Budget 2017: How will stamp duty cut help first-time buyers?

BBC

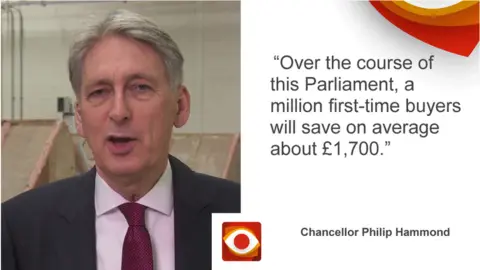

BBCThe claim: Changes to stamp duty will save an average of £1,700 to first-time buyers.

Reality Check verdict: The average first-time buyer would indeed save about £1,700 in stamp duty, but for some people it's likely that would be more than offset by increased house prices, according to the Office for Budget Responsibility (OBR), which provides independent assessments of the Budget. It's likely to be better news for potential first-time buyers struggling to get together a deposit than for those unable to borrow enough as a result of their earnings.

Chancellor Philip Hammond has abolished stamp duty on homes costing less than £300,000, with reduced rates up to £500,000.

You can read about the full details of the policy with the variations around the UK here.

A first-time buyer purchasing a £500,000 property, who would previously have paid £15,000 in stamp duty, will now pay £10,000, while someone buying a property for £300,000, who would previously have faced a stamp duty bill of £5,000, will now not pay anything.

The chancellor told BBC News that the average saving for first-time buyers would be £1,700 - that is the amount of stamp duty that would previously have been payable on the average property bought by first-time buyers, according to the Halifax.

But forecasts from the judgement of the OBR suggest that the benefits would come to existing homeowners and not first-time buyers because house prices are likely to rise by 0.3%.

Struggling with deposit

This policy is part of a package of measures designed to help first-time buyers to access the housing market. To understand whether it is a good thing, it is useful to think about two key reasons why people might be struggling to buy houses.

One possibility is that people are struggling to raise enough money for a deposit. Most mortgages require the borrower to put up a minimum proportion of the purchase price - 5% or 10% for example.

If somebody is struggling to get together a deposit, then being able to spend the £5,000 they had earmarked for stamp duty on the deposit instead, for example, will be useful and also may increase the amount they can borrow, which will mean they can buy a property they may not have been able to in other circumstances.

The Institute for Fiscal Studies (IFS) stressed that while house prices might have risen, this sort of buyer would end up with a more valuable asset, even if only as a result of the new stamp duty policy.

"The price goes up, but the other impact it has is that it allows first-time buyers the ability to purchase properties that they otherwise wouldn't have been able to afford," OBR chairman Robert Chote told the BBC's Daily Politics.

Earnings too low

Another possibility is that people have saved up their deposit but their earnings are not high enough for a mortgage provider to be prepared to lend them enough money to buy a suitable property.

This policy will not be good for them if house prices rise as the OBR suggested. It said that house prices could go up by twice as much as the stamp duty saving because of the extra borrowing made possible for some people by having a bigger deposit.

The OBR also quoted HMRC's verdict on the similar stamp duty holiday after the financial crisis, which was that it "has not had a significant impact in terms of improving the affordability of residential property for first-time buyers".

This point about rising prices was put to the chancellor on the Today programme, but he said this was looking at the stamp duty change in isolation without the effect on the market of the 300,000 net homes per year that the government plans to build in England by the middle of the next decade.

There has been some doubt about the government's ability to achieve this target, not least from the OBR, which has not made any adjustments to its forecasts for housing starts. It said: "Governments have announced a number of initiatives aimed at overcoming housing supply constraints," referring for example to the National Planning Policy Framework from 2012.