Brexit: 'I was asked to pay an extra £82 for my £200 coat'

Ellie Huddleston

Ellie Huddleston"I had no idea at all I was going to be charged any more for deliveries after Brexit. The extra costs were definitely a bit of a shock."

Ellie Huddleston, a 26-year-old Londoner, thought she would treat herself to some new work clothes in the January sales.

Having spotted a bargain, she placed an order for a coat and a number of blouses from two of her favourite clothes brands based in Europe.

But both deliveries were delayed, held up in customs checks for at least a week, she says.

She was surprised when she then received a text from courier company DPD, containing a link asking her to pay £58 in customs duties, VAT and additional charges for her £180 order.

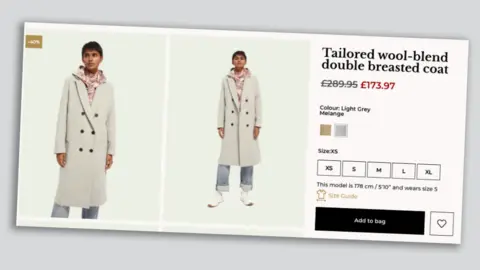

On top of that, the UPS courier for the second parcel showed up at her door several days later, asking for an extra payment of £82 for her £200 coat.

These charges, imposed by new government rules, have to be collected by the courier firms on the authorities' behalf.

"I didn't even know when the parcels would be coming - so I sent both back without paying the extra fees and won't be ordering anything from Europe again any time soon," Ellie says.

When the UK was part of the European Union's customs union, goods could move freely between the country and other member states without import taxes being charged.

But Ellie was one of the shoppers caught unaware of the fact that those rules have changed since the UK's official exit.

Post-Brexit charges

EU retailers sending packages to the UK now need to fill out customs declaration forms. Shoppers may also have to pay customs or VAT charges, depending on the value of the product and where it came from.

However, customs charges are the responsibility of the customer, not the retailer, who often has no idea of how much the eventual extra cost might be.

They cannot be paid in advance and are levied only when the item reaches the UK.

Another unhappy customer, Graeme from Manchester, paid £300 to buy two pairs of suede winter boots from a German firm online.

"You couldn't get them anywhere in the UK, so I had no choice but to order them from Europe," he told the BBC.

The next thing he knew, courier UPS had sent him a text message saying he had to pay £147 extra before the boots could be delivered. He paid up, but is still waiting for the goods to arrive.

"It was virtually impossible to find out what the charges would be beforehand," he says, "so I had to take a shot in the dark.

"I didn't imagine that it would be half as much again."

Getty Images

Getty ImagesUnder the new rules, anyone in the UK receiving a gift from the EU worth more than £39 may now face a bill for import VAT - with many items charged at 20%.

For goods costing more than £135, customs duties may also apply, which can range from 0% to 25% of the product you're buying if they have not been paid by the sender already.

The extra charges are usually collected by the courier on behalf of the government, with customers asked to pay before they can pick up their package.

Some specialist European retailers, such as bicycle part firm Dutch Bike Bits and Belgium-based Beer On Web, recently said that they would stop all deliveries to the UK because of the VAT changes, which came into force on 1 January.

Some firms have started charging additional "handling fees" to shoppers to cover costs associated with extra customs checks and paperwork that must be filled out.

Royal Mail, for example, is charging an £8 fee it says "reflects the cost of clearing items through customs and presenting them to Border Force".

Meanwhile, delivery firm DHL says it is charging UK customers 2.5% of the amount paid to clear customs, with a minimum charge of £11.

Mail and freight company TNT is also adding £4.31 on all shipments from the UK to the EU and vice versa. It has said this reflects the increased investment it has had to make in adjusting its systems to cope with Brexit.

A spokeswoman for Logistics UK told the BBC that the handling fees were "a commercial decision by individual businesses".

But Michelle Dale, senior manager at accountants UHY Hacker Young, said that new charges could present a major problem for firms in the coming weeks.

"I think what we'll find is that a lot of trade with the EU from a business-to-customer perspective will come to a stop until some of these rules are eased," she said.

Your rights and disputes

- UK consumers' rights when buying online, or receiving gifts, from the EU are now more complicated and could lead to disputes. VAT, customs duties and handling fees may all need to be paid. They could be applied before delivery. Many people may find they need to visit the post office to pay all the relevant charges before the item is released

- Under the Consumer Rights Act, online shoppers have 14 days to return an unwanted item, but they may find it costs them money to send it back

- Disputes are likely to arise if buyers think the extra charges are a "hidden cost" that they were unaware of, and feel they should not pay. Now the UK has left the EU, this dispute can no longer be settled in UK courts. It falls under the jurisdiction of the country where the seller is located

- To avoid losing UK consumers' trade, some overseas sellers in other parts of the world have introduced a rebate scheme to refund some of the charges post-delivery

- Meanwhile, any parcels or gifts sent from England, Wales or Scotland to the EU must have one of a variety of customs forms stuck to it

A government spokesperson said: "The new VAT model ensures goods from EU and non-EU countries are treated in the same way and that UK businesses are not disadvantaged by competition from VAT-free imports.

"The new system also addresses the problem of overseas sellers failing to pay the right amount of VAT when they sell goods in the UK. We anticipate this will bring in £300m in tax every year, to fund essential UK public services."

There is speculation the rules may change, but until they do, Ellie says she won't be buying from European firms.

"With all that uncertainty around things and whether or not these charges might change, I'd rather just avoid the hassle," she says.