Budget 2021: 'Now is not the time for tax rises', say MPs

Getty Images

Getty ImagesNow is "not the time for tax rises" as they could undermine the UK's economic recovery from Covid - but they may be needed at a later date, MPs have said.

Ahead of the Budget announcement on Wednesday, a Treasury Committee report says public finances are on an "unsustainable long-term trajectory".

It says some tax rises may not harm recovery, but advises against others.

The committee's chairman, Mel Stride, told the BBC it was "almost inevitable" that some tax rises would occur.

There has been much speculation that the rate of corporation tax might rise, and Mr Stride told the BBC's Today programme: "Putting up taxes is in general not a great thing to do but we are where we are and I think the committee view is that looking at income tax and looking at corporation tax is... the right way to go."

Mr Stride added: "Each 1% increase in corporation tax raises about £3bn so I think... [it] is almost inevitable that some level of rise in going to occur."

He added that the UK had cut corporation tax rates from 28% to 19% and was extremely competitive with the rest of the world so "there seems to be scope for some modest increase".

The Conservatives' election promise was not to raise rates of national insurance, income tax or VAT, but Mr Stride said that did not include the level at which people started paying tax, and those levels could be frozen.

Freezing thresholds would mean more people paying more tax as wages rose.

Huge spending

The Treasury Committee's report said: "With our public finances on an unsustainable long-term trajectory, our clear message is that Budget 2021 is not the time for tax rises or fiscal consolidation, which could undermine the economic recovery.

"But we will probably need to see significant fiscal measures, including revenue raising, in the future."

The report, published as part of the Tax After Coronavirus inquiry, comes after Rishi Sunak said he must "level with people" about the economy.

On Wednesday, Mr Sunak will use the Budget to set out the government's tax and spending plans following a year of financial disturbance and high government borrowing brought on by the coronavirus pandemic.

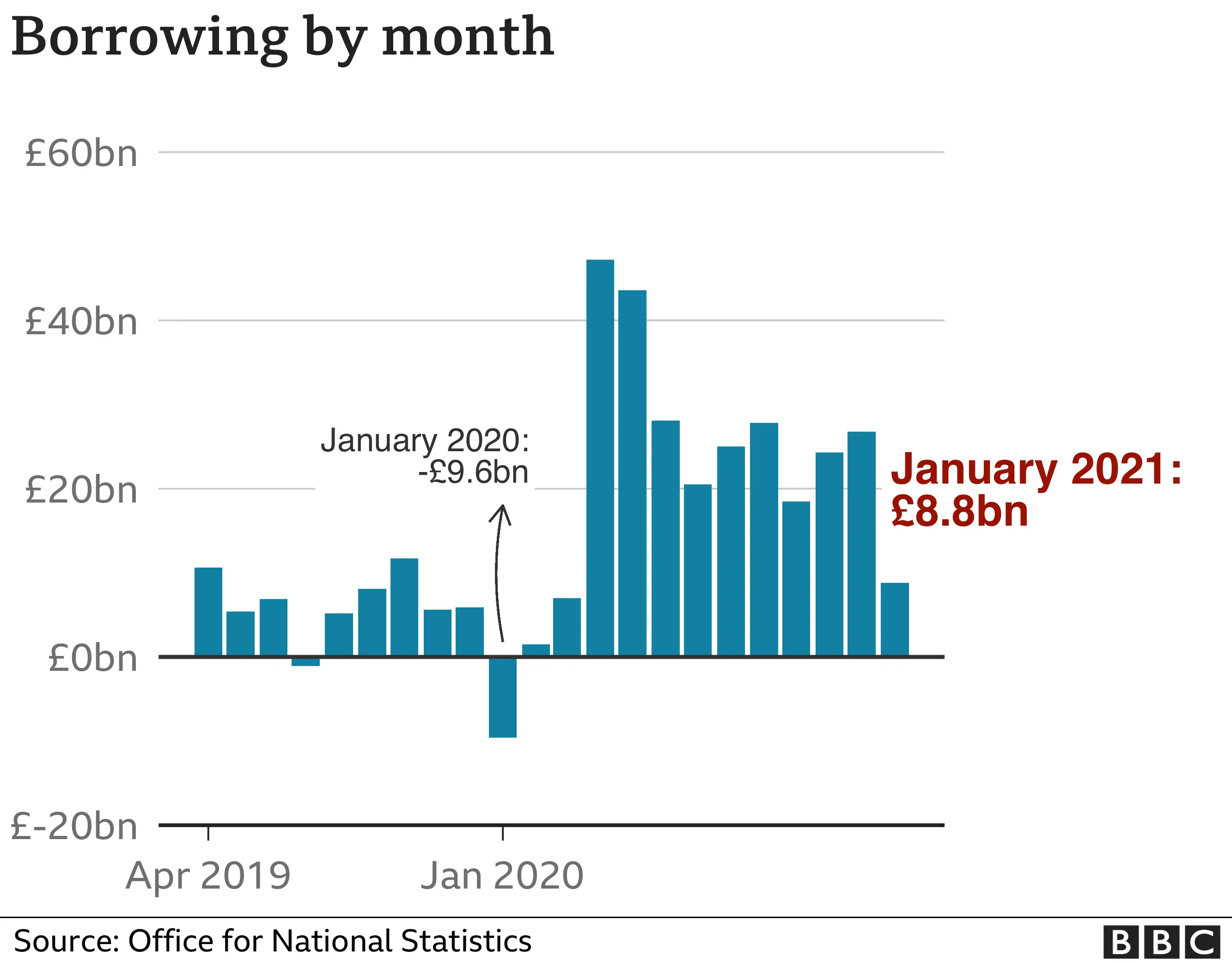

The huge amounts of money spent on pandemic support schemes have meant that government borrowing for this financial year has now reached £270.6bn, which is £222bn more than a year ago, according to the Office for National Statistics.

More than £46bn has been spent covering salaries as part of the furlough scheme, for example, and tens of billions of pounds on guaranteeing loans to businesses.

The committee recommends a number of actions it says could raise additional money for the government without hampering economic recovery.

As well as mentioning corporation tax rises and income tax thresholds, it suggested that stamp duty, a tax paid by people buying properties, is "economically inefficient" and causes damage to the economy by "affecting when and how often people buy homes".

The government should also look at introducing a "loss carry-back" for trading losses, it said. This would allow losses made during the pandemic to be set against up to three previous profitable years, generating a tax refund for both incorporated and unincorporated firms.

It also called a review of the tax treatment of the self-employed "long overdue" and said the current system is "confused, unfair and unsustainable".

The chancellor has said he "is preparing a Budget that provides support for people" as Covid lockdown rules are eased.

At the earliest, restrictions in England are set to be fully lifted by 21 June.

However, Mr Sunak also said he wanted to "be honest" with the public about the pandemic's impact on the economy and "clear about what our plan to address that is".

He warned high levels of borrowing had meant the UK was "more sensitive to interest rate changes" and that debt could "rise indefinitely" if borrowing continued after the recovery.

A Treasury spokesman said that, since the start of the pandemic, more than £280bn had been invested to protect jobs and businesses.

"We've been able to respond comprehensively and generously through this crisis because of our strong public finances," he said.

"The chancellor has made clear that once our economy recovers, we should look to return the public finances to a more sustainable footing.

"We will level with people about how we'll do that - and at the Budget this week we'll set out support for the economic recovery while being up front about the need to repair the public finances once the recovery takes hold."