AT&T to pay $1,000 bonus due to tax cuts

Getty Images

Getty ImagesTelecoms giant AT&T has said it will pay a $1,000 (£747) bonus to more than 200,000 workers, as a result of the US tax reform bill being cleared.

The firm, which still needs government approval to allow it to take over Time-Warner, also said it would invest an additional $1bn in the US in 2018.

US President Donald Trump referred to AT&T's move in a speech celebrating the cuts, which were a key priority.

He has said the cuts will lead to higher wages and more US investment.

Other companies joined AT&T's announcement, providing the president with ammunition to support his claims, which are contested.

Comcast said it would invest more than $50bn in infrastructure over five years and award $1,000 bonuses to more than 100,000 workers, while Boeing announced plans to invest an additional $300m.

Many expect companies to put much of the money saved on taxes into share buybacks and dividends. Already, some companies have announced such plans.

Democratic Senator Chuck Schumer called AT&T's announcement "the exception, not the rule".

'Monumental step'

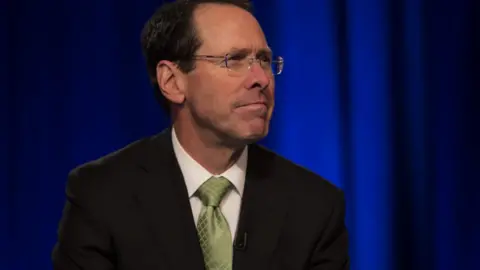

In his statement, AT&T chief executive Randall Stephenson called the new tax plan a "monumental step".

"This tax reform will drive economic growth and create good-paying jobs," he said.

"In fact, we will increase our US investment and pay a special bonus to our US employees."

AT&T, the second largest wireless company in the US, paid about $6.5bn in taxes at an effective rate of about 33% in 2016, according to federal filings.

Under the new plan, the top corporate tax rate in the US will fall from 35% to 21%.

The bonus award is expected to cost the firm about $230m and go to non-manager, unionised employees.

The firm had previously said it would invest $1bn more if tax reform was approved.

The moves come as AT&T gears up for a fight with the federal government.

Last month, the US Department of Justice filed a lawsuit to block AT&T's merger with Time Warner, saying it would reduce competition and raise consumer prices.