The decline of cash in the UK - in charts

PA

PACash use is falling, with predictions that fewer than one in 10 transactions will be completed with notes and coins in 10 years' time.

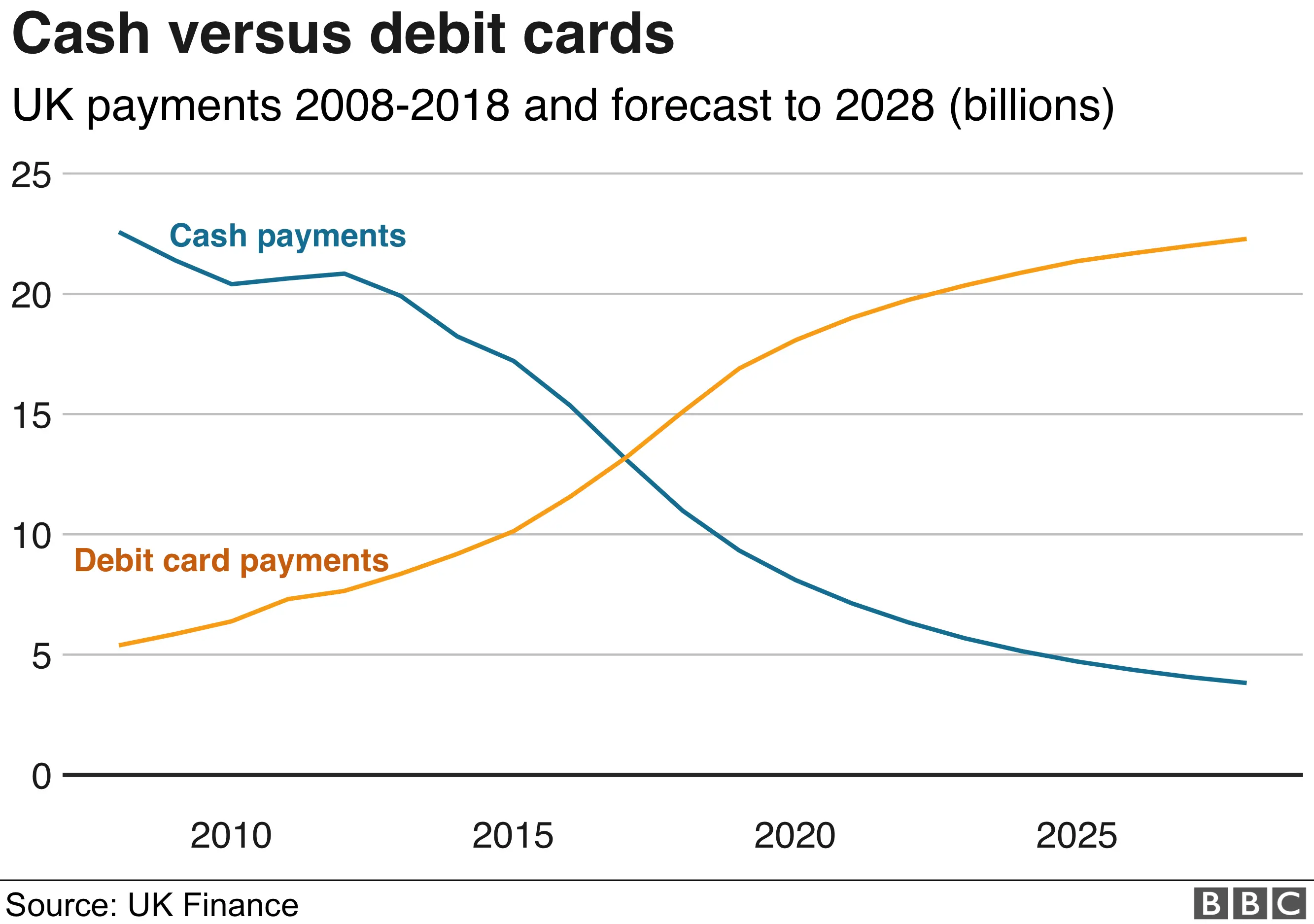

Ten years ago, cash was used in six out of 10 payments, but it has been overtaken in popularity by debit cards, driven by the use of contactless technology.

