happen to government finances.

These are based on its best guess about what will happen, and are subject to change.

According to the watchdog, the UK will grow by 0.6% this year - considerably better than what it expected last autumn, when it predicted the economy would fall into recession and shrink.

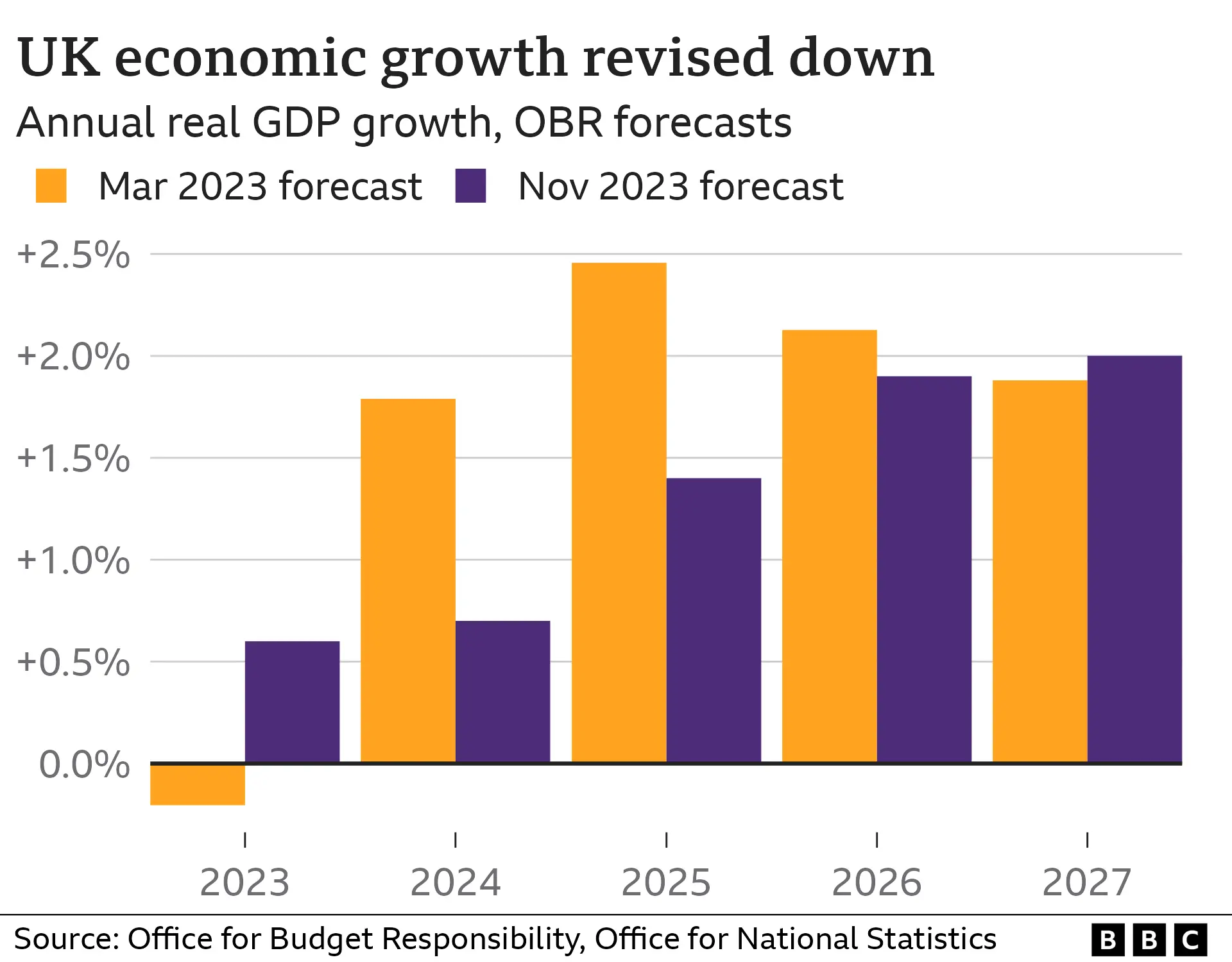

However, it slashed its growth outlook to 0.7% in 2024 and 1.4% in 2025 - down from a previous forecast of 1.8% and 2.5%.

"The economy has proved more resilient to the shocks of the pandemic and energy crisis than we anticipated. But inflation has also been more persistent and interest rates higher than [forecast] in March," it said.

The OBR warned that inflation - currently 4.6% - will only fall to 2.8% by the end of 2024, before reaching the Bank of England's 2% target in 2025.

Previously it forecast inflation would easily beat the target next year.

And it said that UK living standards, as measured by households' real disposable income, were expected to be 3.5% lower in 2024-25 than their pre-pandemic level, before returning to normal several years later.

This drop would be less sharp than previously expected, but still represent "the largest reduction in real living standards since Office for National Statistics records began in the 1950s".

The economy has been struggling with a combination of high inflation, rising interest rates and flagging consumer demand, which is weighing on growth.

In slightly more pessimistic forecasts put out earlier this month by the Bank of England, the central bank said it expected the UK to see almost no growth at all in 2024 and 2025.

The Bank has put up interest rates 14 times since December 2021 to tackle soaring price rises, leaving them at 5.25% - a 15-year high - at its last two meetings.

The idea is this makes borrowing money more expensive, dampening demand and slowing price rises. But higher interest rates also tend to make businesses less likely to invest which can drag on the economy.

And while rates for savers have risen, so have mortgage rates, putting pressure on households.

This has hit property prices, which the OBR said would fall by around 4.7% in 2024.

Delivering his Autumn Statement, Chancellor Jeremy Hunt said the UK was growing faster than the eurozone but that productivity needed to improve.

He said the private sector was more productive in the US, Germany and France because they invested more, but added that his new proposals such as removing planning red tape, helping entrepreneurs raise capital and cutting business taxes would "help close that gap".

Mr Hunt added that government borrowing and debt - which have risen sharply as interest rates have gone up - would be lower than the OBR previously forecast in both 2024 and 2025.

"Some of this improvement is from higher tax receipts from a stronger economy, but we also maintain a disciplined approach to public spending," he said.