Interest rates: Big rise less likely after inflation surprise

Getty Images

Getty ImagesInterest rates are predicted to rise less sharply after the UK saw a surprise drop in inflation in June.

The Bank of England has raised rates 13 times since December 2021 to try to cool soaring price rises, driving up borrowing costs for millions.

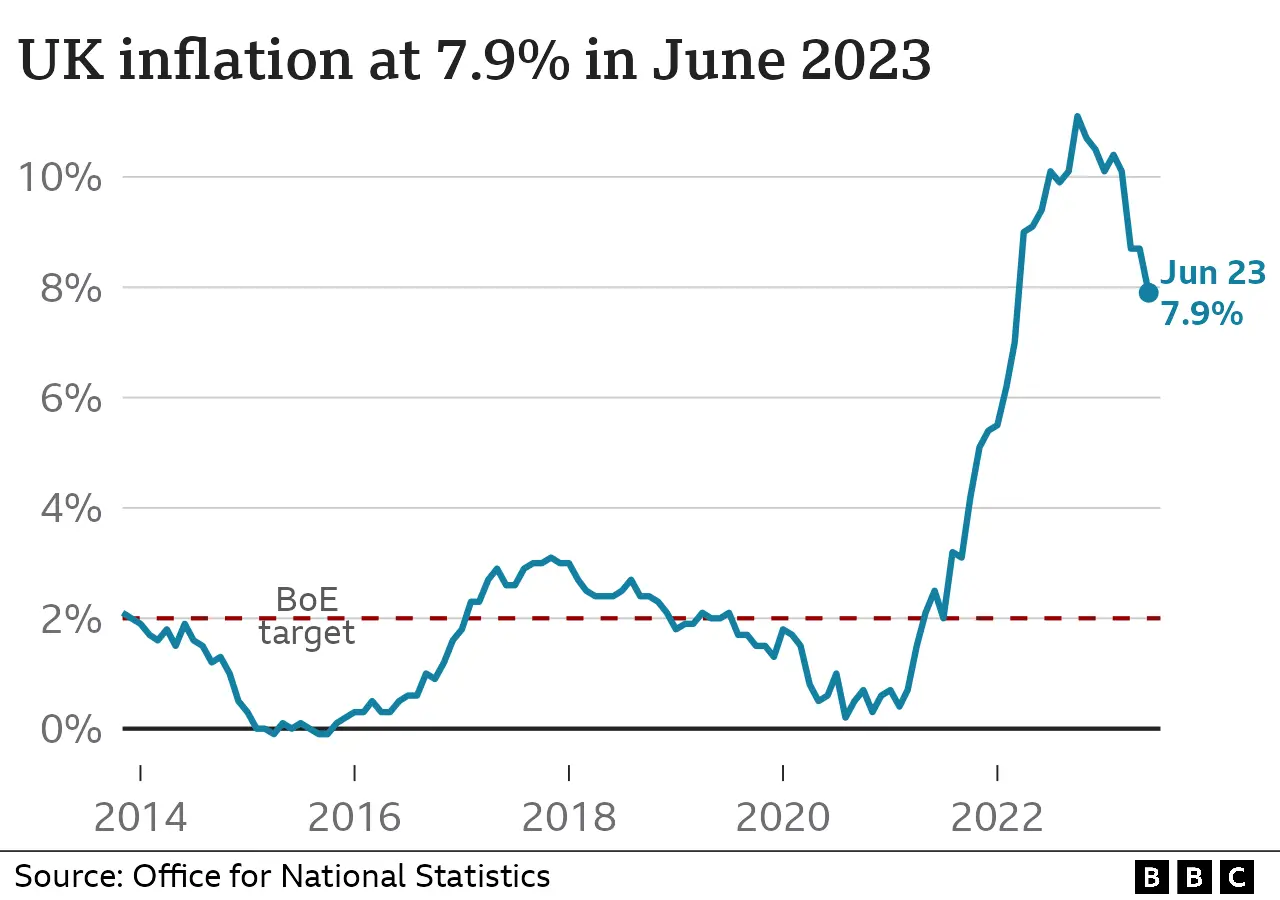

Experts say it is now under less pressure to act after inflation slowed to 7.9% in June, down from 8.7% the previous month.