A review of payments, published by banking trade body UK Finance on Thursday, said cash was here to stay, but would play a less important role in the future.

The most recent figures show cash payments are still common, but declining - down 16% from 2017 to 2018, while debit card use is rising.

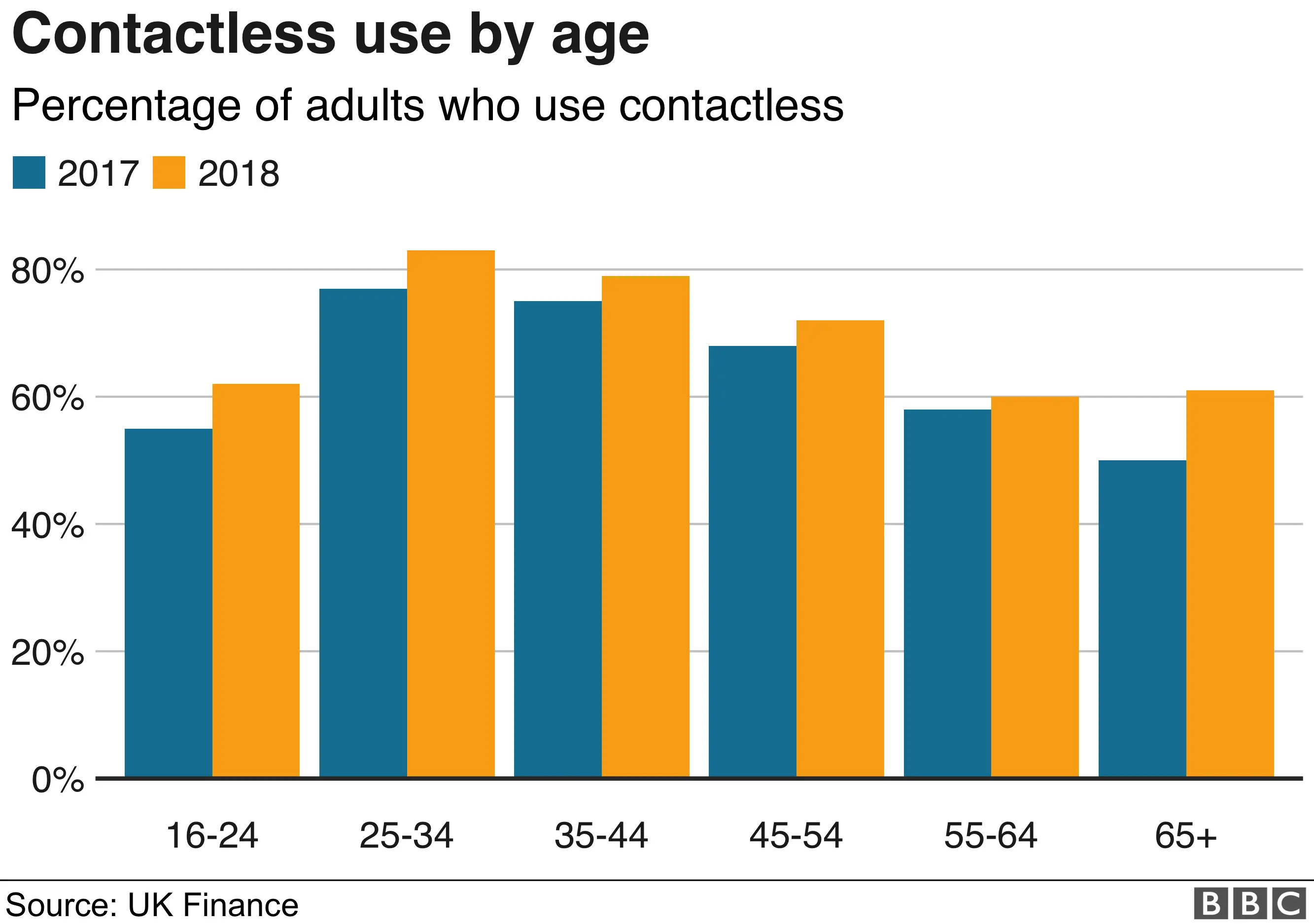

Contactless payments on debit cards were once used primarily by young adults, but older consumers have adopted the technology, with some of the biggest rises in the last year among pensioners.

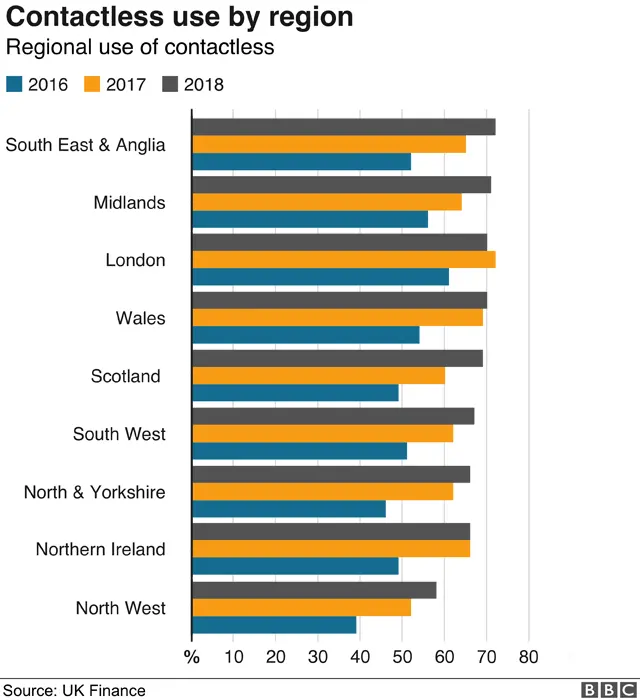

