Households are worse off since the last election, says the IFS

Getty Images

Getty ImagesTax cuts announced in Wednesday's Budget will not make up for the impact of tax increases and rising prices, a leading think tank has said.

The Institute for Fiscal Studies (IFS) said households would be worse off at the election, expected this year, than they were at the start of this parliament.

The chancellor has announced a cut to National Insurance worth £10bn.

Despite that, this will be a record tax-raising parliament, the IFS said.

Chancellor Jeremy Hunt tried to strike an optimistic note as he spelt out the government's strategy on tax and spend for what could be the last time before the country goes to the polls. He pointed to upgrades to short-term forecasts saying the UK would soon be "turning a corner" on growth as it has on inflation.

The extra leeway afforded by those higher predictions on growth, and a handful of tax-raising measures, allowed him to cut another 2p from National Insurance Contributions (NIC), levied on pay packets throughout the UK, on top of a 2p cut he made in January.

He presented it as part of a long-term reform plan to shift the tax burden away from workers designed to encourage people back into work.

The cut would benefit millions of workers, the IFS said, with those on just above average earnings gaining a total of £1,000 a year from the two NIC cuts put together.

But they only mean the government is giving back "a portion" of the money taken away through other tax changes, the IFS said.

The government's earlier policy of freezing tax thresholds means that people are seeing a higher proportion of their salary taken in tax.

