Autumn Statement 2023: National Insurance and more key announcements by Jeremy Hunt

Getty Images

Getty ImagesChancellor Jeremy Hunt has unveiled the contents of his Autumn Statement in the House of Commons.

It sets out the government's tax and spending plans for the year ahead, affecting the take-home pay and household budgets of millions of people, as well as the funding for key public services.

Here is a summary of the main measures.

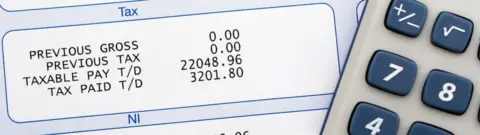

Taxation and wages

Getty Images

Getty Images- Main rate of National Insurance cut from 12% to 10% from 6 January, affecting 27 million people

- Class 2 National Insurance - paid by self-employed people earning more than £12,570 - abolished from April

- Class 4 National Insurance for self employed - paid on profits between £12,570 and £50,270 - cut from 9% to 8% from April

- Legal minimum wage - known officially as the National Living Wage - to increase from £10.42 to £11.44 an hour from April

- New rate to apply to 21 and 22-year-old workers for the first time, rather than just those 23 and over

- How is National Insurance changing?

Benefits and pensions

Getty Images

Getty Images- Universal credit and other working-age benefits in England and Wales to increase by 6.7% from April, in line with September's inflation rate

- Local Housing Allowance rates - which determine level of housing benefit and universal credit people receive to pay rent in Great Britain - to be unfrozen and increased to 30% of local rents from April

- Work Capability Assessment to be reformed to reflect availability of home working after Covid pandemic

- Funding of £1.3bn over the next five years to help people with health conditions find jobs

- Further £1.3bn to help people who have been unemployed for over a year

- Claimants in England and Wales deemed able to work who refuse to seek employment to lose access to their benefits and extras like free prescriptions

- State pension payments to increase by 8.5% from April, in line with average earnings

- Consultation on whether savers get the right to pick the pension scheme their employer pays into - possibly allowing them to have one pension pot for life

- How much will benefits increase?

- What is the state pension and the triple lock?

Economy and public finances

Getty Images

Getty Images- Chancellor's package includes 110 measures aimed at boosting economic growth

- Independent Office for Budget Responsibility (OBR) expects the economy to grow by 0.6% this year and 0.7% next year, rising to 1.4% in 2025; then 1.9% in 2026; 2% in 2027 and 1.7% in 2028

- It forecasts that inflation - the rate prices are rising - will fall to 2.8% by the end of 2024, before reaching the Bank of England's 2% target rate in 2025

- Living standards not expected to return to pre-pandemic levels until 2027-28

- Underlying debt forecast to be 91.6% of GDP next year; 92.7% in 2024-25; 93.2% in 2026-27; before declining to 92.8% in 2028-29

- Borrowing forecast to fall from 4.5% of GDP in 2023-24; to 3% in 2024-25; 2.7% in 2025-26; 2.3% in 2026-27; 1.6% in 2027-28 and 1.1% in 2028-29

- UK growth forecasts slashed for next two years

- What is the OBR and why does it matter?

Business and infrastructure

Getty Images

Getty Images- "Full expensing" tax break - allowing companies to deduct spending on new machinery and equipment from profits - made permanent

- The 75% business rates discount for retail, hospitality and leisure firms in England extended for another year

- Households living close to new pylons and transmission infrastructure to get up to £1,000 a year off energy bills for a decade

- New premium planning services across England, with faster decision dates for major business applications and fee refunds when these are not met

- Funding of £4.5bn to attract investment to strategic manufacturing sectors, including green energy, aerospace, life sciences and zero-emission vehicles

- Some £500m over the next two years to fund artificial intelligence innovation centres

- Financial incentives for investment zones and tax reliefs for freeports extended from five years to 10 years, with new investment zones announced for the West Midlands, East Midlands and Greater Manchester, as well as Wrexham and Flintshire

- A further £80m for new Levelling Up Partnerships to fund regeneration projects in Scotland

Government spending

PA Media

PA Media- Reaffirms previous commitments made last autumn to provide £14.1bn for the NHS and adult social care in England, as well as an extra £2bn for schools, in both 2023‑24 and 2024-25

- Devolved governments in Scotland, Wales and Northern Ireland get equivalent funding

- But OBR says higher inflation means real value of departmental budgets will be £19bn lower by 2027/28 compared with March forecasts

- Defence spending to remain at 2% of national income - a Nato commitment

- Overseas aid spending kept at 0.5% of national income, below the official 0.7% target

Other measures

- All alcohol duty frozen until 1 August next year

- Duty rate on tobacco products increases by 2% above RPI inflation; hand-rolling tobacco rises 12% above RPI

- Fuel duty wasn't mentioned so remains 52.95p per litre for petrol and diesel, after the chancellor announced a 5p per litre cut for 12 months in March

- Up to £7m over next three years for organisations like the Holocaust Educational Trust to tackle antisemitism in schools and universities

- Funding of £5m for Imperial College and Imperial College Healthcare NHS Trust to set up Fleming Centre to work on health innovations

- Some £3m for Tackling Paramilitarism Programme in Northern Ireland

Are you a small business owner or self-employed with a young family? How will the Autumn Statement affect you? Share your experiences by emailing haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk. Please include your name, age and location with any submission.