Buy now, pay later firms such as Klarna face stricter controls

Getty Images

Getty ImagesFears over young shoppers' debts mean buy now, pay later firms such as Klarna will face more scrutiny by regulators.

These services, offered through major retailers, allow people to split payments without paying interest and are used by millions of shoppers.

But the Financial Conduct Authority (FCA) said it would be easy to build-up unseen debts of £1,000.

Now it will regulate the sector, after the value of these services saw a near fourfold rise last year.

Buy now, pay later services were used by five million people in the UK for total sales of £2.7bn in the last year.

However, one in 10 people using them already had debt arrears elsewhere, a wide-ranging FCA review into credit services found.

Economic Secretary to the Treasury John Glen said: "By stepping in and regulating, we're making sure people are treated fairly and only offered agreements they can afford - the same protections you'd expect with other loans."

Chris Woolard, who led the FCA review recommending regulation, said that although buy now, pay later was convenient for some people, for others it was "a really easy way to fall into problem debt".

This debt would not be seen by credit reference agencies and other lenders.

Under the new plans, providers would need to undertake affordability checks before lending and ensure customers were treated fairly, particularly those who are vulnerable or struggling with repayments.

The government said it would legislate as soon as possible, following consultation.

Alex Marsh, the UK head of Swedish company Klarna, accepted that "now is the time for regulation". He said the company worked with those who fell into debt, but ultimately missed payments could be forwarded to debt collectors.

How buy now, pay later works

These firms allow people to choose - at an online or physical checkout - to pay for items in instalments or, in some cases, defer payments for up to 30 days. Large operators include Klarna, Clearpay, and LayBuy.

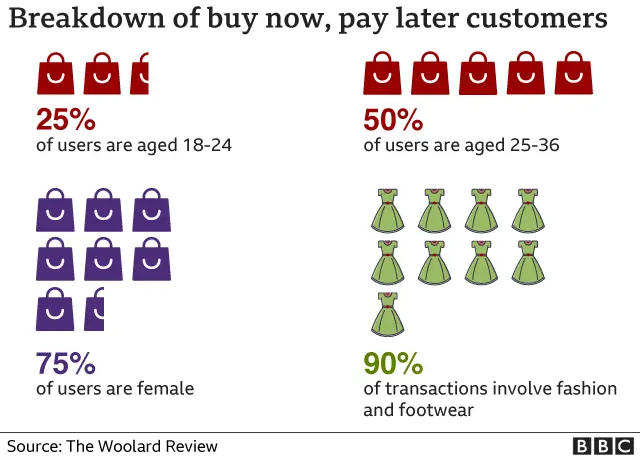

They have proved popular with younger shoppers - particular by offering a cheaper way to try before buying or returning. Use of these services rose fast over the course of the pandemic. Estimates suggest £4 in every £100 currently spent in the UK uses buy now, pay later.

Klarna

KlarnaDebt charities and campaigners have argued advertising via social media, often through influencers, has glamorised debt. They also suggest the services can make it too easy to fall into debt, and - while total debts are not huge - there are risks of unaffordable borrowing.

These companies do not charge interest - instead charging a fee to the retailer and some charge late payment fees to consumers - and they argue they are more payment providers than credit firms. They have not fallen under the same level of regulation as other credit providers, such as credit card or loan companies who require FCA approval to lend and must conduct affordability checks.

At present, anyone who has a complaint regarding a financial problem with a buy now, pay later firm is unable to take their case to the financial ombudsman for an independent adjudication. This should now change.

Alice Tapper, who campaigned via social media for a change to the rules, said: "It was the hundreds of people who shared their story with the campaign who made it painfully clear that the absence of regulation is at the expense of consumers, particularly those who are young and vulnerable."

But Gary Rohloff, managing director and co-founder of Laybuy, which has 400,000 UK users, said: "We believe we are already in a good place when it comes to regulation.

"There needs to be a balance to protect consumers, but also make sure it retains the innovation and simplicity that consumers value."

'A sticky situation'

Sophie Edwards is a follower of fashion, but it is a dedication that left her in debt.

She spent thousands of pounds on clothes, using buy now, pay later services, but then found herself "in a sticky situation" when she was made redundant.

"I was using it for retail therapy, to make myself feel better," she said. "It did not feel like real money.

"You can just go shopping on a Monday, a Tuesday and a Wednesday."

She found herself still needing to pay back hundreds of pounds when she lost her regular pay.

"That does not sound like a lot, but with no income, it really is."

She paid the debt off, and has decided since never to use buy now, pay later services.

Wider problems

The Woolard Review - the wider report into the credit sector which recommended the changes - made a string of proposals to assist those facing financial difficulty, particularly as a result of pandemic.

Among the recommendations were:

- More funding for free debt advice services as the UK recovers from the coronavirus crisis

- Sustained support for people struggling to keep up with payments owing to the Covid fall-out

- Reform of regulation in the community lending and credit union sector, to offer alternatives to expensive short-term debt

- A review of repeat lending that could leave borrowers in difficulty

"New ways of borrowing and the impact of the pandemic are changing the market, with billions of pounds now in unregulated transactions and millions of consumers at greater risk of financial difficulty," Mr Woolard said.