Stamp duty giveaway will have limited impact, says Nationwide

PA

PAThe stamp duty concession for first-time buyers announced in the Budget will have a "limited impact" on housing demand, a lender has said.

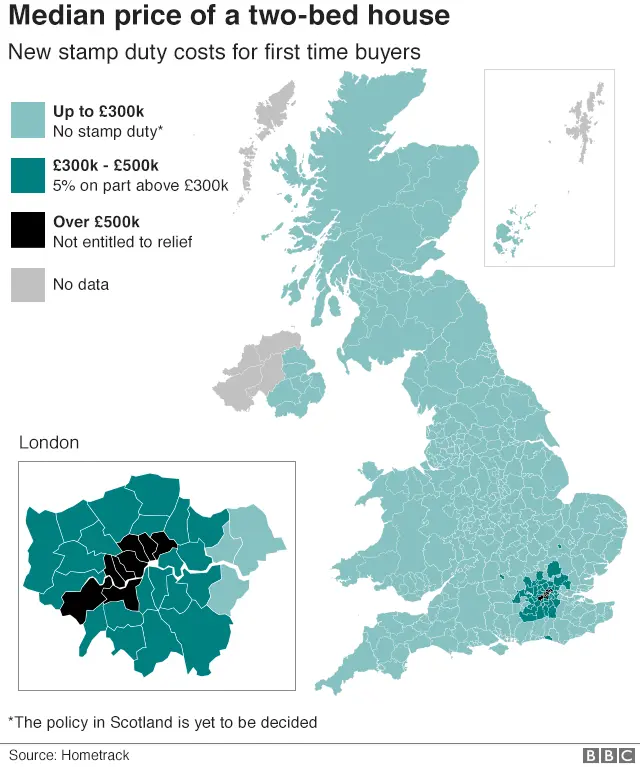

Stamp duty has been abolished when buying a first home up to a value of £300,000 in England, Northern Ireland and temporarily, at least, in Wales.

For properties costing up to £500,000, no stamp duty will be paid on the first £300,000.

The Nationwide said many buyers had already paid little or none of the tax.

Many properties - primarily outside of East Anglia, and the South East and South West of England - were being sold below the previous threshold of £125,000, the lender said.

"The decision in the Budget to abolish stamp duty for first-time buyers ... is likely to have only a modest impact on overall demand," said Robert Gardner, Nationwide's chief economist.

"The potential savings are more substantial for borrowers where house prices are higher, especially in London and the South East."

The Office for Budget Responsibility said last week some of the benefit would be passed on to existing home owners through higher house prices, although the movement would be quite small.

However, the Nationwide noted that, for example, in the South West of England, 93% of first-time buyers had been paying an average of £2,399 in stamp duty.

This proportion would fall to 11% typically paying £531.

Scotland has an independent system of land tax. Stamp duty will be devolved to Wales from March 2018.

House prices

The Nationwide, the UK's biggest building society, said that UK house prices rose by 2.5% in the year to the end of November.

The figure, which is drawn from the lender's own mortgage data, was unchanged from the previous month.

Prices rose by 0.1% in November compared with October, with the average UK home valued at £209,988. A lack of supply has maintained house price growth in recent times.

"There is still a lot that remains to be done in tackling the UK's housing supply issues. For this reason, the focus in the Budget on increasing supply of homes in the year ahead was encouraging," Mr Gardner said.