Are President Trump's tax cuts helping workers?

Getty Images

Getty ImagesIt is bonus season in America - and this year, companies are cutting some workers special cheques.

At Disney, 125,000 workers will receive a $1,000 one-time bonus. Alaska Airlines said 23,000 of its staff would get $1,000 awards, on top of their usual incentive system. And about 60,000 employees at Fiat Chrysler Automobiles are due to take home $2,000 extra.

Those companies are just three of the roughly 250 firms that have announced bonuses, pay increases, more generous benefits or US investments, citing tax cuts the US passed in December, according to Americans for Tax Reform, an organisation that lobbies for lower taxes.

All told, the group counts at least 3 million Americans due for some kind of boost from employers as a result of the overhaul, which slashed the corporate rate from 35% to 21%.

The announcements have reignited debate over whether the controversial law - estimated to cost a total of $1.5tn from 2018 through 2027 - is good for the average American.

What does the White House say?

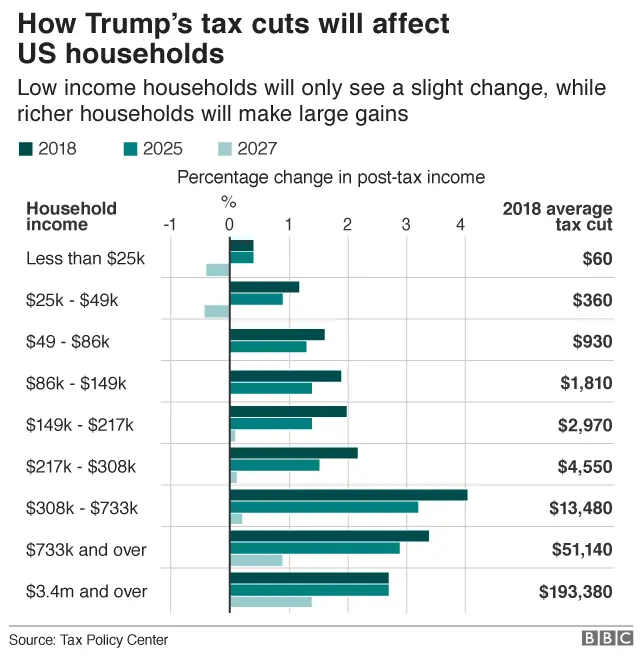

On its face, the new law provides relatively minimal benefit for households.

The cuts for families are estimated to amount to an average of just $1,600 in 2018 - a difference of less than $31 per week. And most of the benefits will accrue to the wealthiest families.

The White House has seized on the company announcements as proof the law offers other benefits to workers.

As President Donald Trump put it in a recent Twitter post: "Tremendous investment by companies from all over the world being made in America. There has never been anything like it.

"Now Disney, J.P. Morgan Chase and many others. Massive Regulation Reduction and Tax Cuts are making us a powerhouse again. Long way to go! Jobs, Jobs, Jobs!"

What do opponents say?

Opponents of the overhaul have dismissed the announcements as little more than publicity stunts, pointing to billions more going to share buybacks and dividends - and in some cases, layoffs at the very companies promoting the awards.

Telecommunications giant AT&T, for example, was among the first to announce its plans: $1,000 bonuses for more than 200,000 workers and $1bn in extra US investment in 2018.

But the company - which is trying to win government approval to purchase Time Warner - is also negotiating with union workers over roughly 1,000 layoffs.

Similar elements of spin and redundancies have coloured other announcements.

Getty Images

Getty ImagesOn the same day that Walmart announced plans to increase its minimum pay to $11 and offer bonuses of up to $1,000, word emerged that the firm was closing 63 of its Sam's Club stores and laying off thousands of workers.

Apple, after touting a five-year $350bn contribution to the US economy, acknowledged that much of the money reflected its current spending pace.

And the firm - which politicians have criticised for years for its overseas cash pile and offshore manufacturing - had already committed nearly as much - $300bn - to buy back shares and boost dividends.

In the broader context, the benefits for workers are "trivial", says Beth Allen, spokeswoman for the Communications Workers of America, the labour union that represents staff at AT&T and other companies.

"Our workers at AT&T in particular, because the layoffs happened at the same time, saw it for what it was - which was something the company was doing to get to the press," she said.