It means UK inflation has dropped to its lowest level in more than a year.

Falling fuel prices contributed to the slowdown in June, while food prices are rising less quickly, according to the Office for National Statistics (ONS) which publishes the figures.

However, the UK's inflation rate remains almost four times higher than the Bank's official 2% target - and far above other developed countries.

In the US, inflation is 3%, and in the eurozone it is 5.5%.

"It is a large drop [in the UK] but let's not forget that last month we saw no change at all in headline inflation so in some ways what we are seeing this morning is catching up with the falls we've seen in other similar countries," ONS chief economist Grant Fitzner told the BBC's Today Programme.

"It still looks like we may have the highest rate of inflation in the G7 [group of developed nations], so still some way go."

Prices of food, energy and services have shot up since last year, squeezing household incomes.

To tackle the problem the Bank has raised interest rates from near zero to their current level of 5%. The idea is that by making borrowing more expensive, consumers will spend less and price rises will cool.

Rising interest rates have also driven up mortgage borrowing costs to their highest level in 15 years, leaving millions of homeowners facing higher monthly repayments.

On Wednesday, the average two-year fixed residential mortgage rate crept up to 6.81%, while the five-year rate was 6.33%. This time last year rates were closer to 3%.

With inflation finally falling by more than expected, economists are scaling down their expectations of immediate interest rate rises - although they still think there are more in store.

How are interest rate changes affecting you?

- Email: [email protected]

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Please read our terms & conditions and privacy policy

At its next decision on 3 August, the Bank is now widely expected to raise rates to 5.25% from the current 5%.

Beyond that, analysts at Capital Economics predict rates will rise slightly higher due to the persistence of some inflation pressures - peaking at 5.5%. However, without June's drop in inflation, they say the peak would more likely have been above 6%.

So the pain faced by those due to re-mortgage may be less acute than it could have been. Even so, a million households will be paying an extra £200 - or more - on their monthly mortgage payments by the end of the year.

While inflation is falling it does not mean prices are falling, just that they are rising less quickly. Many households continue to struggle with the soaring cost of living.

Laura McLelland, a mum of three from Scorton in Lancashire, told BBC Breakfast that in order to give her family a treat meal every two weeks, she has to cut back on other household bills.

"I am just trying to reduce the washing in the house, trying not to put the light on, or put the cooker on twice a night, just trying to be outside more with my children," she says.

Every fortnight, the family has a chippy tea.

"I put the money aside so I know I've got it," she says. "I've got a budget. I sort of think, 'right I've got to put that aside' because everybody needs a treat now and again don't they?"

How can I save money on my food shop?

- Look at your cupboards so you know what you have already

- Head to the reduced section first to see if it has anything you need

- Buy things close to their sell-by-date which will be cheaper and use your freezer

'Good news'

James Smith, research director at the Resolution Foundation think tank which focuses on improving living standards, said June's "chunky inflation rate fall" offered some "unambiguously good news" after months of disappointing data on the state of the economy.

An 18-month squeeze on people's "real" wages was "coming to an end", he said.

But Yael Selfin, chief economist at KPMG UK, said that while inflation was likely to continue falling, it would not return to the Bank of England's 2% target before early 2025.

As such, the Bank was likely to continue to raise rates.

Inflation is now expected to fall below 7% next month as drops in household energy bills impact the numbers.

So-called core inflation - which strips out volatile elements like fuel and energy prices - also dipped in June.

However, annual food price inflation remained stubbornly high at 17.3%.

Chancellor Jeremy Hunt welcomed June's inflation figures but said the government wasn't complacent. "We know that high prices are still a huge worry for families and businesses."

But Rachel Reeves, Labour's shadow chancellor, said inflation had been "persistently high and remains higher than our international peers".

And Liberal Democrat Treasury spokesperson Sarah Olney said June's figures would "bring cold comfort to countless families worried about their mortgage going up".

Additional reporting Elaine Doran

How are the changing inflation and interest rates affecting you? Share your experiences by emailing [email protected].

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at [email protected]. Please include your name, age and location with any submission.

Sign up for our morning newsletter and get BBC News in your inbox.