Why is Thames Water in so much trouble?

PA Media

PA MediaThames Water, the UK's biggest water company, has picked US private equity giant KKR as its "preferred partner" to buy the troubled firm.

The news comes shortly after Thames secured a £3bn rescue loan to avoid coming under government control.

Thames has huge debts and is struggling to fix leaks, sewage spills and modernise outdated infrastructure.

It serves about a quarter of the UK's population, mostly across London and parts of southern England, and employs 8,000 people.

How did Thames end up with so much debt?

Many UK water companies have large debts, but Thames Water's problems are the worst.

Water companies were privatised in 1989, with the idea that private investment would improve the system.

But critics say this hasn't happened - some companies have taken on too much debt and failed to invest in infrastructure.

When Thames was privatised in 1989, it had no debt. But over the years it borrowed heavily and now has debts of about £19bn.

Its debt pile increased sharply when Macquarie, an Australian infrastructure bank, owned Thames Water, with debts reaching more than £10bn by the time the company was sold in 2017.

Macquarie said it invested billions of pounds in upgrading Thames's water and sewage infrastructure while it owned the company, but critics argue that it took billions of pounds out of the company in loans and dividends.

Will Thames now be bought by a US company?

Thames has been urgently seeking outside investment to help shore up its finances, and said recently it had received approaches from six firms about taking a stake in the business.

It has now named KKR as its "preferred partner" for the investment process. KKR is one of the world's largest private equity firms with $160bn of investments globally. The US firm is already a shareholder in another UK water provider, Northumbrian Water.

Thames did not say how much KKR planned to invest, but said the proposal would lead to a "material impairment" for some creditors, meaning a write-off of some of the debt and interest Thames Water owes.

Thames added there was no certainty that a binding proposal would emerge, and any deal would need to be approved by regulators.

Could Thames have fallen under government control?

Earlier this year, Thames secured £3bn in emergency funding, which it said would give it the space needed to complete a restructuring of its debts and attract a cash injection from prospective new investors.

The proposals had to be approved by the High Court after a group of creditors opposed it, arguing that the 9.75% interest rate on the loan was too costly.

The group then appealed against the High Court's decision, but this was dismissed.

If the funding deal had not been approved, Thames faced the possibility of a temporary nationalisation, under a measure known as a Special Administration Regime.

What does all this mean for customers?

No matter who eventually owns or runs Thames Water, customers will see no impact on their services. Taps will still run and toilets will still flush.

However, water bills in general are set to rise, with the rate at which they are due to increase set by the water regulator Ofwat.

The regulator says that Thames Water can increase bills by up to 35% - excluding inflation - over the next five years.

But the company says it needs a 53% rise to fix pipes and keep up with demand. It appealed for permission to charge more, although it then deferred this appeal while it sought extra funds from investors.

Customers are unhappy. Consumer groups argue people shouldn't have to pay more because the company has been badly run.

But Sir Adrian Montague, Thames Water's chairman, has warned that without bigger price rises, the company cannot guarantee safe and resilient water supplies that can cope with climate change and population growth.

