Klarna boss: 'I'm surprised by buy now, pay later concerns'

Klarna

KlarnaThe boss of payments company Klarna has said that he is surprised by concerns about the buy now, pay later model.

Klarna chief executive and co-founder Sebastian Siemiatkowski told the BBC it upset him when his company is compared to defunct payday loans firm Wonga.

Buy now, pay later services were used by five million people in the UK last year.

The Financial Conduct Authority (FCA) is to be given powers to regulate the sector.

This means that buy now, pay later companies will have to conduct proper affordability checks before lending and ensure customers are treated fairly if they are struggling to repay the loans.

It will also give consumer the right to complain to the Financial Ombudsman Service if things go wrong.

'Emotionally upset'

Buy now, pay later firms allow people to choose - at an online or physical checkout - to pay for items in instalments or, in some cases, defer payments for up to 30 days.

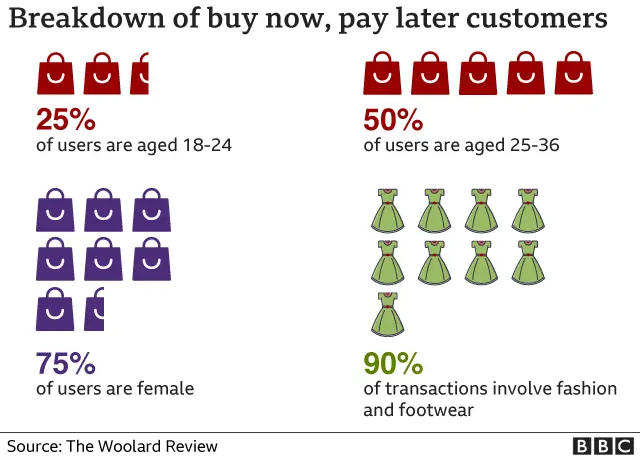

They have proved popular with younger shoppers - particular by offering a cheaper way to try before buying or returning - and use of these services rose fast over the course of the pandemic. Estimates suggest £4 in every £100 currently spent in the UK uses buy now, pay later.

Speaking to BBC Radio 5 Live's Wake Up To Money programme, Mr Siemiatkowski said: "To me it's slightly surprising to see the concern with buy now, pay later.

"I'm emotionally upset when I hear comparisons to Wonga.

"Klarna is very different. We've been fighting the bank establishment for years.

"I'm surprised to see that there's not a more positive response."

Wonga, which collapsed in 2018, was once the UK's biggest payday lender but its practices attracted intense scrutiny.

Founded in 2005 in Stockholm, Sweden, Klarna launched in the UK in 2014.

The company has seen 100% growth year-on-year in the UK and 60-70% growth worldwide, according to Mr Siemiatkowski.

However, he admitted that mistakes were made with some of Klarna's advertising.

"We're putting in extra work to make sure we live up to our own high standards," he said.

"We've identified that there's been mistakes done. We have not always followed our own advertising principals and marketing principals.

"The increased interest in these products are something we obviously take to heart and have made that extra effort."

Buy now, pay later services clocked up total sales of £2.7bn in the last year.

However, one in 10 people using them already had debt arrears elsewhere, a wide-ranging FCA review into credit services found.

The FCA said it would be easy to build-up unseen debts of £1,000.

Chris Woolard, who led the FCA review recommending regulation, said that although buy now, pay later was convenient for some people, for others it was "a really easy way to fall into problem debt".

You can listen to the Wake Up To Money podcast here.