Are there other reasons for the plans?

Analysts say companies have reasons outside of the tax bill to be re-thinking worker benefits.

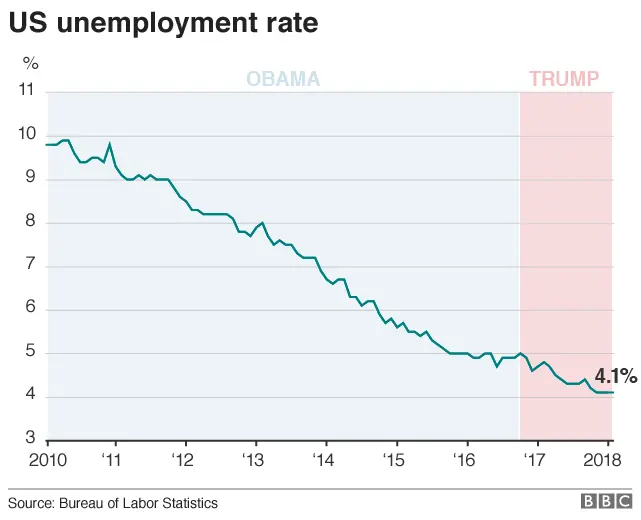

The US unemployment rate is now hovering around 4.1% - a level last seen in 2000 - putting pressure on firms to keep workers happy.

But it is also clear that self-promotion and political calculus are driving some of the announcements.

"Why didn't they just tell their workers privately?" says Laurence Kotlikoff, an economics professor at Boston University, who described some of the announcements as "implicit back-scratching" for the White House.

"They're making a big deal of this to serve some other purpose, maybe getting the country to like their product or getting the government to lay off a bit."

Banks represent more than a third of the companies with announcements on the Americans for Tax Reform list. That sector is among the biggest beneficiaries of the tax changes, and also expects lighter regulations.

Many companies, however, were already paying below the 35% headline rate.

Professor Kotlikoff says that suggests firms are making their decisions due to sentiment - not policy changes. Those moods can shift quickly, he warns.

What long-term effect will this have?

The White House maintains the optimism will translate into expansion and investments, hiring, and, ultimately, higher wages, as firms compete for workers.

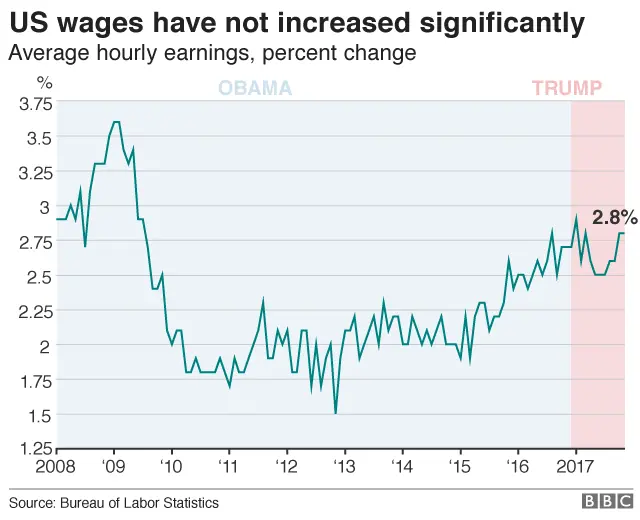

That would be a welcome change for the US after years of relatively stagnant wage growth.

John Bremen, who advises companies on human capital and benefits as a managing director for Willis Towers Watson, says there are signs that is starting to happen.

His firm surveyed more than 300 companies, and found that roughly two-thirds were considering improving benefit packages or had already taken action as a result of the law.

Many firms were already looking at ways to retain and attract workers due to the tight labour market, but the tax law "amplifies it and accelerates it," he says.

Economists predict the tax cuts will boost the US - and global - economy, albeit modestly, by spurring consumer spending and investment.

This week, the IMF revised up its global growth forecast by 0.2 percentage points, citing the overhaul. In the US, the Tax Policy Center says tax cuts are likely to lift the economy by 0.8% in 2018, but the effects will fade over the decade.

As departing Federal Reserve Chair Janet Yellen said when asked about the effect of the tax cuts last month: "Much uncertainty remains."

The same could be said for the American worker.