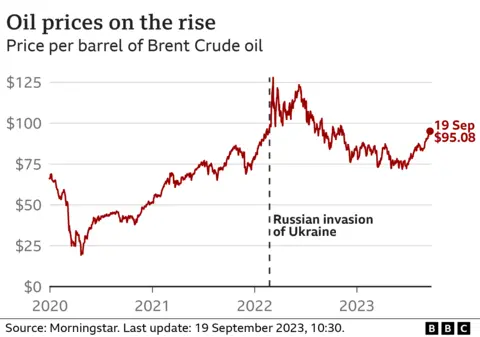

Warning over fuel prices as oil hits 10-month high

Getty Images

Getty ImagesDrivers have been warned of rising fuel costs after global oil prices surged to their highest level for 10 months.

Brent crude, a benchmark for prices, breached $95 a barrel on Tuesday amid predictions of shorter supplies.

It came as the International Energy Agency (IEA) said a decision by Saudi Arabia and Russia to cut production could cause a "significant supply shortfall" by the end of this year.

The RAC motoring group warned drivers were "in for a hard time" at the pumps.

Latest figures show UK drivers are now paying £1.55 on average per litre of petrol, with diesel at £1.59.

Since the start of August, average petrol prices have increased by 10p per litre and diesel prices by 13p.

Following Russia's invasion of Ukraine in February 2022, oil prices soared, hitting more than $120 a barrel in June last year.

They fell back to a little above $70 a barrel in May this year, but have steadily risen since then as producers have tried to restrict output to support the market. Saudi Arabia and Russia, members of the Opec+ group and two of the world's largest oil-producing nations, decided to reduce production earlier in August.

At the same time, the US Energy Information Administration said on Monday that US oil output from its top shale-producing regions was set to decline in October for the third straight month, reaching its lowest level since May.

As the biggest exporter and the leader of the pack, Saudi Arabia wants oil prices to stay elevated to make sure it has a steady stream of income while it tries to diversify its economy.

However, the West has accused Opec, whose members regularly meet to agree on production levels, of manipulating prices.

Petrol and diesel prices have jumped in recent months, and further rises could lie ahead due to crude oil being the main component of fuel, motoring groups say.

The AA warned rising prices were coming at a time when fuel efficiency typically drops as a result of darker evenings due to engines needing to work harder with heaters and lights being used more.

"Drivers have been lashed by a 10p-a-litre rise in the cost of petrol since the beginning of August," said Luke Bodset, the AA's spokesman on pump prices.

"The only things in their favour have been daylight still in the rush hour and mild weather, which means less fuel consumption. The drivers now beginning to feel happier are those with electric cars."

RAC fuel spokesman Simon Williams said with oil heading back towards $100 a barrel, drivers were "in for a hard time at the pumps", but he added that a rise to three figures "should really only take the average price up by another 2p".

But he warned: "If retailers are intent on making more money per litre with increased margins then this could [take the average petrol price] closer to 160p."

Analysts warn rising global oil prices could impact inflation - the rate at which prices rise - in many countries. Inflation soared in 2022 and has only recently started to come down.

"The symbolically important $100 [a barrel of oil] mark is now being considered once more," said Sophie Lund-Yates, lead equity analyst at investment firm Hargreaves Lansdown.

"This is a difficult development, with fuel accounting for a significant portion of overall inflation."

The latest inflation figure for the UK will be released by the Office for National Statistics (ONS) on Wednesday. Inflation has fallen in recent months but remains high at 6.8%.

Over the last few years households have been hit by higher fuel and energy bills, while businesses have put up prices to cope with rising costs.

A recent fall in the pound may have made fuel even more expensive. As well as supply and demand, oil prices are also affected by the exchange rate between the pound and dollar, as Brent crude is traded in dollars.

Saudi Arabia's Energy Minister Prince Abdulaziz bin Salman defended Opec+'s moves to restrict supply on Monday, saying energy markets needed light-handed regulation to limit volatility.