Budget 2021: The challenge facing Rishi Sunak

Chancellor Rishi Sunak

Chancellor Rishi SunakChancellor Rishi Sunak's Budget will be one of the most-closely watched in years, as the government grapples with the enormous economic costs of the Covid-19 pandemic, and as he charts a financial roadmap for the country.

In his 3 March statement, the chancellor will outline the state of the UK economy and its outlook for the future - and give details of the government's plans for raising or lowering taxes.

So how is the UK economy faring under the twin impacts of coronavirus and Brexit? In the following charts, we take a snapshot of the nation's economic health - highlighting some of the economic challenges facing the chancellor.

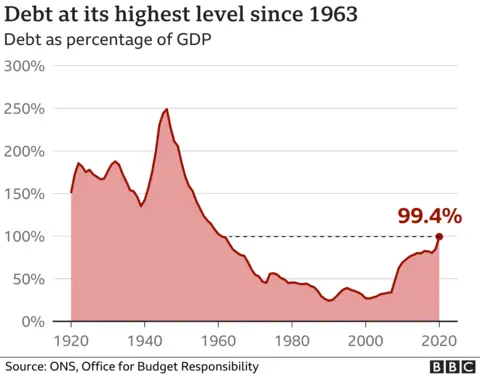

The UK's national debt has reached its highest level since 1963 - reflecting the huge cost of pandemic support measures such as the furlough scheme. National debt here means the total amount the government owes to its lenders - it is the accumulation of borrowing over many years.

So far this year, the annual total for government borrowing - the amount the government borrows to make up for the gap between what it spends and what it raises in taxes - has reached £270.6bn, which is £222bn more than a year ago, according to the Office for National Statistics (ONS).

The independent Office for Budget Responsibility (OBR) estimates that this figure could reach £393.5bn by the end of the financial year in March. This would be the highest amount in any year since the Second World War.

But it is also worth pointing out that this figure has been above 100% of Gross Domestic Product (GDP) or annual national income in 131 of the last 320 years.

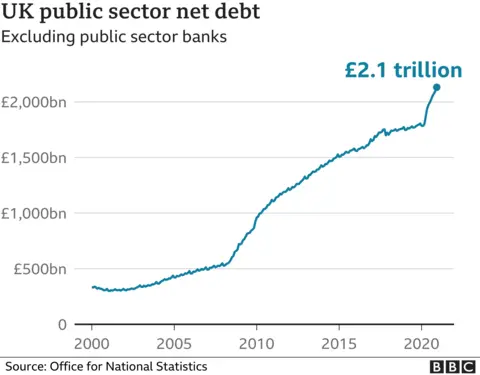

The 21st Century so far has been one of rising levels of public sector net borrowing (how much both central and local government have borrowed to carry out their spending programmes). Last month's figure was £8.8bn, the highest January borrowing amount since monthly records began in 1993.

As a result of the pandemic, public sector net debt has risen by £316.4bn over the 10 months since last April to an all-time high of £2.1 trillion.

