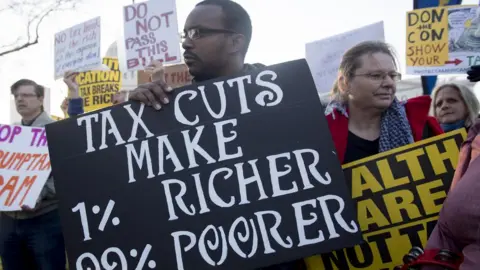

US tax bill: Winners and losers

Republicans are poised to declare victory on one of their longstanding goals: overhauling the US tax code.

It is the most sweeping rewrite in a generation and was a key campaign pledge for US President Donald Trump and other party leaders.

Here are some of the winners and losers.

Winners

Multinational corporations

Under current law, corporations face a range of tax rates, starting at 15% and rising to 35% on taxable income over $10m.

The new plan creates a single 21% corporate rate, effective in 2018.

It also switches the US to a territorial system, which means that multinationals will no longer face US tax on profits earned overseas, barring certain exceptions.

In exchange, the US has imposed a one-time, ultra-low tax on the profits companies currently have stashed abroad, levied at 8% on illiquid assets and 15.5% on liquid assets like cash.

Corporations are thrilled - and so are shareholders, who expect companies to use the extra cash for bigger dividends or share buybacks. That is one reason why the stock market has soared in recent weeks.

The ultra-rich

AFP/Getty

AFP/GettyUnder the new plan, the top tax rate in the US will fall from 39.6% to 37%. That applies to income above $500,000 for individuals and $600,000 for couples - a higher threshold than it is now.

The new law also roughly doubles the amount exempt from the 40% inheritance tax to roughly $11m for individuals and $22m for couples.

Those benefits flow to a relatively small group.

Only about 1% of households earn more than $500,000, according to the Joint Committee on Taxation.

And the Tax Policy Center estimates that under current law, only 5,500 estates will pay tax in 2017.

Both provisions expire after 2025.

The commercial property industry

The new plan creates a deduction for owners of businesses organised as pass-through entities - a favourite structure of property firms in the US, including the president's business, the Trump Organisation.

Under current law, owners of those firms pay taxes on profits based on the personal rate (since the profits "pass through" to the owners).

The new plan allows 20% of that income to be deducted for households making less than $315,000. Above that, the perk is more limited - but it is available to commercial property owners.

Property businesses also managed to beat back other proposals they said would hurt the industry.

The benefit expires after 2025.

Private schools

The new plan expands the uses of tax-privileged education savings accounts, known as 529s. Once reserved for higher education, the new plan allows parents to use up to $10,000 to pay for private or religious schools.

Losers

Some families in high-tax, high-cost states

AFP/Getty

AFP/GettyUnder current law, families can claim deductions for what they pay in state and local taxes. The new law will cap the deduction at $10,000 - a provision expected to hurt some people in states such as New York, New Jersey and Maryland.

Those are also states with high housing costs, so homeowners there could be hit by the new cap on the mortgage interest deduction. Currently loans up to $1m are eligible, but that falls to $750,000 under the new plan.

Perhaps not coincidentally many of the states most affected by the provisions are Democratic.

Most taxpayers in the future

Analyses suggest most taxpayers - about 80%, according to the Tax Policy Center - will have lower tax bills in 2018, after the plan's lower rates go into effect.

But those cuts expire after 2025. The plan also switches to a less generous calculation of inflation.

By 2027, the Tax Policy Center estimates that the overall change would be negligible. And 53% of taxpayers would face higher bills, many of them in the lower income brackets.

People paying for their own health insurance

The new plan repeals the requirement that people carry health insurance or face a tax penalty. Analysts expect healthy people to quit purchasing plans - which would make costs rise for those who remain.

The plan temporarily expends a deduction for medical expenses to try to counter those effects.

Arctic animals

Republicans attached a measure to the tax bill that opens drilling in the Arctic National Wildlife Refuge.