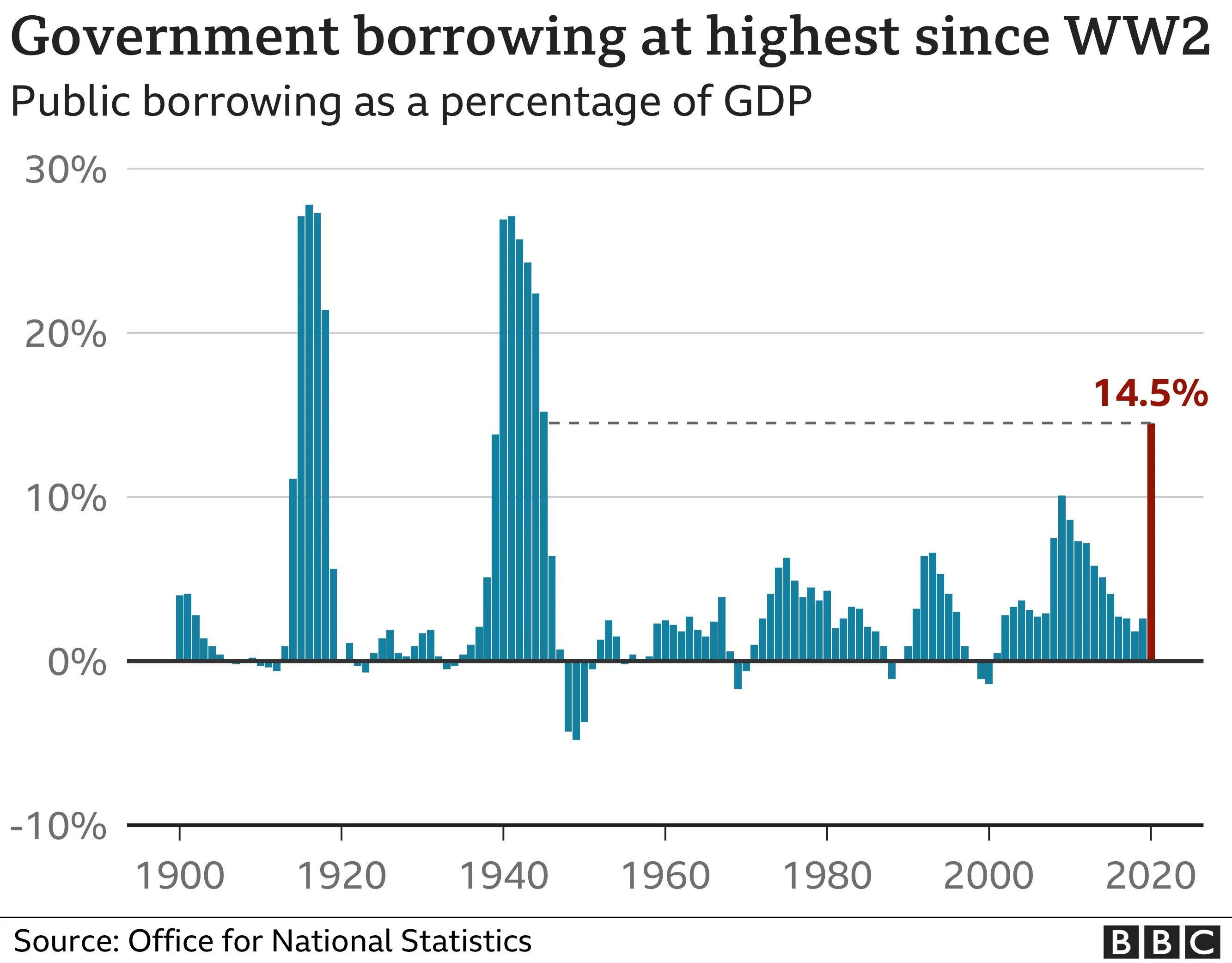

Covid costs push government borrowing to highest since WW2

PA Media

PA MediaThe cost of measures to support the economy during the coronavirus pandemic has pushed government borrowing to the highest level since the end of World War Two.