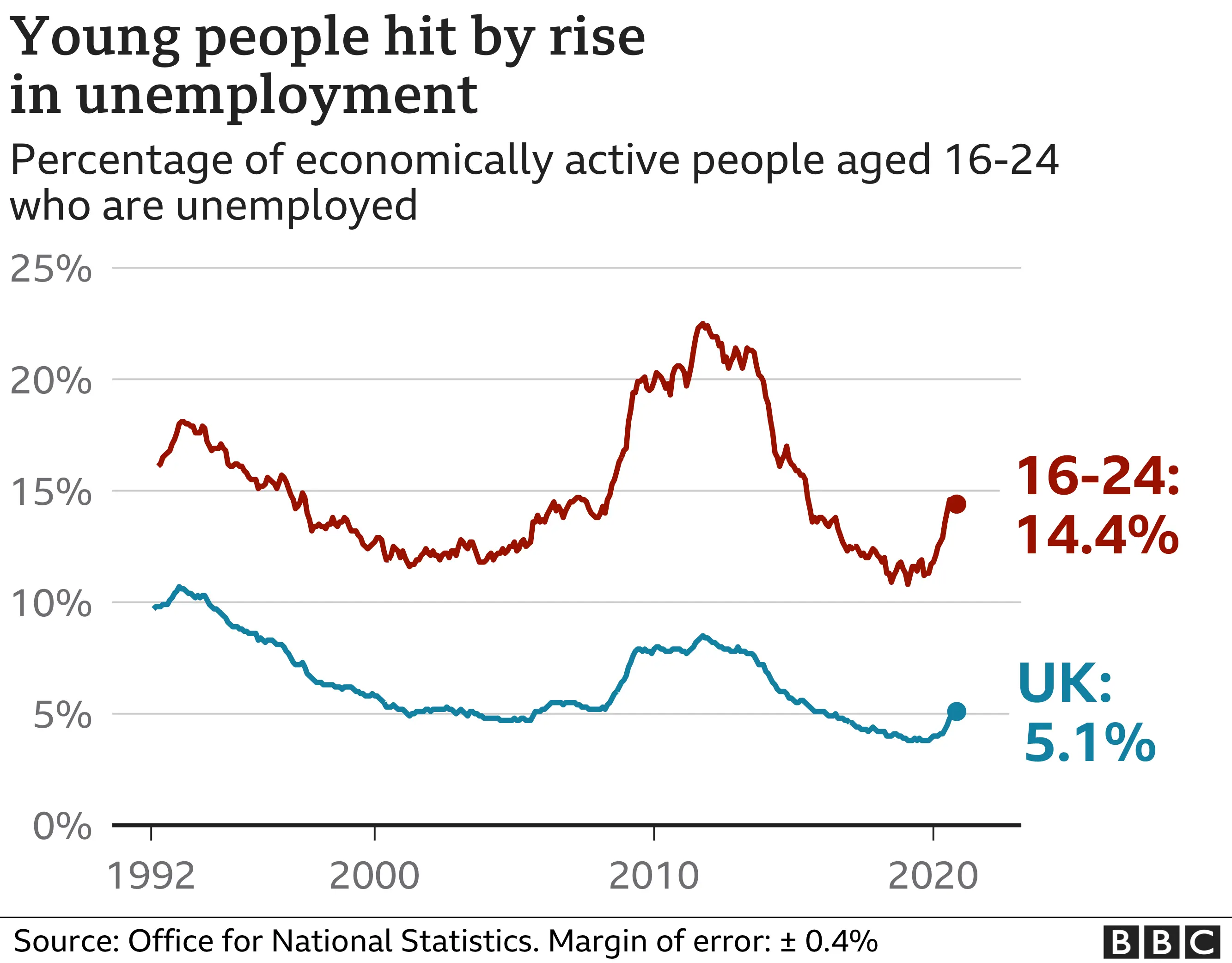

Unemployment is currently 5.1%, according to the Office for National Statistics (ONS). This is the highest figure for five years, and shows the effects of lockdowns on the economy due to the pandemic, with many workplaces forced to close their doors.

