Retail sales fall in May as shoppers dine out

Getty Images

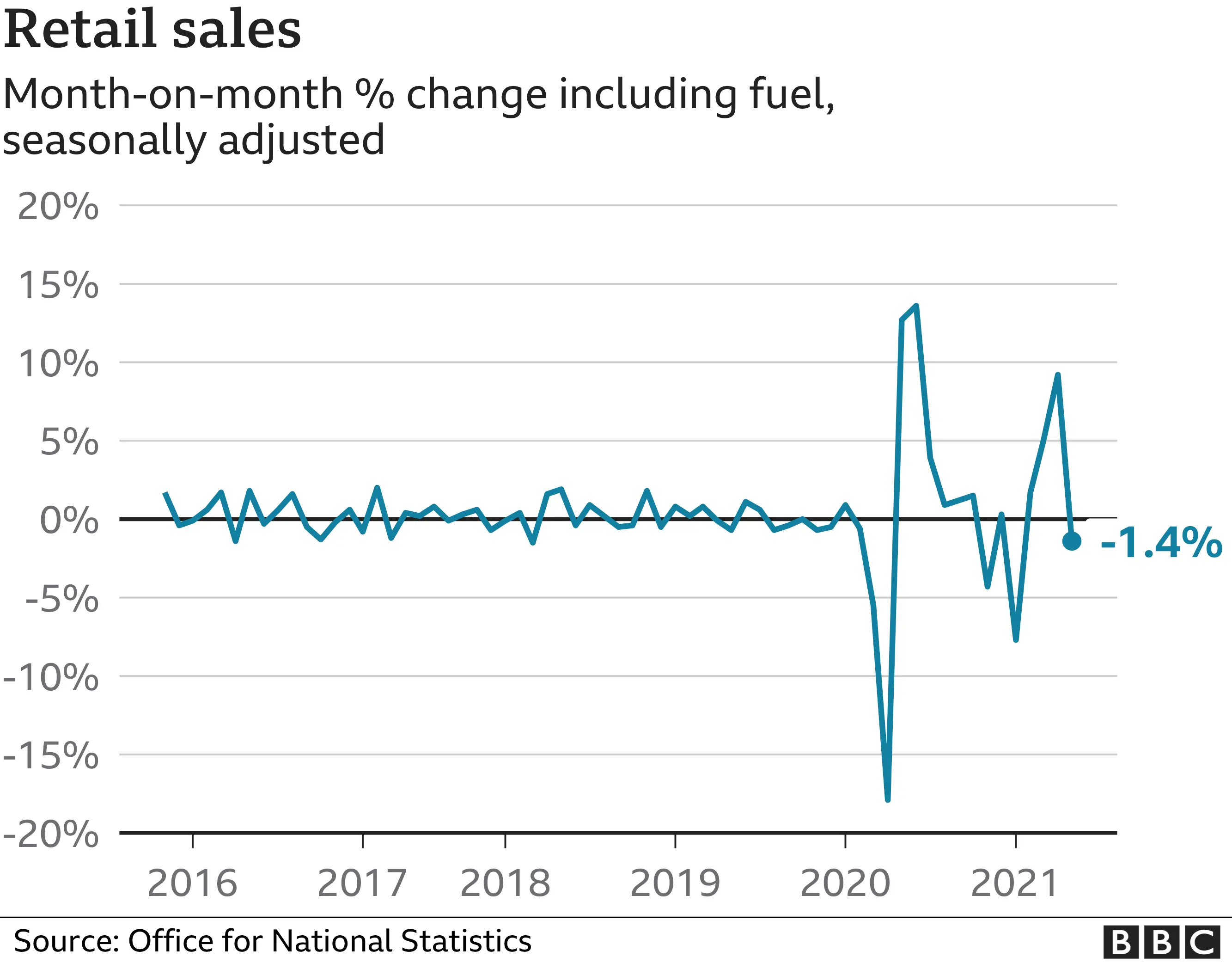

Getty ImagesRetail sales fell by 1.4% between April and May as people chose to visit reopened bars and restaurants instead of buying food at supermarkets.

The Office for National Statistics said sales fell most significantly at food stores as consumers took advantage of Covid restrictions being lifted in the hospitality sector to eat out.

In contrast, sales at non-food shops rose on demand for outdoor furniture.

The proportion of online sales dipped as people returned to physical shops.

It is the third month in a row that the proportion of online sales has fallen, but the ONS said they "remain nearly 60% higher than the level seen in February 2020" before the pandemic.

The ONS said that the volume of food sales dropped by 5.7% between April and May.

New figures from Tesco for the three months to 29 May appear to follow the trend. It said like-for-like sales grew strongly in March before "moderating" in April and May.

Tesco said that compared to the same period last year - when supermarkets experienced a rush in trade during the first lockdown - sales across the group rose by 1%.In the UK alone, trade rose by 0.5%.

Compared with the first quarter of 2019 before the pandemic, Tesco said sales were up by 8.1%.

Getting ready for summer

ONS data shows that sales at non-food shops grew by 2.3% between April and May although there were "contrasting pictures within the sector".

Shops selling households goods reported a sharp rise in sales with anecdotal evidence suggesting "increased spending on outdoor garden furniture in preparation for the summer and the relaxation of social gathering rules".

Toy and sports equipment retailers also saw a rise in trade.

Getty Images

Getty ImagesConversely, sales fell for both clothing and department stores, but the ONS said this followed strong growth in previous months and compared to May last year clothing shop sales rose 28.9% and department stores increased by 12.6%.

Paul Dales, chief UK economist at Capital Economics said that while the 1.4% fall in retail sales was "disappointing", he said it "may not mean that overall consumer spending is much weaker than we have been expecting if there was just a bigger shift in spending from the shops to the pubs as indoor hospitality reopened in mid-May".

We did more socialising and less shopping last month. Tesco only managed to eke out sales growth of 0.5% in the UK for its first quarter of the year. But the business has now started to come up against some tough comparisons with the start of the pandemic last year when supermarket sales went through the roof as shoppers stockpiled and the first lockdown began.

It's going to be hard going for all our supermarkets to deliver much growth this year given the stonking sales they enjoyed last year.

Tesco's boss, Ken Murphy, says customer behaviour is also starting to normalise with smaller shopping baskets and people making frequent trips to the aisles.

But Tesco's online sales remain strong with some 1.3 million orders being fulfilled every week. Like a number of other businesses, it's also experiencing a shortage in HGV drivers but Mr Murphy thinks this is something that Tesco can manage.

However, Pantheon Macroeconomics said more up-to-date data "tentatively suggest(s) that the recovery in households' spending is struggling to progress".

The Bank of England said that credit and debit card payments in the seven days to 10 June were 5% lower compared to February last year before the pandemic. This is worse than the 1.5% decline recorded in May when compared to February 2020.

It also said figures from restaurant reservation firm OpenTable indicated that "restaurant diner numbers peaked in the second half of May and subsequently have nearly returned to normal levels for the time of the year".

Pantheon's chief UK economist, Samuel Tombs, said: "We continue to think that the recovery in households' spending will lose momentum as it approaches its pre-Covid level later this year.

"Households' real disposable income looks set to fall in the fourth quarter, as the end of the furlough scheme reduces employment and inflation rises to match wage growth."