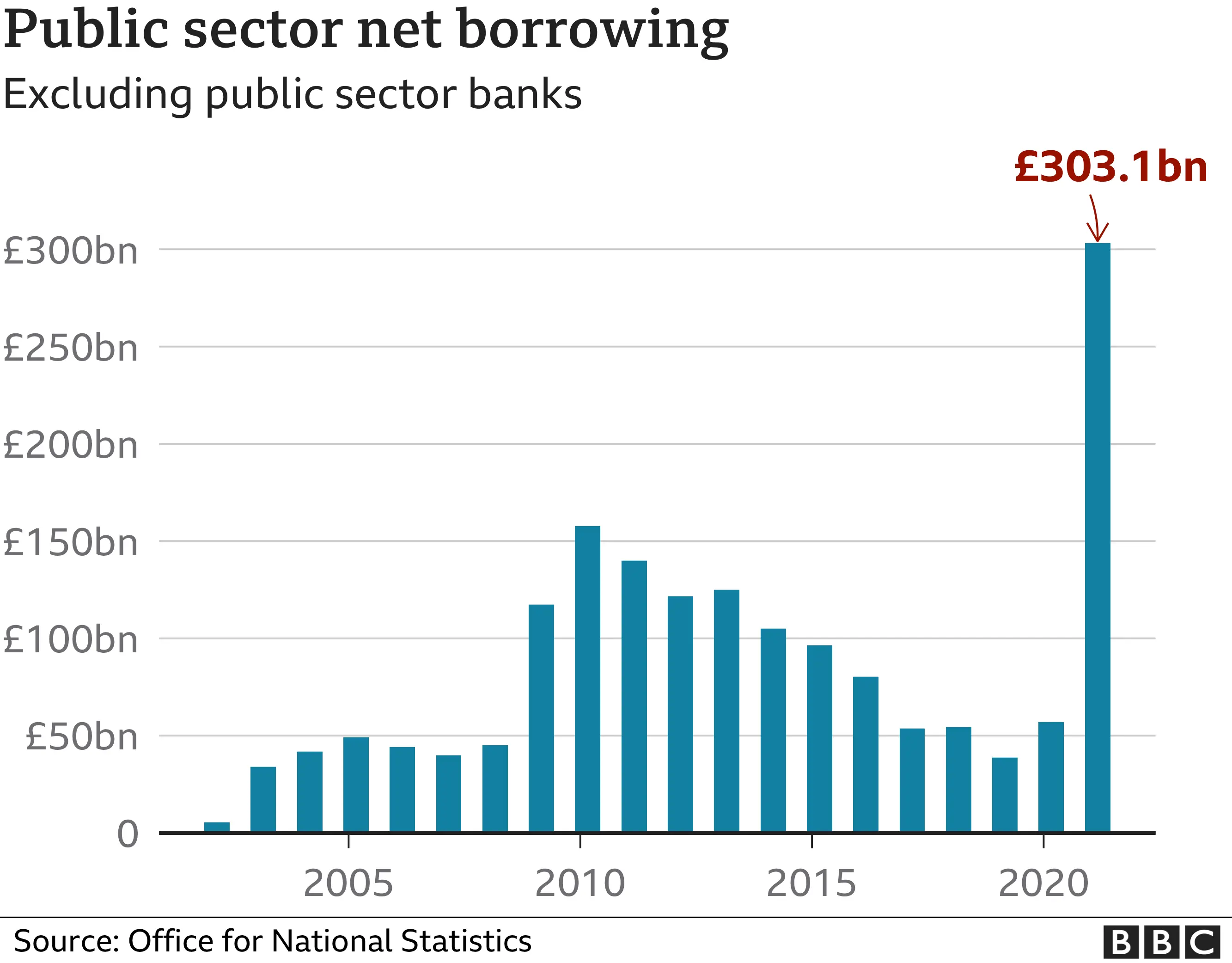

Government borrowing - the difference between spending and tax income - hit £303.1bn in the year to March, the Office for National Statistics said.

Compared to the previous year, borrowing is nearly £250bn higher.

Measures such as furlough payments have hit government finances hard.

