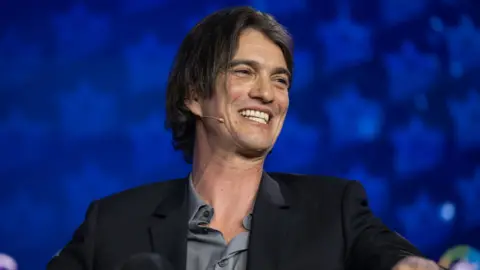

WeWork's ousted boss plots buyback of bankrupt firm

Getty Images

Getty ImagesWeWork's former boss, Adam Neumann, wants to buy back the bankrupt shared office company, according to a letter made public on Tuesday.

He approached the firm in December about a potential deal, the message from his lawyer to WeWork said.

It accused WeWork of resisting the idea, despite its bleak financial situation.

WeWork said it received offers on a "regular basis" and was focused on "the best interests" of the firm.

"We continue to believe that the work we are currently doing - addressing our unsustainable rent expenses and restructuring our business - will ensure WeWork is best positioned as an independent, valuable, financially strong and sustainable company long into the future," it said.

Mr Neumann was ousted from WeWork in 2019 after a disastrous - and ultimately fruitless - attempt to list the company on the stock exchange exposed its financial weaknesses and raised questions about his leadership.

WeWork was hit by the shutdown of offices during the pandemic a few months later and never fully recovered. Mr Neumann's time at WeWork was later portrayed by the actor Jared Leto in an Apple TV series called WeCrashed.

The company filed for bankruptcy last November when it sought court protection as it tried to renegotiate leases with its landlords.

Mr Neumann, who now leads a new property firm called Flow, approached WeWork in December about a possible deal.

WeWork initially "resisted" the overtures, according to the letter from Mr Neumann's lawyers, worried that it would hurt talks with landlords.

Eventually WeWork said it would consider a financing proposal, but the letter said Mr Neumann has yet to receive information to help inform its offer.

It also claimed WeWork cancelled a meeting in 2022 to discuss a proposed $1bn (£790m) in financing from Mr Neumann while he was en route in the air.

"We write to express our dismay with WeWork's lack of engagement even to provide information to my clients in what is intended to be a value-maximizing transaction for all stakeholders," wrote lawyer Alex Spiro of Quinn Emanuel, who confirmed the authenticity of the letter, which was first reported by the New York Times.

Mr Spiro wrote that Mr Neumann offered "management expertise" and a takeover could boost the value of the firm.

"WeWork should at least educate itself about that potential and not preclude itself from maximizing value," he said.

According to the letter, Mr Neumann is "partnering" with investors, including the hedge fund Third Point.

In a statement, the New York based firm said it had only had "preliminary conversations with Flow and Adam Neumann about their ideas for WeWork, and has not made a commitment to participate in any transaction".

WeWork, founded in 2010, was once hailed as the future of the office, expanding to more than 800 locations around the world.

But the growth proved too costly to sustain, leaving the firm with multi-billion dollar losses.