US-China trade war: 'We're all paying for this'

MinkeeBlue

MinkeeBlue"I've been building my business, and growing it year after year, and then this happened," says Sherrill Mosee, who is one of the many who've been caught in the crossfire of the US and China tariff war.

She is the founder of handbag and backpack maker MinkeeBlue, which is based in Philadelphia but manufactures its products in China and then imports them to the US.

It is one of a huge range of companies - from shoe makers to chemical firms and tech suppliers - facing the impact of the bruising trade fight between the world's two largest economies.

Ms Mosee has seen import tariffs on her products more than double in the last few months.

Top trade negotiators from the US and China met in Shanghai this week for their first face-to-face talks since May. But the meetings were brief and no swift resolution is yet in sight.

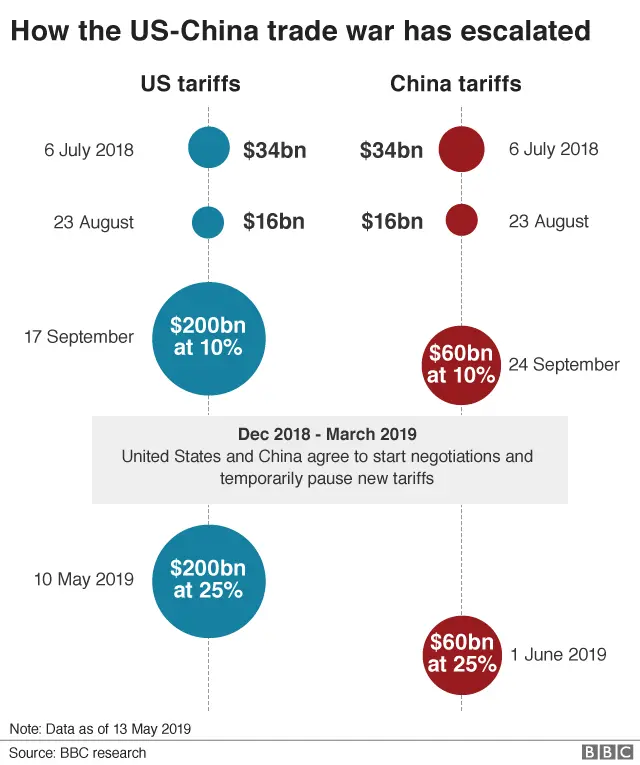

Both sides have imposed tariffs on billions of dollars worth of goods, leading to higher costs for business and consumers.

Ms Mosee says import duties on her bags were "already expensive" at 17.6% before the US-China trade war started - now the rate is 42.6%.

Getty Images

Getty ImagesTo get her products into the US, that tariff must be paid at the border. Ms Mosee says she's had to "scramble around to get the additional funds" to pay the higher duties, including looking for loans.

"As a small business my finances were already a little tight. I had to figure out how I was going to get the money to operate the business. We're all paying for this, not [only] China," she says.

Ms Mosee has raised the price of some bags - which are designed with compartments to carry lots of items like shoes and laptops - by roughly 25% to offset the impact of the higher import tariff.

Those price hikes mean Ms Mosee's customers, who buy online from countries including the UK, Dubai, Canada and Australia, are feeling the knock-on effects of the trade battle.

Shifting production

To sidestep the higher tariffs, some companies are choosing to move out of China.

A recent survey by the American Chambers of Commerce in China and Shanghai found 40% of respondents are considering shifting or have already relocated their Chinese manufacturing facilities - mostly to South East Asia.

Global Trade

One company that has made the jump is another US seller of bags and travel accessories, Litegear.

Its products, which are mostly made from recycled plastic bottles, had previously all been manufactured in China.

Litegear

LitegearWhen tariffs on some of those goods were hiked by 10% last December, chief executive Magi Raible had a feeling the matter might drag on for some time. She acted quickly to shift some production out of China to Cambodia. Later those tariffs were increased by another 15%.

Now around half of her products - mainly smaller accessories - are made in the South East Asian country. The rest are still made in China.

Despite her swift action there was a gap in production, and overall the tariff rises have hit Litegear profits by up to 15%.

"The learning curve has been very steep," Ms Raible says.

A planned merger with a luggage firm had to be scrapped as her potential partner couldn't absorb the higher costs, or pass them on to consumers.

Magi Raible

Magi Raible"He went out of business and I lost the opportunity to double the size of my business. That was really terrible for us," says Ms Raible.

"I'm fighting this battle… and I'm adjusting, but it costs jobs, it costs building the business, it costs profits."

She doesn't oppose the overall aim of pressing China to reform its trading practices but isn't happy with the current strategy.

"I feel that the approach is hurting Americans way more than helping the problem."

Jobs freeze

Even for firms that are already located outside China, the ripple effect is beginning to be felt by some. Take for example, semiconductor manufacturers in Singapore.

The country is a hub for the industry, producing microchips which are used in a huge range of electronic devices, many of them made in China. As a result, the sector is feeling the consequences of the tariffs, says Ang Wee Seng, executive director of Singapore's Semiconductor Industry Association.

"It is a known fact that the trade tension has started to directly impact the business here and the region," he says. "The whole globe is affected by this."

On top of that Washington's move to add Chinese telecoms giant Huawei to a trade blacklist has curtailed business too.

The semiconductor industry is facing a wider slowdown and Mr Ang says the trade war has made the business environment even tougher.

He says recent meetings with chip manufacturers in Singapore suggested employment in the sector is being affected.

"Every one of them is doing a headcount freeze and they are hiring in a very selective form," he says. "It's an indication that there is a slowdown in the market already."

Additional reporting by Ana Nicolaci da Costa