Borrowing hit £28bn in March alone - a record high for that month.

Despite the record figure, Paul Johnson, director of the Institute for Fiscal Studies, told the BBC's Today programme the annual borrowing figure was "slightly better than expected a month ago".

But, he added: "The big story in a sense is they [the borrowing figures] are £250bn more than a year ago.

"And that, of course, is because of to some extent the recession of the last year but mostly because of the huge amount of additional government spending to support the economy over the last year."

Government borrowing of £303bn is at the same time, an extraordinary record, but also something a relief.

For starters it is not £400bn, as anticipated only a few months ago, though this number will go up when some Covid support loans fail to be repaid.

But its cause has been primarily an active government decision to spend more to support incomes during the pandemic. Of the £250bn difference in borrowing between this year and last, over £200bn comes from extra spending, the rest on a reduction in taxes.

In the latest reported month, March, taxes were barely down on last year. Whereas VAT, fuel duty and business rates were down, self assessment, PAYE, stamp duty and capital gains taxes were up.

That is part of a wider trend of the economy riding the second lockdown much more effectively than the first. It is epitomised by this morning's separate retail sales figures showing a boost even ahead of the physical reopening of shops.

The ONS suggested Britons wanted to look good and deck out their gardens ahead of some restrictions being lifted. Others, less charitable, suggested lockdown excess meant our clothes no longer fit.

The chancellor's slimming regime for the public finances is a gentle one. Borrowing is predicted to continue at high levels this year, as jobs support continues until the autumn, and massive tax cuts are meant to persuade companies to invest in plant and machinery.

It is a rebound in growth that will most effectively shrink these record borrowing numbers. That is why amid the sea of red ink, there is some reason for relief.

Measures to support individuals and businesses during the pandemic contributed to a £203.2bn, or 27.5%, increase in central government day-to-day spending in the year to March, the ONS said.

Meanwhile, tax and National Insurance receipts fell by £34.9bn, down 5% compared with the previous 12 months.

The ONS also said public borrowing as a percentage of GDP, or national output rose, to 14.5% - also the highest since the end of the second world war when it reached 15.2% in 1946.

The huge amount of borrowing over the past year has now pushed public sector net debt up to £2.142 trillion, which is 97.7% of GDP - a rate not seen since the early 1960s.

Michal Stelmach, senior economist at KPMG, said: "Rising debt is largely an unfortunate consequence of the government's focus on shielding the economy as much as possible from the impact of Covid-19.

"However, doing otherwise could have created long-lasting scars which would be far worse for fiscal sustainability."

Despite the record annual figure, the ONS said it was £24.3bn lower than the Office for Budget Responsibility (OBR), the fiscal watchdog, had forecast in March.

Ruth Gregory at Capital Economics said: "If we are right in thinking the economic recovery will be faster and fuller than the OBR anticipates, borrowing will probably fall more quickly than most expect."

'Brighter outlook'

Separate research published on Friday added to hopes of a swift rebound for the economy, as it suggested that the easing of lockdown measures this month has triggered a surge in activity among UK businesses.

A closely watched survey, produced by IHS Markit/CIPS, indicated that the looser pandemic restrictions had led to the fastest UK private sector growth since late 2013.

The IHS Markit/CIPS Purchasing Managers' Index (PMI) rose to 60 in April, according to initial findings, up from 56.4 in March. Any figure above 50 indicates expansion.

The service sector grew faster than manufacturing for the first time since the Covid pandemic began, the survey found, largely because of the reopening of non-essential shops in England and Wales from mid-April.

"Companies are reporting a surge in demand for both goods and services as the economy opens up from lockdowns and the encouraging vaccine rollout adds to a brighter outlook," said Chris Williamson, chief business economist at IHS Markit.

"Business activity should continue to grow strongly in May and June as virus restrictions are eased further, setting the scene for a bumper second quarter for the economy.

"There's also good news for the job market," he added. "Firms have been encouraged to take on extra staff at a rate not seen for over three-and-a-half years.

"There are some causes for concern, however, as export performance remains relatively lacklustre, often linked to post-Brexit trading conditions, and prices continue to rise sharply."