Does Help to Buy prop up housebuilders?

Getty Images

Getty ImagesThe Help to Buy housing scheme, launched in 2013, is hailed by the government as one of its big successes.

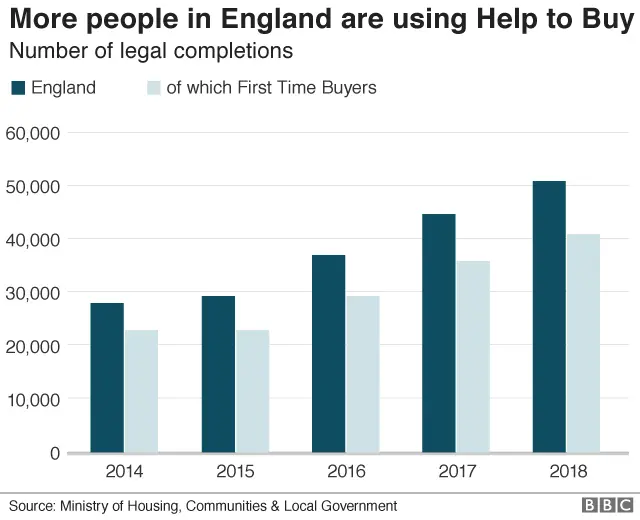

The Treasury says 494,108 English homes have been bought through the scheme, with the vast majority going to first-time buyers living outside London.

Ministers and mortgage lenders alike say it lifts people into home ownership by getting them on the housing ladder.

But critics say it merely subsidises housebuilders and pushes up the price of new homes.

Similar schemes exist in Wales, Scotland and Northern Ireland.

What is Help to Buy anyway?

There are two main forms: Help to Buy loans and Help to Buy Individual Savings Accounts (Isas).

In the first version, the government lends up to 20% of the cost of a newly built property - or 40% within Greater London - so buyers need only a 5% deposit and a 75% mortgage to buy it.

Those purchasing a new-build home are not charged interest for the first five years.

The Help to Buy Isa was launched later, in December 2015, and is open to first-time buyers in the UK.

Savers receive a 25% bonus from the government when they withdraw the money they have saved to buy their first property. The maximum purchase price is £250,000, or £450,000 in London.

The maximum government bonus that someone can receive is £3,000, if they have saved £12,000.

Savers can deposit up to £200 a month, although they can kick-start saving with a lump sum of £1,200.

What are the arguments in favour?

Chancellor Philip Hammond is certainly firmly behind the scheme, which was introduced by his predecessor, George Osborne.

He has extended it to run until March 2023 and says the move will support "half a million more home purchases".

He said: "The government supports those who dream of owning their own home and wants to help them take the first step on to the property ladder."

Support also comes from the Intermediary Mortgage Lenders Association.

Its executive director, Kate Davies, said Help to Buy had become "a cornerstone of the UK property market" and provides "essential support to the whole of the UK property sector".

She added: "Although last year saw the highest number of first-time buyers since the financial crisis, millions of households are still waiting to get on the housing ladder and Help to Buy will continue to play a crucial role in helping some of these households into home ownership over the next four years."

So what's the problem?

The argument against the scheme has gained ground this week, with the news that one of the UK's biggest builders of houses, Persimmon, saw its annual profits top £1bn last year.

A day earlier, the firm's share price fell 5% because of suggestions that its participation in Help to Buy was under government scrutiny.

For opponents of the scheme, that just shows how dependent the firm has become on big injections of public cash.

Mike Amey, managing director of global investment management firm Pimco, told the BBC that profit on a house sold by Persimmon had trebled since Help to Buy was introduced, "roughly from £20,000 to £60,000".

Getty Images

Getty ImagesAnd property expert Henry Pryor told the BBC that last year, half the number of homes Persimmon built were underpinned by support from Help to Buy.

Mr Pryor said the scheme was brought in for legitimate reasons following the credit crunch, to restore confidence in the sector.

But since then, it had become "the crack cocaine of the building industry", he said.

"When we are weaned off it, it is going to be painful," he added.

Other big housebuilders, such as Barratt and Taylor Wimpey, are thought to have benefited to a similar extent.

Are there other unintended consequences?

Well, it has arguably distorted the housing market by making it more advantageous to buy a new-build home than an existing one.

Research by investment bank Morgan Stanley in 2017 said the price gap between new homes and second-hand ones had set a new record.

"There has always been a small premium for new-build; people will pay extra for spanking-new kitchens and bathrooms. But since 2013, that premium has rocketed," it said.

For Mark Dyason, managing director of specialist property broker Thistle Finance, Help to Buy could come to a sticky end when the scheme is finally wound up.

He said: "Help to Buy is in much the same vein as low [interest] rates since the global financial crisis.

"They have kept the economy going, but equally they have kicked the can down the road.

"The Help to Buy scheme is arguably a hollow victory, with the potential to cause all manner of problems, both for the buyers who have used it and the developers that have offered it."