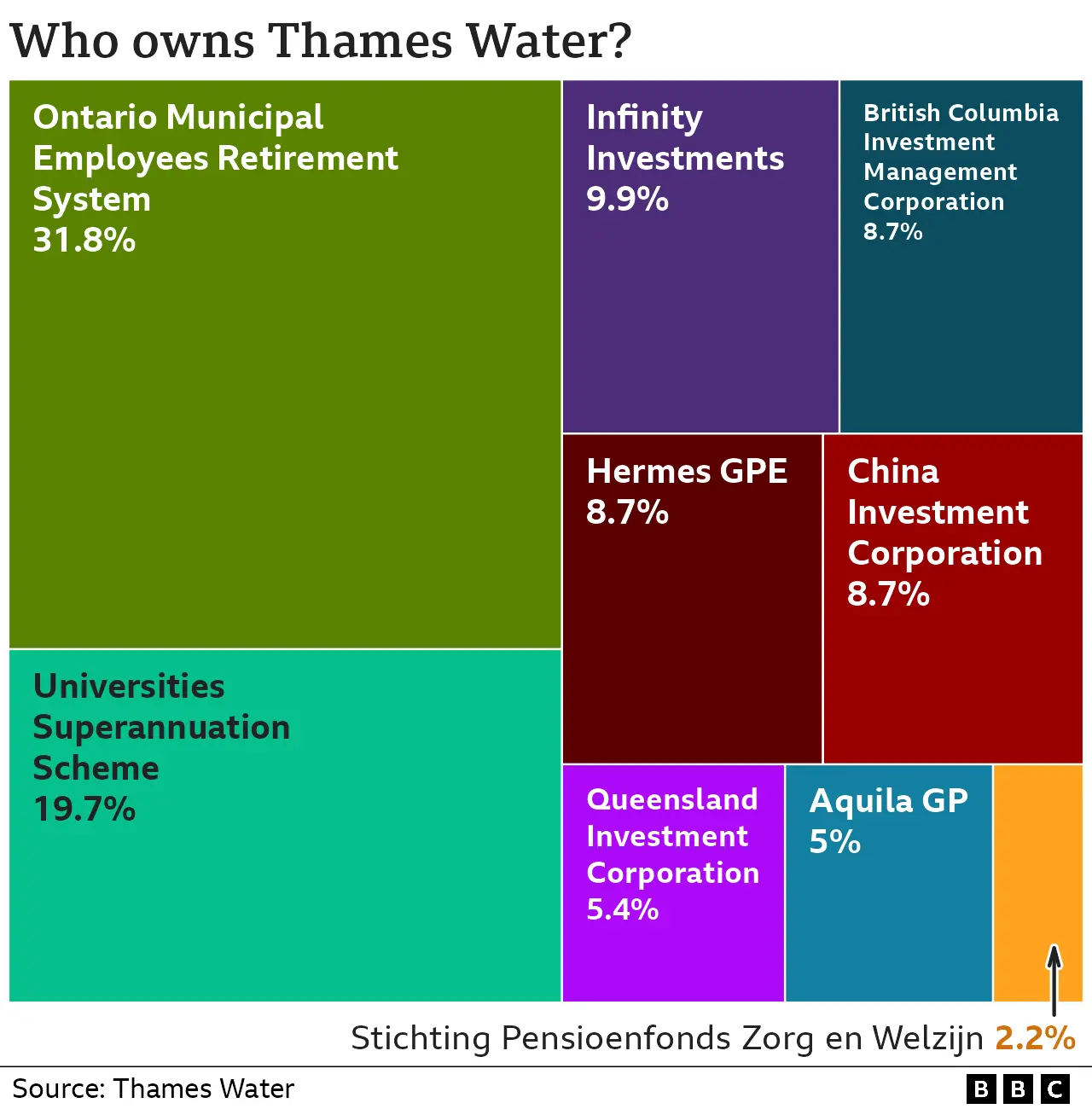

Who owns Thames Water now?

Thames Water is privately owned by a group of pension funds and investment firms. The biggest shareholders include:

- Ontario Municipal Employees Retirement System (Canada) - 32%

- Universities Superannuation Scheme (UK) - 20%

- Abu Dhabi Investment Authority - 10%

- China Investment Corporation - 9%

Other investors include funds from Canada, Australia, and the Netherlands.

Why was Thames Water privatised?

The entire water and waste sector was privatised 34 years ago under the late Margaret Thatcher's Conservative government for £7.6bn. At the time, Mrs Thatcher wrote off the industry's £5bn debt, leaving companies with a clean slate and gave them £1.5bn in public money.

The government had wanted to privatise the industry in 1984 but a public backlash against the plan saw it shelved until after the general election three years later. At the time, the UK was under pressure from Europe to improve the purity of its water.

However, meeting European standards would cost billions of pounds worth of investment which, it was hoped, would come from the private sector and, by extension, companies' customers.

"If we want environmental improvement, it will cost money," said Mrs Thatcher in 1988. "It will be the people who want those improvements in water who will have to pay."

Former Labour MP Ann Taylor later said of privatising the water industry: "The message is always the same - maximise the cost to the consumer to ensure maximum return to the investor. We should not be surprised at that. After all, that is what private investors expect of their companies."