Cost of living: Big banks' bosses defend savings rates and branch closures

Getty Images

Getty ImagesSavers have access to a host of competitive savings deals, bank bosses have argued, as they faced criticism over poor rates of interest.

The chief executives of four of the biggest banks in the UK were hauled before MPs who questioned the generosity of their savings rates.

The UK chief executives of Lloyds, NatWest, HSBC and Barclays said deals had improved as savers shopped around.

They also said branch closures were a response to consumers' changing habits.

Savers' choice

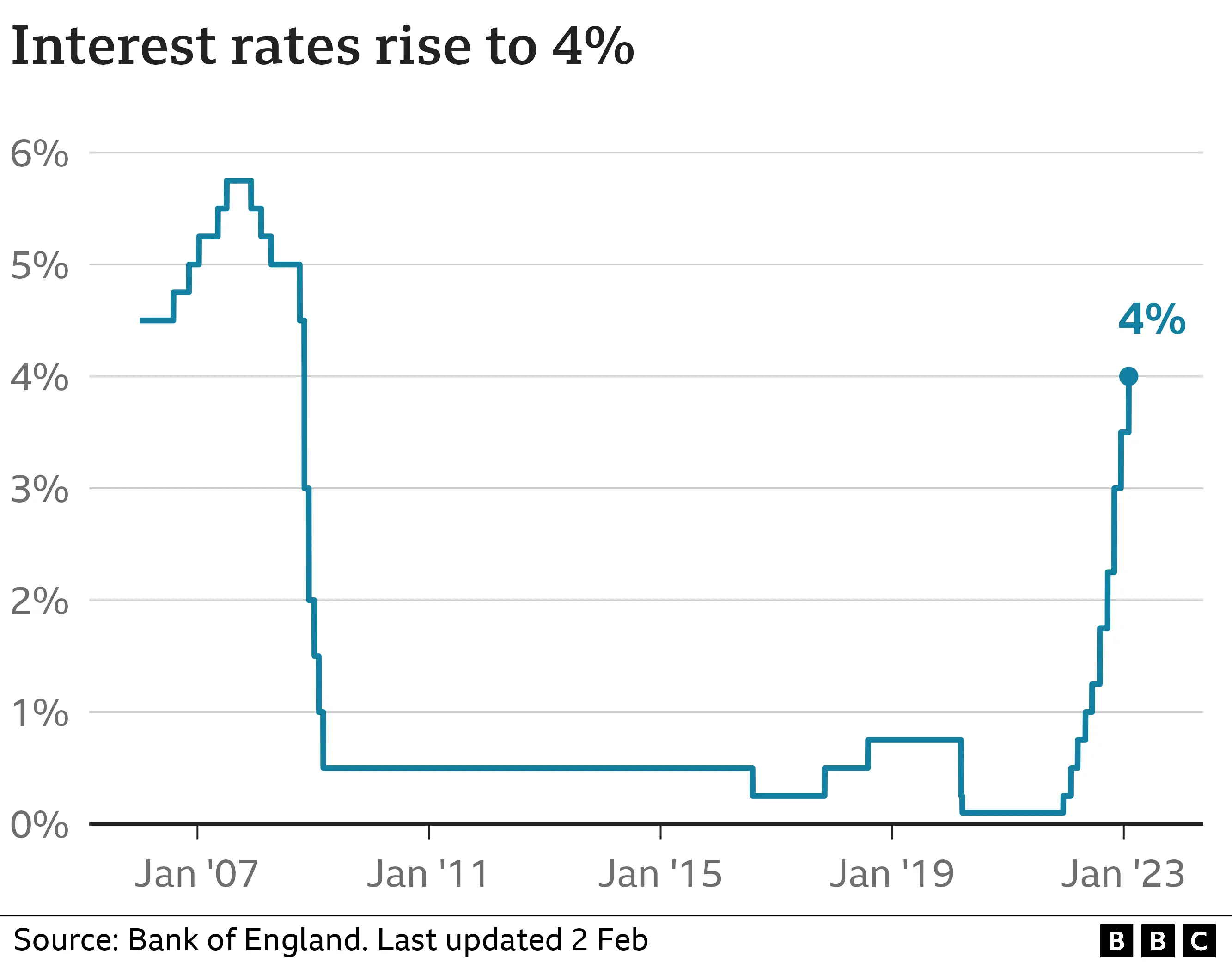

The Bank of England's benchmark interest rate was at historically low levels for a decade until December 2021, since when it has risen consistently. It is now at 4%, having risen from 0.1%.

MPs on the Treasury Committee said their constituents complained that mortgage rates rose more rapidly than the returns offered to savers when the base rate went up.

Described as the highest-paid panel which had sat before the committee for some time - collectively earning more than £10m a year - the quartet of bank bosses argued that this debate incorrectly centred on the interest rate offered on easy-access savings accounts, which typically have a return of less than 1%.

They argued that regular saver deals offered market-leading rates of interest, and that instant-access products were often a "gateway" to higher interest deals.

Matt Hammerstein, from Barclays, Charlie Nunn, from Lloyds Banking Group, Ian Stuart, from HSBC, and Dame Alison Rose, from NatWest, argued that they were also encouraging customers to begin a savings habit.

"Only one in four people have £100 of savings in their account," said Dame Alison. "There is a real concern about financial confidence in young people. We have targeted savings for young people's accounts as well."

Savings levels built considerably during the pandemic, as consumers' ability to spend was curtailed. The soaring cost of living has since dampened some of this saving.

However, the bosses - whose banks control 60% of the market - argued that many people were actively searching for better deals as interest rates rose. Mr Nunn said price comparison websites had become highly developed in this area.

While some were shopping around, millions were still low on confidence in making good financial decisions, and so needed good guidance.

Many households are also facing the prospect of having to pay more on their mortgage repayments in the coming year.

Mr Stuart pointed to a new fixed-rate deal, launched by HSBC on the same day as the hearing, which was the first five-year deal with an interest rate of less than 4% since early October.

He argued that this showed that mortgage rates were falling, despite the Bank rate still rising, and was far lower than the rates that had been predicted after the mini-budget.

Yet, he said that the "headwinds are ahead of us, not behind us" when analysing the number of people who were falling behind on mortgage repayments.

The bank chief executives were also pressed on branch closures, with all accepting they had shut a host of premises in recent years.

Mr Stuart said that this was a response to the changing ways people were managing their money.

"Customer behaviours started to change in 1982 with the advent of the cash machine, and it has been on a journey from that point and it has sped up," he said.

He said that 98% of transactions in December were digital, displaying how the needs of customers from a branch had changed in recent decades.

The bosses gave examples of cash pods, bank hubs, mobile banking vans, and smart ATMs as alternatives, with specialists often using different channels to talk to customers in their own homes.