IMF warns rising prices will be worse in UK

PA Media

PA MediaThe International Monetary Fund (IMF) has doubled down on criticism of the chancellor's mini-budget, days after warning it will fuel rising prices.

The body, which works to stabilise economic growth, admitted tax cuts announced by Kwasi Kwarteng would boost growth in the short-term.

But it said the cuts would "complicate the fight" against soaring prices.

It expects high prices to last longer in the UK with only Slovakia out of the eurozone set to see higher inflation.

Inflation, which measures how the cost of living changes over time, is expected to peak at about 11.3% before the end of the year in the UK, according to the IMF's latest assessment of the global economy.

In each of the next two years, it expects price rises will average at about 9% - far above the Bank of England's target of 2%.

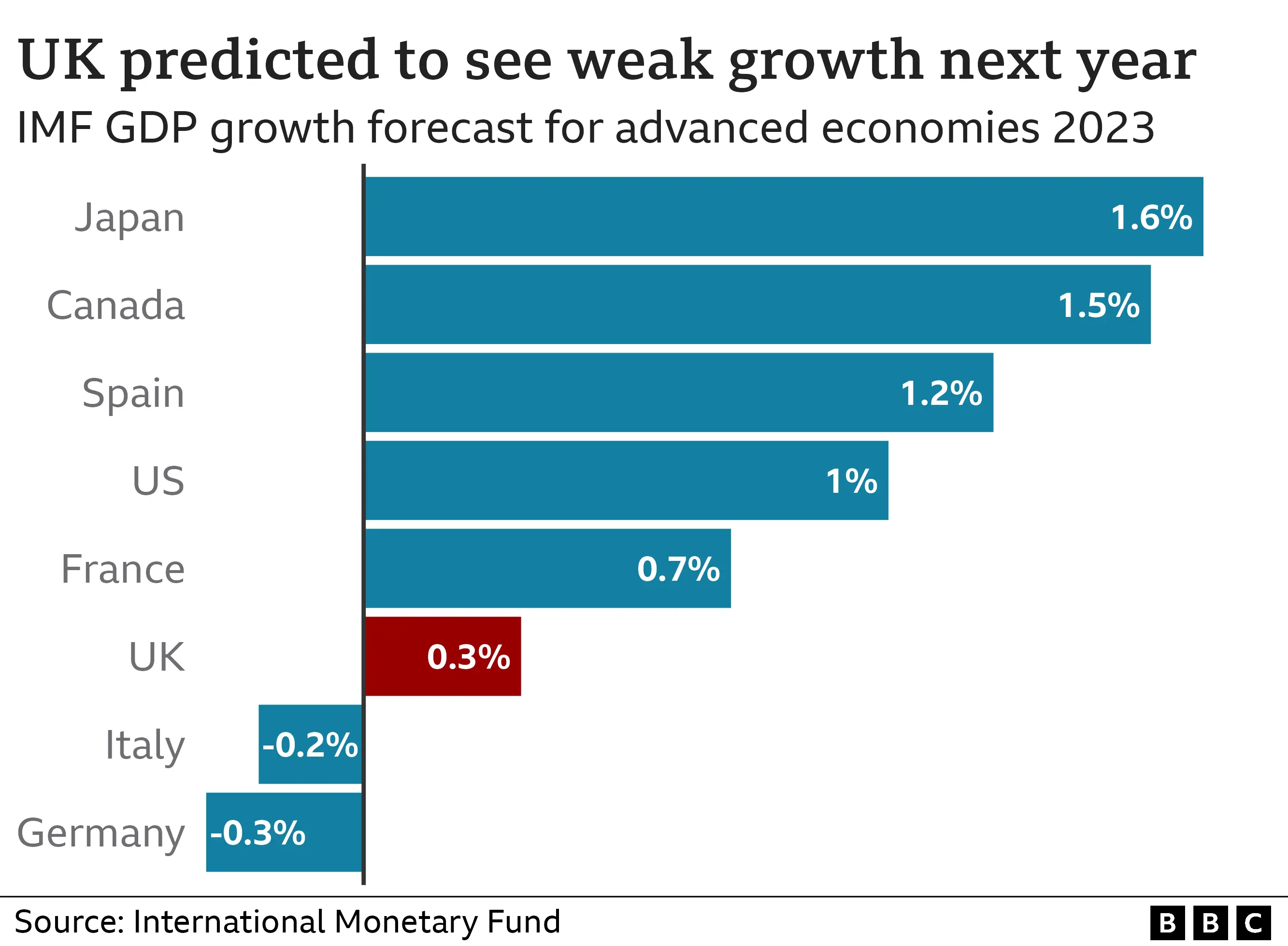

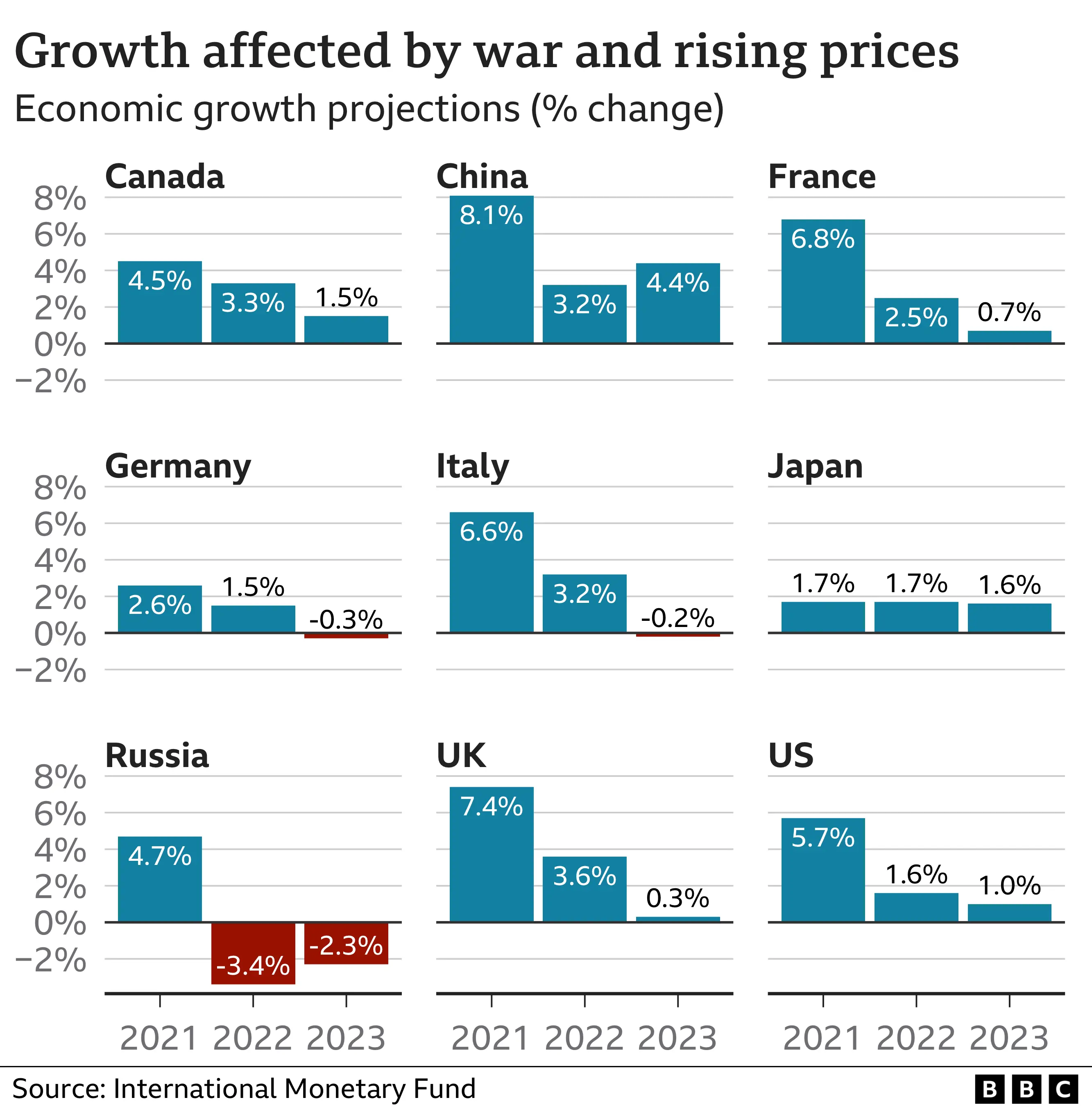

Although the UK economy is set to grow the fastest of the major economies included in the G7 group this year, it is projected to grind to a near-halt next year, with it expanding by just 0.3%.

The most recent figures included in the report by the influential financial institution do not fully, however, take into account the UK chancellor's recent mini-budget.

'Steady hand'

After Mr Kwarteng unveiled plans for huge tax cuts in the UK, the IMF criticised the plans warning they were likely to increase inequality and add to pressures pushing up prices.

It was an unusually outspoken statement from the IMF, which has a key role in acting as an early economic warning system.

The IMF said it understood the government's mini-budget aimed to boost growth, but it said that the tax cuts could speed up the pace of price rises, which the UK's central bank, the Bank of England, is trying to bring down.