The use of contactless was given a massive leg-up a few years ago, when it was adopted by the London Underground. Now, however, other regions have caught up with - or overtaken - London in terms of the proportion of adults who make contactless payments.

Theories about the lower take-up in the North West of England include an ageing population in coastal towns sticking with cash, plus the lack of digital access owing to a lack of connectivity in areas such as the Lake District.

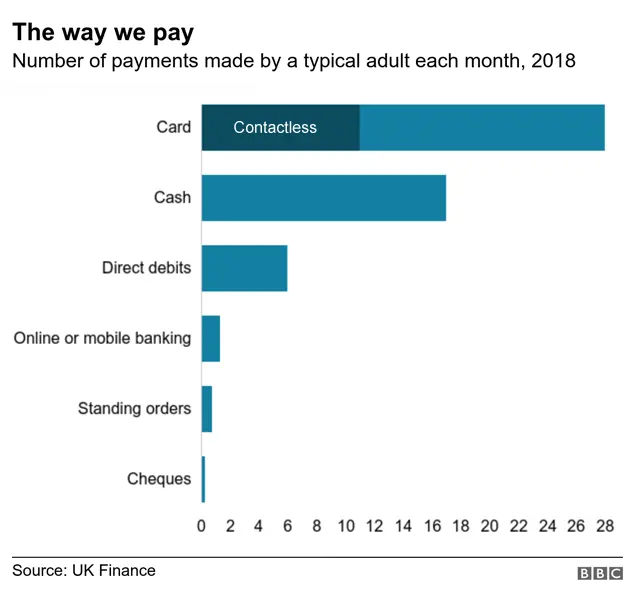

Overall, this means that debit cards are used more than any other form of payments in our monthly outgoings, but cash is far from dead.