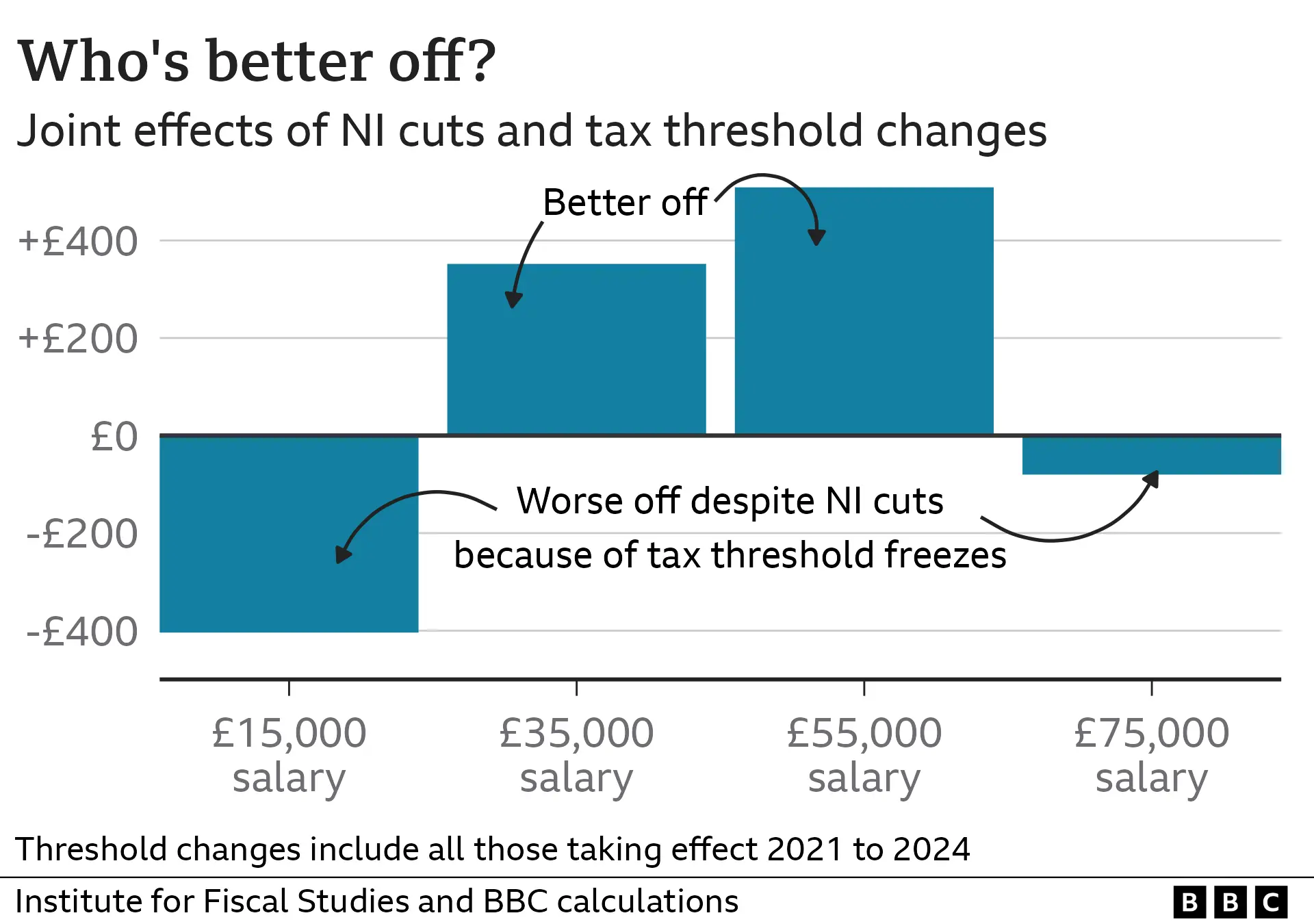

The precise pattern of gains and losses following the tax changes varies depending on income.

In the upcoming financial year an average earner would enjoy a tax cut of about £340, and people earning between £26,000 and £60,000 will be better off, the IFS said.

However by 2027 the average earner would be only £140 better off, and only people earning between £32,000 and £55,000 a year would be better off from the combined tax changes.

"The big picture on tax remains much the same," said IFS director Paul Johnson. "This remains a parliament of record tax rises.

"Overall, for every £1 given back to workers (including the self-employed) by the NICs cuts, £1.30 will have been taken away due to threshold changes between 2021 and 2024, with this rising to £1.90 in 2027."

Labour leader Sir Keir Starmer said the government's strategy was to "give with one hand, and take even more with the other".

The state of the economy, and more importantly how people feel about their own personal finances, is under the spotlight as battle lines are drawn up for a general election that must be called before next January.

Conservatives will be hoping that the Office for Budget Responsibility's slight upgrade to the growth forecasts for this year - from 0.7% to 0.8% - and for next year - from 1.4% to 1.9% - will help change the narrative after recent economic data showing the UK went into recession last year.

But the upgrades are not large and fall away after two years. The IFS said overall the picture on living standards remained "dismal".

Read more on Budget

Before the Budget the IFS urged the chancellor not to cut taxes as without a substantial improvement in growth, it would result in a severe squeeze on some areas of public spending in the years ahead, including the criminal justice system and local government.

Mr Johnson said the chancellor's strategy still implied "substantial cuts to funding of many public services which are clearly struggling with their current level of funding".

Mr Hunt defended the squeeze on public spending as realistic if schools, hospitals and the police deployed automation, artificial intelligence and drones.

The IFS provides a verdict on the chancellor's Budget every year, analysing what his policy strategy is likely to mean for the economy and people's incomes.

The official forecasts on economic growth are provided alongside every Budget by the Office for Budget Responsibility (OBR), the government's official independent economic forecasting body. Although forecasts can be derailed by anything from geopolitics to government policies, they provide a rolling basis for assessing the state of the public finances.

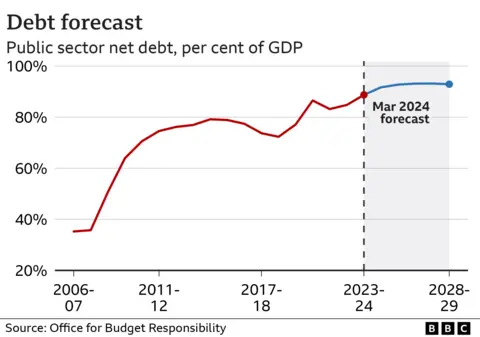

With the government's newly announced measures taken into account, the OBR now expects borrowing to rise slightly in the next financial year, before remaining broadly in line with previous forecasts. It would fall below 3% of GDP by 2025-26, meeting one of the fiscal rules the government has set itself.

Overall the country's debt, measured against the size of the economy, is still set to rise over the next four years, before falling back marginally in the fifth year, thereby meeting another of the government's fiscal rules.

However, debt as a proportion of GDP will still be 92.9% in 2028-29, higher than the 89% it is expected to be this year.