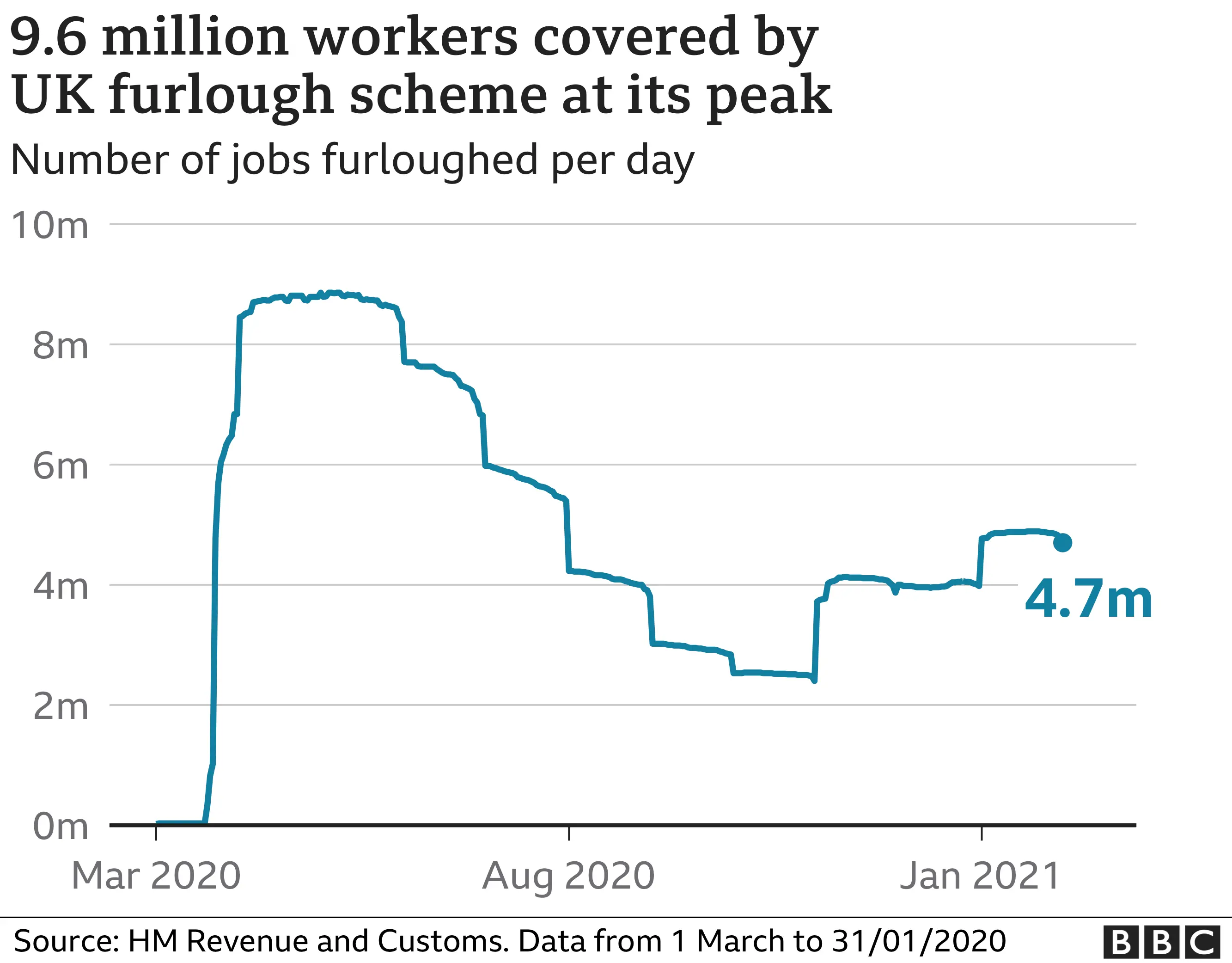

So far, this hasn't resulted in a rapid rise in unemployment, as the furlough support scheme has helped to protect jobs, but this could change if the scheme ends as planned in April. Most economists expect the unemployment rate to continue rising in 2021.

However, the roll-out of Covid vaccines is happening quickly and this may help to keep unemployment down if it allows a staged re-start of the UK economy.

Young people have been hit particularly hard by the labour market fallout from coronavirus, with workers aged under 24 accounting for nearly half of the total fall in employment during the economic slump, according to research by the Institute for Employment Studies (IES).

At the same time, more people are chasing fewer jobs, so young people are struggling to enter the employment market.

Significantly, young people account for 46% of the overall fall in employment during the pandemic - even though they only account for just one in nine of the workforce.

Prime Minister Boris Johnson has hinted that furlough support for workers will continue beyond April, as he pledged not to "pull the rug out" from under the UK economy when he unveiled plans to ease the national lockdown in four steps.

If the government does not extend the job support schemes, then the latest forecast from the Bank of England suggests that UK unemployment will reach 7.75% during the summer.

Full-time work has risen during the pandemic, despite the impact of Covid on the labour market. However, the numbers of those in part-time jobs or self-employed have dropped, as freelancers and those in precarious work bear the brunt of the crisis.

Campaign groups are calling on the chancellor to plug gaps in schemes such as the self-employed income support scheme (SEISS) to support millions of self-employed people and other workers excluded from furlough. The Resolution Foundation think tank says that 2.3 million workers are missing out on help because they are not covered by SEISS.

