Fraud: Better chance of compensation for victims

Getty Images

Getty ImagesBlameless victims of fraud who are tricked into transferring money to con-artists will be legally entitled to compensation, under government plans.

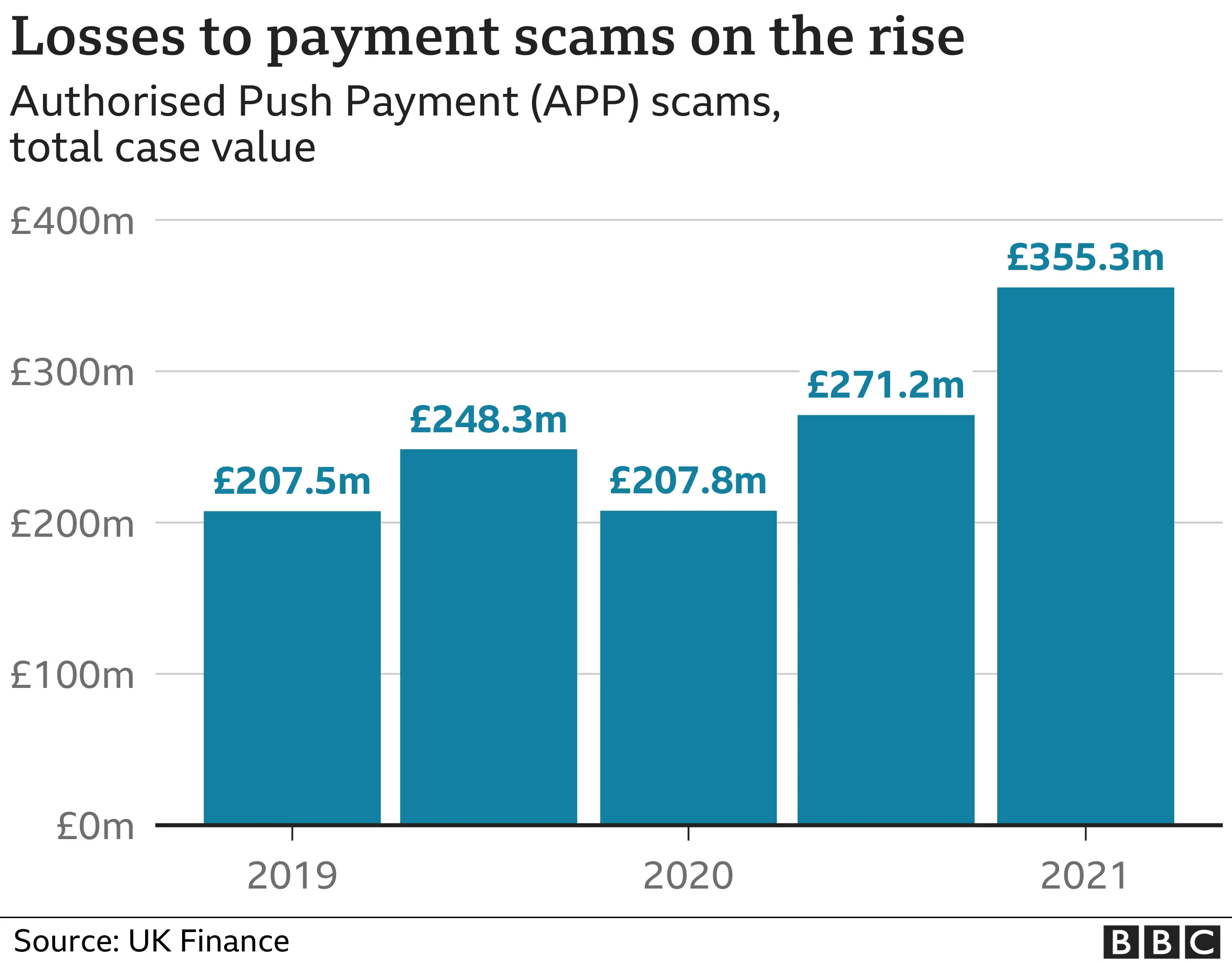

This type of fraud rose by 71% in the first half of the year.

At present, refunds by banks are governed by a voluntary code which consumer groups argue has been a lottery for scam victims.

Regulators will also force the UK's 14 big banking groups to publish data on fraud reimbursement.

A total of £355m was lost through so-called authorised push payment (APP) fraud cases in the first half of the year. Victims pay fraudsters who they believe are genuine organisations, such as banks, the police, or solicitors.

These scams accounted for a significant chunk of the £754m lost in total to fraud during the same period.

Banks have interpreted a voluntary code differently, meaning some victims are refunded while others are not, in seemingly similar circumstances.

Customers are also unaware of the frequency of cases involving their own banks, and what proportion of victims are reimbursed by their bank.

Under the plans, which are under consultation until January, legislation would be changed to ensure blameless victims are refunded.

The Payments Systems Regulator also said that large banks and building societies would need to publish data on APP scams, including reimbursement levels for victims.

They would include the AIB Group (UK), Bank of Scotland, Barclays, Clydesdale Bank, the Co-operative Bank, HSBC, Lloyds, Metro Bank, Monzo, NatWest/RBS, Nationwide Building Society, Northern Bank, Santander, Starling Bank, TSB, Ulster Bank and Virgin Money.

Anabel Hoult, chief executive, of consumer group Which?, which made a super complaint on bank transfer scams five years ago, described the plans as "a huge win for consumers".

"People are still losing life-changing sums of money every day, so the Treasury must move swiftly towards introducing the necessary legislation," she said.

Katy Worobec, managing director of economic crime at UK Finance, which represents the banks said: "Fraud has a devastating impact on victims and the money stolen funds serious organised crime, so the banking industry's primary focus is always on stopping these scams happening in the first place.

"Over £300m has been reimbursed to thousands of customers since the APP voluntary code was introduced in 2019. We agree that more needs to be done and have long called for a regulated code, backed by legislation, to ensure consumer protections apply consistently."

However, she said that other organisations, such as social media and online platforms, needed to play their part in tackling fraud as well.