Shop sales fall in October as Budget fears hit spending

Getty Images

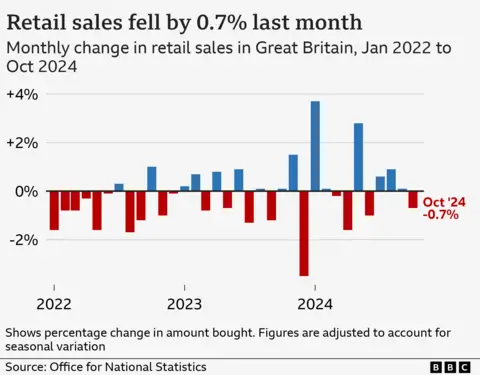

Getty ImagesRetail sales fell last month as shoppers held back on spending ahead of the Budget, according to official figures.

Sales volumes fell by 0.7% in October, the Office for National Statistics (ONS) said, with clothing stores having a "notably poor" month.

Speculation over which taxes might be increased ahead of last month's Budget has been cited as a reason why households and businesses were more reluctant to make spending decisions.

While the drop was bigger than expected last month, the ONS said that wider trends showed sales had been sturdy.

Sales volumes were up 0.8% in the August to October period when compared with the previous three months.

"When we look at the wider trend, retail sales are increasing across the three-month and annual periods, although they remain below pre-pandemic levels," said ONS senior statistician Hannah Finselbach.

She said October's fall "was driven by a notably poor month for clothing stores, but retailers across the board reported consumers held back on spending ahead of the Budget".

Sales at clothing stores were down 3.1% in October, with separate surveys having suggested that milder weather last month meant shoppers delayed buying warmer clothing.

The retail sales figures are the latest in a run of disappointing data on the economy.

Earlier this week, data showed higher-than-expected government borrowing, while the latest inflation figures showed prices rising faster than expected.

And last week, figures indicated that the economy barely grew between July and September.

Retailers have been among the most vocal of the businesses complaining about tax rises announced in last month's Budget.

On Tuesday, many of the UK's biggest chains - including Tesco, John Lewis and Marks & Spencer - wrote to Chancellor Rachel Reeves to say that job losses in the sector were "inevitable" and prices would rise because of the tax rises and other increasing costs.

Jacqui Baker, head of retail at RSM UK, said the figures were "concerning" given that most retailers are now heading into their busiest time of the year with Christmas only a few weeks away.

"With half-term falling later this year and relatively mild weather, consumers have put off buying their winter coats and boots," she said.

"This has made it difficult for retailers to shift stock, particularly as many have held off spending to take advantage of Black Friday deals."

However, she added that with the Budget out of the way and interest rates coming down, this should "help with confidence and create a clear runway for Christmas spending".

There was better news for retailers from a separate survey which suggested consumer confidence has improved this month.

Neil Bellamy, consumer insights director at GfK, which produced the survey, said while there was "evidence of nervousness in recent months" ahead of the Budget and US election, "we have moved past those events now".

However, he added it was too soon to expect a big improvement in the mood of consumers.

"As recent data shows, inflation has yet to be tamed, people are still feeling acute cost-of-living pressures, and it will take time for the UK's new government to deliver on its promise of 'change'."