Pay by cash? Not for long, report warns

Getty Images

Getty ImagesThe system allowing people to use cash in the UK is at risk of "falling apart" and needs a new guarantee to ensure notes and coins can still be used.

A hard-hitting review by finance experts has concluded that market forces will not save cash for as long as people need it.

The report calls on the government and regulators to step in to ensure cash remains viable.

Suggestions include ensuring rural shops offer cash-back.

The report also said that essential services, such as utility and council bills, should still allow customers to pay in cash.

An independent body, funded by the banks, should be set up that would step in if local communities were running short of access to cash in shops and ATMs, the report said.

The research - called the Access to Cash Review - is authored by former financial ombudsman Natalie Ceeney and was paid for by cash machine network operator Link, but was independent from it. It took evidence from nearly 100 businesses and charities across the UK.

How quickly is cash use falling?

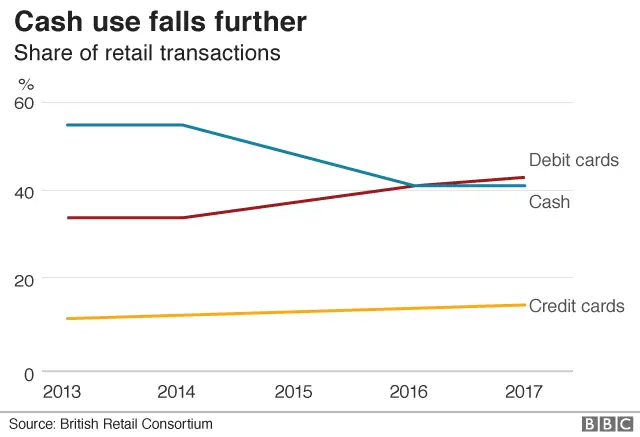

Cash use has been falling dramatically in recent years. In 2017, debit card use - driven by contactless payments - overtook the number of payments made in cash in the UK for the first time.

The report said that the current rate of decline would mean cash use would end in 2026.

However, it concluded that notes and coins would still be used in 15 years' time, but accounting for between 10% and 15% of transactions.

The demise of cash, if unchecked, would be driven primarily by retailers and other businesses refusing to accept cash owing to the cost of handling it.

'My cashless pub is cheaper to run'

Mike Keen opened The Boot pub in Freston, near Ipswich, last year as a cashless business with no tills.

"There are a whole bunch of reasons. The [biggest] gain is management time," he said, such as never having to cash up at the end of the day, drive to the bank and queue to pay it in, two or three times a week.

He said that saved the business 15 hours a week, and many thousands of pounds.

Insurance premiums had been lower as there was no cash on the premises, security was less of a problem, and the time taken to serve customers was much quicker, he said.

What is the problem with a cashless society?

Banknotes and coins are a necessity for eight million people, according to the review's interim findings published in December.

These include rural communities where alternative ways of paying are affected by poor broadband or mobile connectivity, and many people who have physical or mental health problems and therefore find it hard to use digital services.

The report also concludes that vulnerability in this area is generally the result of income, not old age.

"Poverty is the biggest indicator of cash dependency, not age," the review concludes.

"There are worrying signs that our cash system is falling apart. ATM and bank branch closures are just the tip of the iceberg, underneath there is a huge infrastructure which is becoming increasingly unviable as cash use declines," Ms Ceeney said. "If we sleepwalk into a cashless society, millions will be left behind."

'Survival' tougher without cash

Kev Jackson has been homeless and currently lives in temporary accommodation.

"Cash is easy because you know what you have got on you," he said. "On a card - when you can't see your balance - it is easy to overspend. [Cash] is very good for budgeting."

"A lot of people [on the streets] do not have bank accounts, so they only carry cash. If you can't spend cash in a shop, it is going to be difficult for them. They won't be able to survive."

He said that he preferred using a card himself, but was concerned that technology left many people behind.

What should be done?

Evidence from Sweden, seen as much closer to a cashless society than the UK, suggested that infrastructure was needed before cash use declined beyond anyone's control.

The review suggested that an independent body was needed to oversee a guarantee that people need not travel too far to get access to cash.

Innovation should also be used to protect cash, such as:

- Local shops offering cash-back to customers, rather than customers relying on ATMs

- Small businesses given the opportunity to deposit cash in secure lockers or "smart" ATMs, rather than have to make a weekly trip to a bank branch

- A "radical" change to the infrastructure behind cash, overseen by the Bank of England, to lower the cost and maintain free access for consumers

Britain's cash infrastructure costs around £5bn a year to run. It is paid for predominantly by the retail banks and run mostly by commercial operators.

The Bank of England's chief cashier, Sarah John, said it would call together key players in this sector to develop a system that would support lower levels of cash use and encourage innovation "to support cash as a viable means of payment for those who want to use it".

What has already been done?

Consumer group Which? has called for a single regulator to have a statutory duty to protect access to cash and build a sustainable cash infrastructure for the UK.

Eric Leenders, from UK Finance, which represents banks, said: "The finance industry is using a range of solutions to ensure cash can still be accessed including over the counter withdrawals through 11,500 Post Offices and cash-back from retailers, to investment in ATMs and mobile bank branches to reach more rural communities.

"We will continue to work with the review team, government, and regulators to take forward this important work."

Ron Delnevo, of the ATM Industry Association, said that there should be a requirement, backed by law, on businesses to accept cash, mirroring moves by some local authorities in the US.