Yuan fall: Why is China's currency getting weaker?

Getty Images

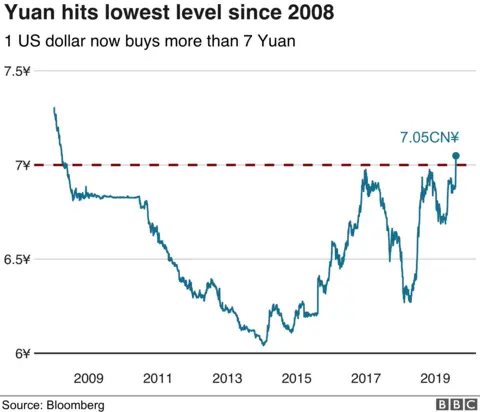

Getty ImagesChina's currency has weakened to its lowest point in more than a decade, prompting the US to label Beijing a currency manipulator.

The US move came on Monday, after the currency fell below 7 yuan to the US dollar for the first time since 2008.

Beijing has previously sought to prevent the currency from slipping below the symbolic level.

The escalation of the trade war, sparked by fresh US tariff threats, is seen to have prompted the policy shift.

On Monday, the People's Bank of China (PBOC) said the slump in the yuan was driven by "unilateralism and trade protectionism measures and the imposition of tariff increases on China".

It comes days after US President Donald Trump said he would impose a 10% tariff on $300bn ($246bn) worth of Chinese goods, effectively hitting all of China's imports to the US with duties.

How does China devalue its currency?

The yuan is not freely traded and the government limits its movement against the US dollar.

Unlike other central banks, the PBOC is not independent and faces claims of interference when big moves occur in its value.

Capital Economics Senior China Economist Julian Evans-Pritchard said by linking the yuan's devaluation to the latest tariff threats, the PBOC has "effectively weaponised the exchange rate, even if it is not proactively weakening the currency with direct intervention".

What is the impact of a weaker yuan?

A weaker yuan makes Chinese exports more competitive, or cheaper to buy with foreign currencies.

From the US perspective, it is seen as an attempt to offset the impact of higher tariffs on Chinese imports coming into America.

While it appears a win for consumers around the world - who can now buy Chinese products more cheaply - it carries other risks.

A weaker yuan will also make imports into China more expensive, potentially driving up inflation and creating strains in its already slowing economy, as well as pushing currency holders to invest in other assets.

Have they done this before?

Yes. Back in 2015, China's central bank pushed its currency to its lowest rate against the US dollar in three years, in part to deal with easing growth. The central bank said the move was designed to support market-reforms.

AFP

AFPThe last time the yuan traded at the 7-level against the dollar was during the global financial crisis.

Capital Economics Mr Evans-Pritchard said China has long argued the 7-per-dollar level is an arbitrary threshold, "but had previously intervened to prevent the currency from breaching this threshold".

Why has it angered the US?

Making Chinese goods more competitive strikes at the heart of Mr Trump's trade war with Beijing.

The US president has long accused China of devaluing its currency in order to support its exports - claims Beijing has denied.

Despite linking the latest slide in the yuan to the trade war, China continued to state it would not engage in "competitive devaluations".

PBOC Governor Yi Gang said on Monday China "China would "refrain from competitive devaluations, and will not target exchange rate for competitive purposes".

Why is currency manipulation so controversial?

Currency manipulation - by China or any other other country - is seen to flout global trading rules by conferring unfair competitive advantages.

A country does so by artificially inflating or deflating its exchange rate. It may be designed to make exports more competitive, to avoid inflation or reduce capital inflows.

A paper by Laurence Howard in the Emory Law Review said currency manipulation has "serious effects on the global market".

"Around the globe, currency manipulation is possibly responsible for millions of jobs lost in the United States and a smaller, but still significant, number of jobs lost in Europe," Mr Howard wrote.

What's next for the yuan?

Analysts forecast the yuan will weaken further.

Oanda market strategist Edward Moya said continued yuan depreciation "should be expected" and we could "see another 5% before the end of the year".

Capital Economics now expects the yuan to end the year at 7.30 per US dollar, compared with previous forecasts of 6.90.