Downing Street defended the chancellor's plans, with the Prime Minister's official spokesperson saying its policies aimed "to support British people at a time of global high prices" and said the IMF report showed "the global challenges that countries are facing".

The IMF warned the global economy was facing a downturn with "the worst yet to come" as war in Ukraine helps push prices higher around the globe.

"For many people 2023 will feel like a recession," it warned.

It said governments and central banks globally had to work together to help people through the turmoil.

The IMF's Pierre-Olivier Gourinchas told the BBC: "Imagine a car with two drivers at the front and each of them has a steering wheel - and one wants to go left and the other wants to go right."

He added: "One is the central bank trying to cool off the economy so that price pressures will ease, and the other one wants to spend more to support families... it's probably not going to work very well."

In the UK, the chancellor has already said he will bring forward his economic plan where he will spell out how he plans to pay for the tax cuts and provide an independent forecast on the UK economy's prospects, a move welcomed by the IMF.

However on Tuesday, government borrowing costs remained close to the levels seen at the height of the market turmoil last month despite fresh action from the Bank of England to try and stabilise financial markets.

The IMF has said "the worst is yet to come" in the world economy, saying "for many people 2023 will feel like a recession".

It made the comments as it downgraded forecast growth around the world as a result of a longer-lasting inflationary shock, arising from Russia's invasion of Ukraine. Rising global interest rates, and a strong dollar, are adding to these pressures, said the world's most important international financial institution.