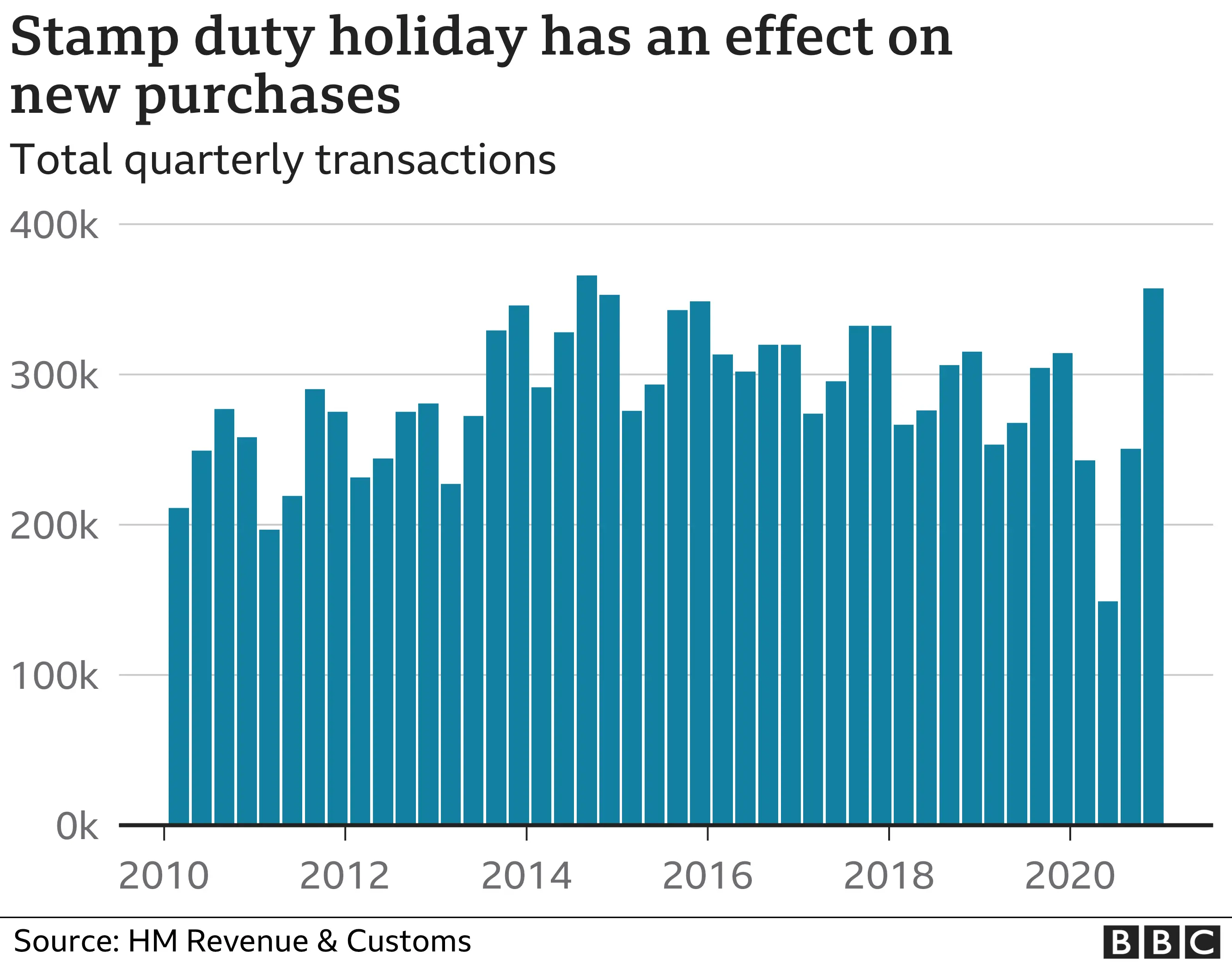

UK house prices climbed 8.5% last year - that's the highest annual growth rate since October 2014 - with the average UK house price reaching a record high of £252,000 in December 2020.

The North West had the highest growth of 11.2%, while London rose just 3.5%.

One of the factors behind the rise has been the stamp duty holiday in England that was introduced last July. However, if the tax break ends on 31 March as planned, sales and house price rises are likely to slow afterwards.