Millions choose a cashless lifestyle

Getty Images

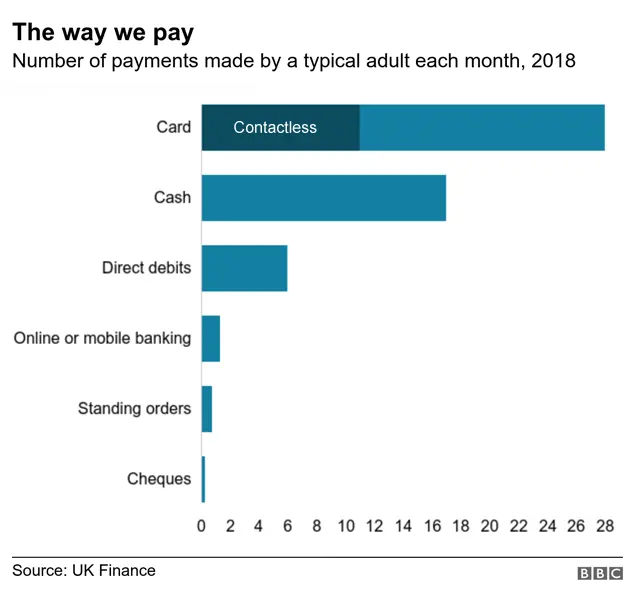

Getty ImagesMore than five million people led a close to cashless lifestyle last year, as debit cards secured their position as the most popular method of payment.

Two million more people used cash no more than once a month in 2018 compared with the previous year, a report by banking trade body UK Finance has said.

However, 1.9 million people mainly used cash, primarily to budget.

The figures will reignite the debate over the future of bank branches, ATMs, and digital security.

"More and more customers are now opting for the speed and convenience of paying with their contactless cards. This rapid rate of technological change is set to continue over the coming decade," said Stephen Jones, chief executive of UK Finance.

"However, technology is not for everyone and cash remains a payment method that is valued and preferred by many, so maintaining access to cash will be vital to ensure no customer is left behind."

A total of 39 billion transactions were made in the UK last year by businesses and individuals, the UK Payment Markets report said.

The vast majority of these (34.9 billion) were by consumers, and most (29.7 billion) were spontaneous, rather than scheduled payments. Businesses made 4.4 billion payments, but often of much higher value.

Debit cards were the most frequently used method of payment, accounting for 15 billion payments. The report forecast that half of all payments would be made by debit card by 2024.

This is driven primarily by the use of contactless - which itself was boosted by adoption on public transport systems. Take-up has been increasing across all age groups, particularly among pensioners last year, and regions of the UK.

Cashing out

The volume of payments using cash fell by 16% in 2018 compared with the previous year, down to 11 billion transactions.

Whereas cash accounted for 60% of payments in 2008, this proportion fell to 28% last year. UK Finance predicted this would drop to 9% - fewer than one in 10 transactions - in a decade's time.

It suggested cash would become "less important than in once was", but that the UK would not become a cashless society.

It said there was a chance of cash being used less frequently than credit or charge cards in 10 years' time. However, evidence shows many turned back to cash amid the financial crisis, and a return of an economic recession or shock could increase cash use.

The fall in cash use has led to debate over the need for cash machines, and fears that they are disappearing from rural areas.

John Howells, chief executive of ATM network operator Link said: "The sharp drop in cash usage means that it is vital now to reform how cash is distributed to maintain broad, free access for all consumers. Link is determined to deliver this with the support of industry and regulators."

The switch to payments by card or on devices also raises concerns among many over the exposure to security flaws, and that financial institutions will be armed with data showing how and where almost every penny of our money is spent.

Along with the disappearance of cash goes the anonymity than it offers, for better or worse.