The direct impact of the gas shutdowns in continental Europe means some major economies are hit even more badly - Germany and Italy are now predicted to contract next year. The projections do not fully take into account the chancellor's mini budget and its aftermath, which will "lift growth somewhat in the near term", but "complicate the fight against inflation".

The IMF criticised the UK's mini-budget in stark terms last month, and also repeated a more general warning about untargeted fiscal support, without mentioning the UK specifically.

The IMF also cautioned that governments would need to protect the least well-off from the impact of higher prices.

Poorer households often spend relatively more than others on food, heating, and fuel, it pointed out - all areas that have seen steep price rises as energy and grain exports have been restricted after the invasion of Ukraine.

And countries that are reliant on Russian gas in Europe are being hit particularly badly. Germany's economy, for example, is now predicted to contract next year.

Meanwhile, Russia's economy is expected to contract by 2.3% next year, the biggest fall of all the nations included in the projections.

Speaking on Monday, IMF boss Kristalina Georgieva noted that growth was also being dragged down in China by continued Covid restrictions, while in the US rising interest rates were "starting to bite".

At the first in-person meetings between the IMF and the World Bank since the pandemic, she said countries could "reduce the pain ahead of us in 2023" by acting together.

She added that the IMF will be pushing for major economies to carry on with their efforts to bring down the cost of living, even if they have a negative impact on economic growth.

If they don't do enough, she said, "we are in trouble. We cannot afford inflation to be a runaway train."