Help to Buy: 'Most users did not need help report finds'

Getty Images

Getty ImagesAlmost two-thirds of homebuyers who used the government's Help to Buy scheme could have bought a home without it, an official report has said.

However, they may not have been able to buy the house they wanted without the help, the report from the National Audit Office (NAO) found.

It also found that one in 25 of participants had household incomes of over £100,000.

The scheme did help boost the profits of building firms, the NAO said.

It was too early to determine if the scheme had delivered value for money for the taxpayer, the report said.

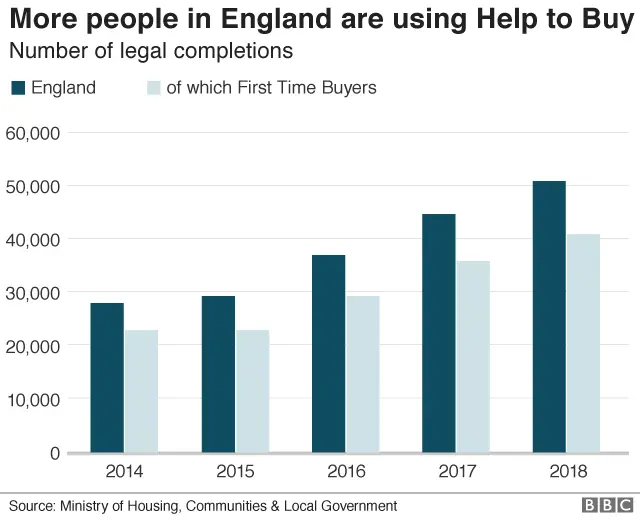

"Help To Buy has increased home ownership and housing supply, particularly for first-time buyers," Gareth Davies, head of the NAO, said.

"However, a proportion of participants could have afforded to buy a home without the government's help.

"The scheme has also exposed the government to significant market risk if property values fall, as well as tying up a significant public financial capacity.

"The government's greatest challenge now is to wean the property market off the scheme with as little impact as possible on its ambition of creating 300,000 homes a year by 2021," he said.

The scheme comes in two forms, Help to Buy loans and Help to Buy Individual Savings Accounts (Isas).

In the first version, the government lends up to 20% of the cost of a newly built property, or 40% within Greater London, so buyers need only a 5% deposit and a 75% mortgage to buy it.

Those purchasing a new-build home are not charged interest for the first five years.

The Help to Buy ISA was launched later, in December 2015, and is open to first-time buyers in the UK.

Savers receive a 25% bonus from the government when they withdraw the money they have saved to buy their first property. The maximum purchase price is £250,000, or £450,000 in London.

The maximum government bonus that someone can receive is £3,000, if they have saved £12,000.

"By 2023, the government will have invested up to £29bn in the scheme, tying up cash which cannot be used elsewhere," the NAO said.

Bigger firms made the most of the scheme.

Between 2013 and 2018 more than half the sales in England made by Redrow, Bellway, Taylor Wimpey, Barratt and Persimmon involved Help to Buy.

'Housing bubble'

Persimmon is the biggest beneficiary, with almost 15% of the sales made under the Help to Buy Scheme.

Persimmon saw its annual profits top £1bn last year.

Last year Persimmon's previous chief executive refused to answer questions about his £75m bonus, walking off-camera.

Jeff Fairburn said it was "unfortunate" he had been asked about the payout, which was reduced from £100m after a public backlash.

Mike Amey, managing director of global investment management firm Pimco, has told the BBC that profit on a house sold by Persimmon had trebled since Help to Buy was introduced, "roughly from £20,000 to £60,000".

Fran Boait, executive director of campaigning body Positive Money, said: "It's now beyond clear that rather than helping those who can't afford to buy a home, Help To Buy has mainly been a subsidy for a housing bubble, benefiting property developers and existing home owners."

The government's investment is expected to be returned from the scheme by 2032 after it closes in 2023. However, the size of the loans mean it is very much exposed to the performance of the housing market.

From April 2021, the scheme will be restricted just to first-time buyers.