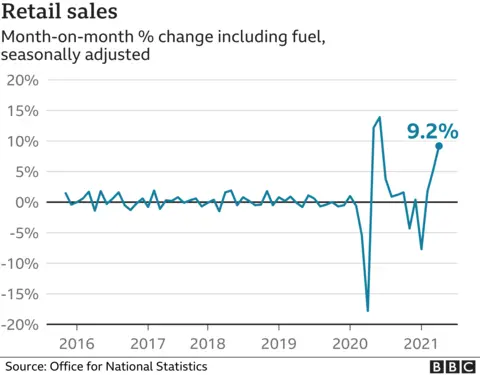

Retail sales soar 9.2% in April as shops reopen

Getty Images

Getty ImagesA surge in spending on clothes helped to boost retail sales last month, as lockdown measures eased and non-essential shops reopened.

Retail sales jumped 9.2% in April, the Office for National Statistics (ONS) said, with sales of clothing soaring by nearly 70% compared with March.

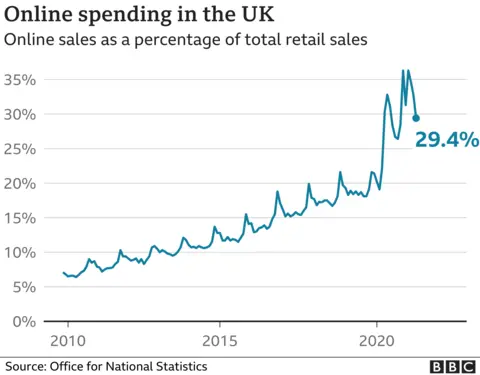

Sales overall were more than 10% higher than pre-pandemic levels, although online sales dipped.

Economist Paul Dales called the surge in clothing sales "astonishing".

The Capital Economics chief UK economist said the April data "showed that households were particularly keen to update their wardrobes".

Further evidence of the rebound in the UK economy came in a separate survey, an IHS/Markit Purchasing Managers' Index, which suggested that activity among private business during May has expanded at the fastest pace for more than two decades.

'Pent-up demand'

Retailers such as clothing and furniture stores, which the government classed as non-essential, reopened to shoppers in England on 12 April after shutting in early January.

Aled Jones, head of retail at Lloyds Bank, said: "Fashion retailers [were] the ultimate beneficiaries of beer gardens reopening and the 'rule of six' night out returning."

Silvia Rindone, EY UK & Ireland retail leader, said April had seen "significant pent-up consumer demand".

"With consumers keen to return to the in-store shopping experience and indulge in retail therapy, we saw a sales boost across most categories."

'Tills ringing'

The reopening of non-essential shops led to a boost for many small businesses.

Delia Prudence, owner of The Art Room, an art supplies shop in Scarborough, said: "We were expecting to be busy in April but not that busy.

"The tills were ringing non-stop. One customer even came in with a bottle of Prosecco to celebrate us reopening."

Industry body the British Retail Consortium (BRC) said that April had given "a welcome boost for thousands of retailers in England and Wales" due to pent up demand.

"Improved weather during April meant greater sales of fashion, particularly in outerwear and knitwear, as the public renewed their wardrobe and made plans to meet friends and family outdoors," said BRC chief executive Helen Dickinson.

However, she said that while the figures were "a step in the right direction", demand "remains fragile".

"Footfall is still down by 40% on the pre-pandemic period, and there are still 530,000 people who work in retail still on furlough," she said, adding that the end of the full business rates relief in England "poses a significant threat to retailers".

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said that there were signs that sales might rise further in May.

However, he predicted that the recovery in household spending "will stall as it approaches its pre-Covid level later this year".

The winding-up of the furlough scheme at the end of September is likely to trigger a renewed fall in employment, while rising inflation will push down real wages, he said.

In addition, the end of the stamp-duty holiday on 30 September will probably lead to a "sharp decline" in housing market activity, leading to less demand for "big-ticket" household goods.

Growth spurt 'unprecedented'

The latest survey of private sector businesses from IHS Markit/CIPS found the recent rebound continuing strongly as lockdown restrictions are eased.

Its "flash" - or preliminary - Purchasing Managers' Index (PMI) rose to 62.0 in May, up from 60.7 in April. A figure above 50 indicates expansion.

The figure was the highest since the survey began in January 1998 and reflected "strong contributions" from both the manufacturing and services sectors.

"The UK is enjoying an unprecedented growth spurt as the economy reopens," said Chris Williamson, chief business economist at IHS Markit,

"Factory orders are surging at a record pace as global demand for goods continues to revive, and the service sector is reporting near-record growth as the opening up of the economy allows more businesses to trade."

However, the recent economic rebound has raised fears that inflation could pick up. The PMI survey found that cost pressures were at a 13-year high, leading firms to raise their prices.

"A direct consequence of demand running ahead of supply was a steep rise in prices, hinting strongly that consumer price inflation has much further to rise after lifting to 1.5% in April," Mr Williamson said.