Halifax apologises after interest rate email blunder

Getty Images

Getty ImagesHalifax has said sorry after it sent emails to customers incorrectly saying that the Bank of England had raised interest rates.

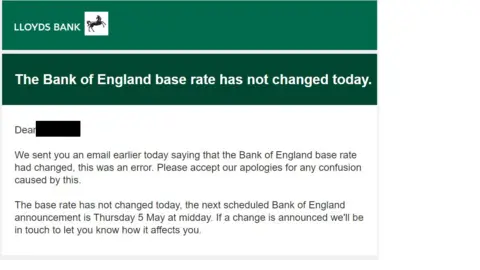

Some mortgage customers received a message on Tuesday saying "the Bank of England base rate has changed today".

But the decision by the central bank on whether or not to raise interest rates is not due until Thursday lunchtime.

The lender followed up with a second email later, apologising to customers for "any confusion" caused.

It added that the email had been prepared in advance of Thursday's decision by the Bank of England's Monetary Policy Committee (MPC) "so that in the event of a rise we could quickly advise customers and help them understand how that might affect their mortgage".

"We are emailing customers today to apologise and confirm that there are no changes to their mortgage or rates," they added.

Halifax, which is one of the UK's biggest mortgage lenders, would not tell the BBC how many of its customers had received the email.

Some Lloyds customers also received the message by mistake, as well as the subsequent apology.

Part of the Lloyds Banking Group, Halifax told customers on a fixed-rate mortgage that their repayments will not be affected by an increase.

If interest rates rise, it can make borrowing more expensive - especially for homeowners with mortgages on a variable rate.

Prices are now rising at their fastest rate in 30 years in the UK, as coronavirus restrictions ease and consumers spend more.

One of the tools available to the Bank of England to curb inflation, which measures how prices change over time, is adjusting interest rates.

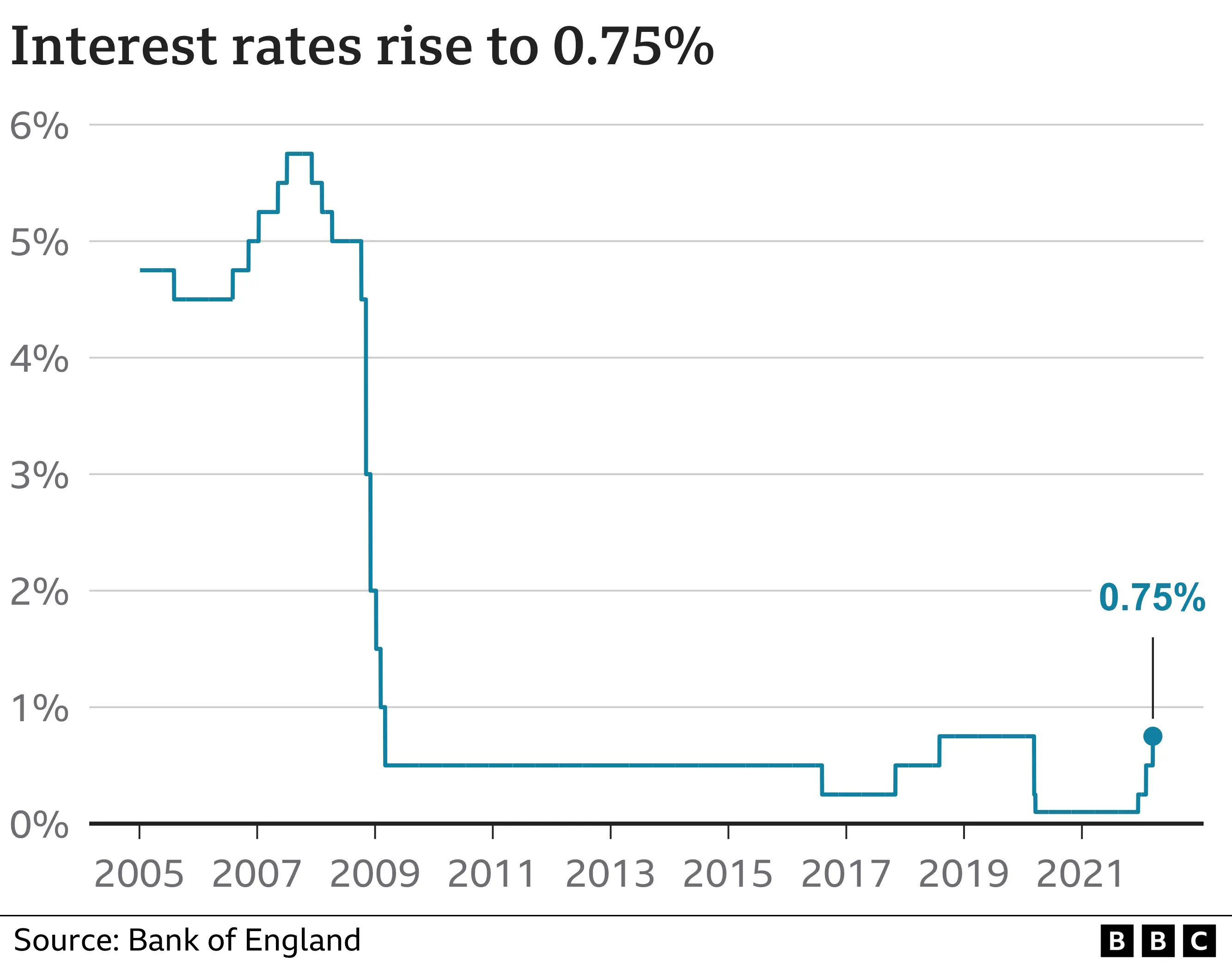

In March, they were raised from 0.5% to 0.75% - their highest level since March 2020 as the Bank of England seeks to contain rising prices and meet its 2% target on inflation.

The next announcement from the nine UK economists who make up the MPC is due on Thursday at 12:00.

Ruth Gregory, senior UK economist at Capital Economics, has said that with inflation reaching 30-year highs, and further energy bills increases likely later this year, the Bank might be "sufficiently worried" to increase interest rates again.

Investec economist Philip Shaw also said that he thinks that the base rate will increase to 1.0%.

He pointed out that price pressures had started increasing beyond energy and food in areas like clothing, furniture and accommodation, stoking the Bank's concerns that inflation might remain higher for longer than first thought "especially against the backdrop of historically very tight labour market".

"Of course, it should be recognised that raising interest rates will do very little to moderate inflation over the next six months and that the aim of tightening policy now is to prevent inflation from remaining above 2% over the medium-term and to protect the central bank's credibility," he added.